Answered step by step

Verified Expert Solution

Question

1 Approved Answer

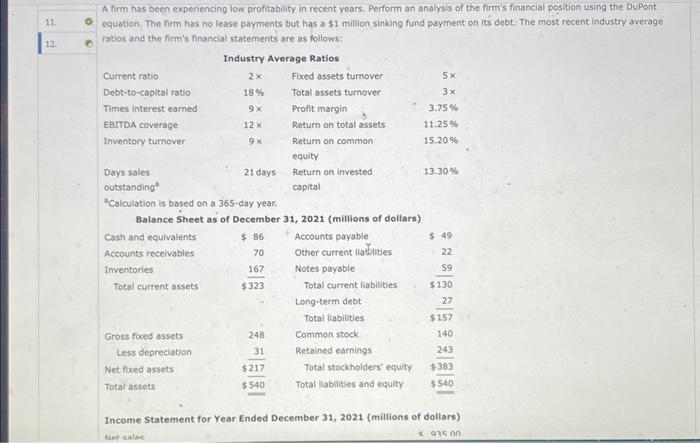

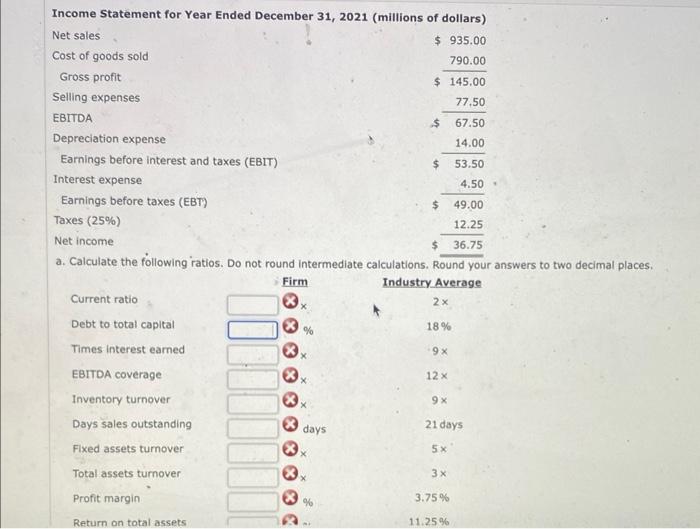

please help a and B ! A firm has been expenencing low profitabuity in recent years. Perform an analysis of the firm's financial position using

please help a and B !

