Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!! a b Burger Corp has $538,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year

please help!!

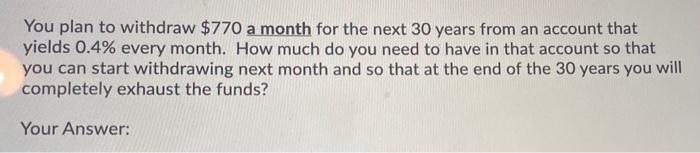

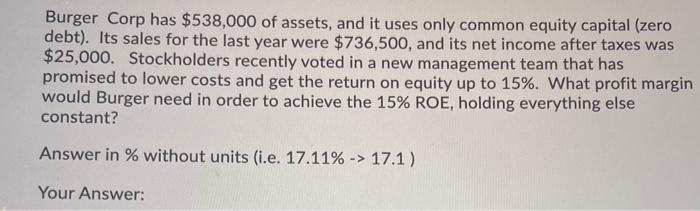

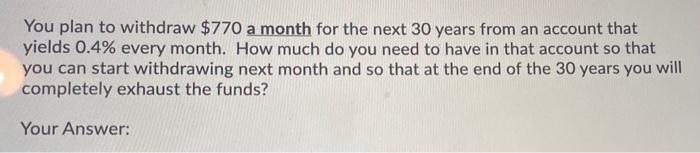

Burger Corp has $538,000 of assets, and it uses only common equity capital (zero debt). Its sales for the last year were $736,500, and its net income after taxes was $25,000. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15%. What profit margin would Burger need in order to achieve the 15% ROE, holding everything else constant? Answer in % without units (i.e. 17.11% -> 17.1) Your Answer: You plan to withdraw $770 a month for the next 30 years from an account that yields 0.4% every month. How much do you need to have in that account so that you can start withdrawing next month and so that at the end of the 30 years you will completely exhaust the funds? Your a

b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started