Answered step by step

Verified Expert Solution

Question

1 Approved Answer

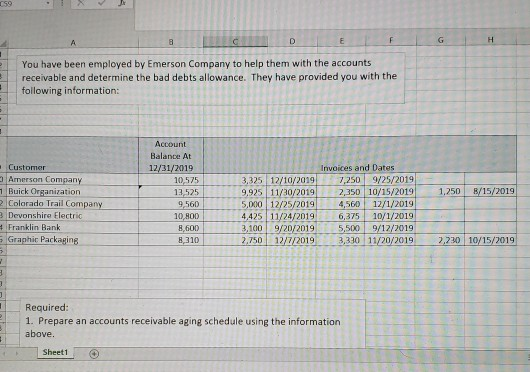

please help A 8 D E F G H You have been employed by Emerson Company to help them with the accounts receivable and determine

please help

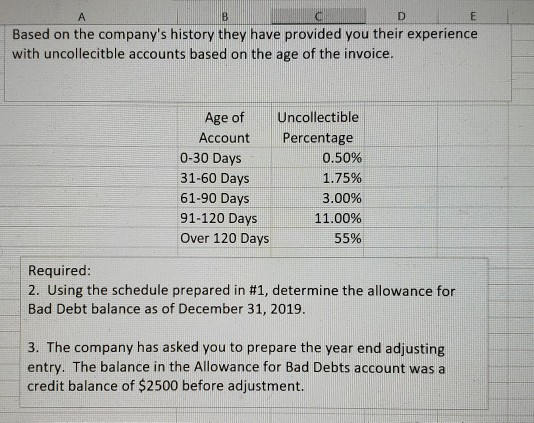

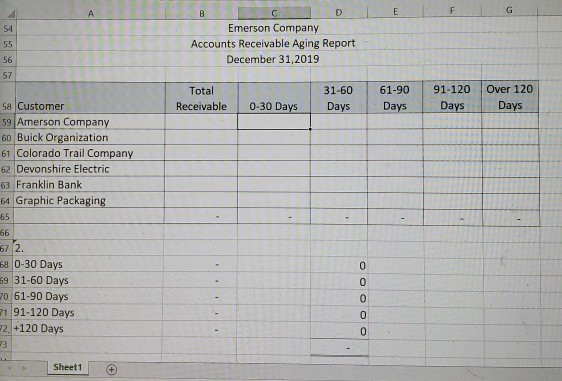

A 8 D E F G H You have been employed by Emerson Company to help them with the accounts receivable and determine the bad debts allowance. They have provided you with the following information: Account Balance At 12/31/2019 10,575 13,525 1,250 8/15/2019 Customer Amerson Company 1 Buick Organization Colorado Trail Company 3 Devonshire Electric # Franklin Bank Graphic Packaging 9560 3,325 12/10/2019 9,925 11/30/2019 5,000 12/25/2019 4,425 11/24/2019 3,100 9/2D/2019 2.750 12/7/2019 Invoices and Dates 7,250 9/25/2019 2,350 10/15/2019 12/1/2019 6,375 10/1/2019 9/12/2019 3,330 11/20/2019 10,800 8,600 8,310 5,500 2,230 10/15/2019 1 Required: 1. Prepare an accounts receivable aging schedule using the information above. Sheet1 B D E Based on the company's history they have provided you their experience with uncollecitble accounts based on the age of the invoice. Age of Uncollectible Account Percentage 0-30 Days 0.50% 31-60 Days 1.75% 61-90 Days 3.00% 91-120 Days 11.00% Over 120 Days 55% Required: 2. Using the schedule prepared in #1, determine the allowance for Bad Debt balance as of December 31, 2019. 3. The company has asked you to prepare the year end adjusting entry. The balance in the Allowance for Bad Debts account was a credit balance of $2500 before adjustment. A E G F 54 55 56 B D Emerson Company Accounts Receivable Aging Report December 31, 2019 57 Total Receivable 31-60 Days 61-90 Days 91-120 Days Over 120 Days 0-30 Days 58 Customer 59 Amerson Company 60 Buick Organization 61 Colorado Trail Company 62 Devonshire Electric 63 Franklin Bank 64 Graphic Packaging 65 66 67 2. 69 0-30 Days 59 31-60 Days 70 61-90 Days 1 91-120 Days 72, +120 Days 23 OOO OO Sheet1 3. Bad Debt Expense Allowance for Bad Debts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started