Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! A. Based on the sales growth rates, does this company more likely or less Ikely need external financing? B. What options should this

please help!

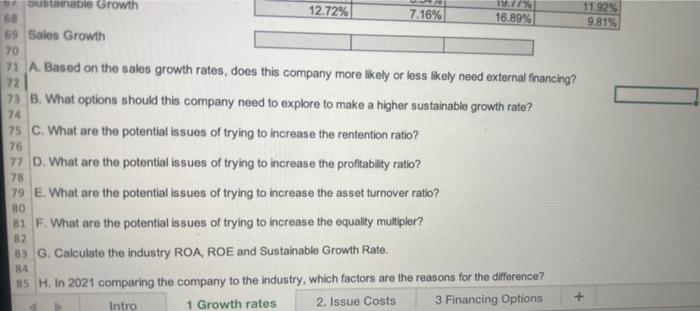

A. Based on the sales growth rates, does this company more likely or less Ikely need external financing? B. What options should this company need to explore to make a higher sustainable growth rate? C. What are the potential issues of trying to increase the rentention ratio? D. What are the potential issues of trying to increase the profitability ratio? E. What are the potential issues of trying to increase the asset turnover ratio? F. What are the potential issues of trying to increase the equality multipler? G. Calculate the industry ROA, ROE and Sustainable Growth Rate. H. In 2021 comparing the company to the industry, which factors are the reasons for the difference? A. Based on the sales growth rates, does this company more likely or less Ikely need external financing? B. What options should this company need to explore to make a higher sustainable growth rate? C. What are the potential issues of trying to increase the rentention ratio? D. What are the potential issues of trying to increase the profitability ratio? E. What are the potential issues of trying to increase the asset turnover ratio? F. What are the potential issues of trying to increase the equality multipler? G. Calculate the industry ROA, ROE and Sustainable Growth Rate. H. In 2021 comparing the company to the industry, which factors are the reasons for the difference Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started