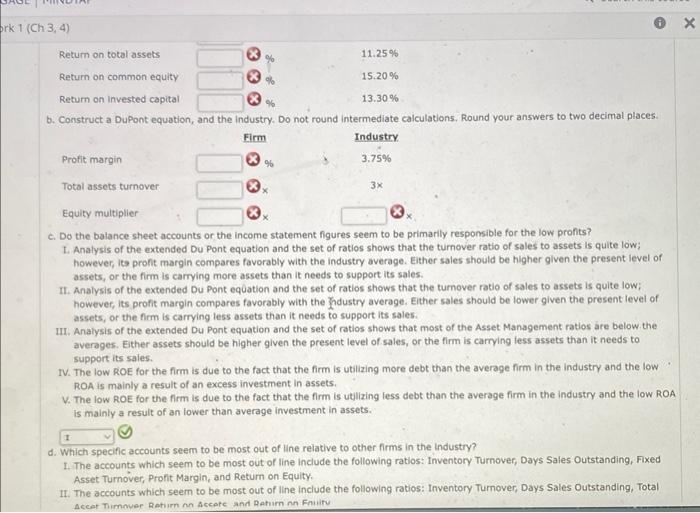

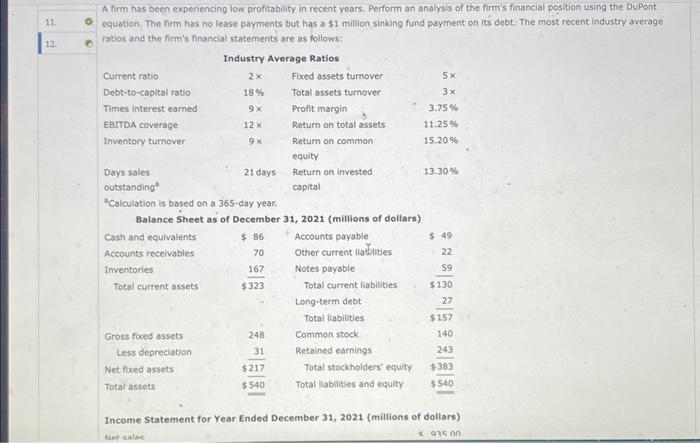

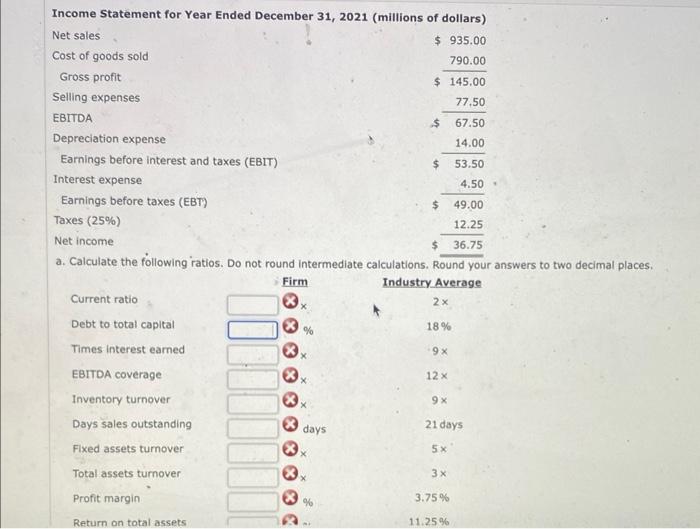

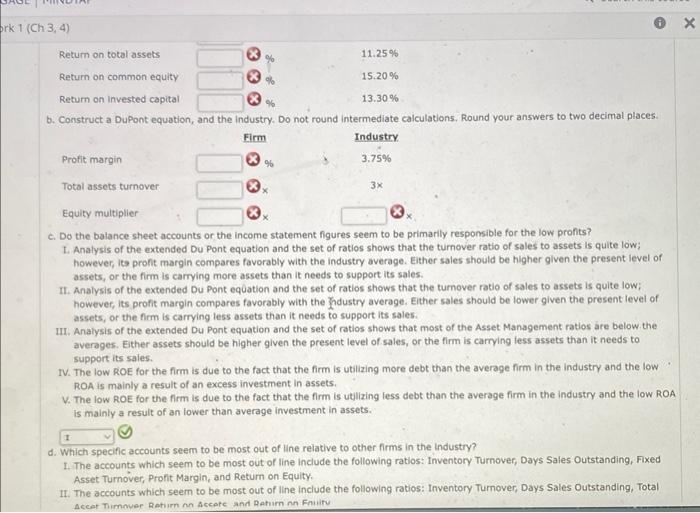

A firm has been expenencing low profitabuity in recent years. Perform an analysis of the firm's financial position using the Dupont equation. The firm has no lease payments but has a $1 million sinking fund payment on its debt. The most recent industry average ratios and the firm's financial statements are as follows: "Calculation is based on a 365-day year: Balance Sheet as of December 31,2021 (millions of dollars) Income Statement for Year Ended December 31, 2021 (millions of dollars) & Qre nn Income Statement for Year Ended Decembar 31. 2021 fmilinne of Anllsmel c. Do the balance sheet accounts or the income statement figures seem to be primarily responsible for the low profits? 1. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite low; however, ite pront margin compares favorably with the industry average. Either sales should be higher given the present level of assets, or the firm is carrying more assets than it needs to support its sales. II. Analysis of the extended Du Pont equation and the set of ratios shows that the turnover ratio of sales to assets is quite low; however, its profit margin compares favorably with the dustry average. Either sales should be lower given the present level of assets, or the firm is carrying less assets than it needs to support its sales. III. Analysis of the extended Du Pont equation and the set of ratios shows that most of the Asset Management ratios are below. the averages. Either assets should be higher given the present level of saies, or the firm is carrying less assets than it needs to support its saies. TV. The low ROOE for the firm is due to the fact that the firm is utilizing more debt than the average firm in the industry and the low ROA is mainly a result of an excess investment in assets. v. The low ROE for the firm is due to the fact that the firm is utilizing less debt than the average firm in the industry and the low ROA is mainly a result of an lower than average investment in assets. d. Which specific accounts seem to be most out of line reiative to other firms in the Industry? 1. The accounts which seem to be most out of line include the following ratios: Inventory Turnover, Days Sales Outstanding, Fixed Asset Turnover, Profit Margin, and Retum on Equity. II. The accounts which seem to be most out of line include the following ratios: Inventory Turnover, Days Sales Outstanding, Total Accer Timnuer Ratium in Accepe and Ratiim in Fnilirv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started