Answered step by step

Verified Expert Solution

Question

1 Approved Answer

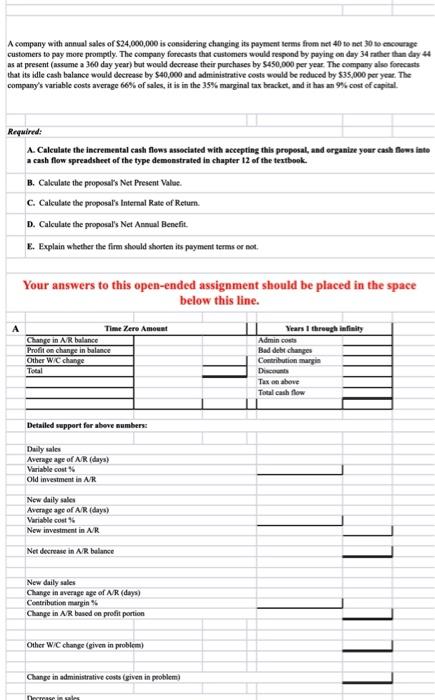

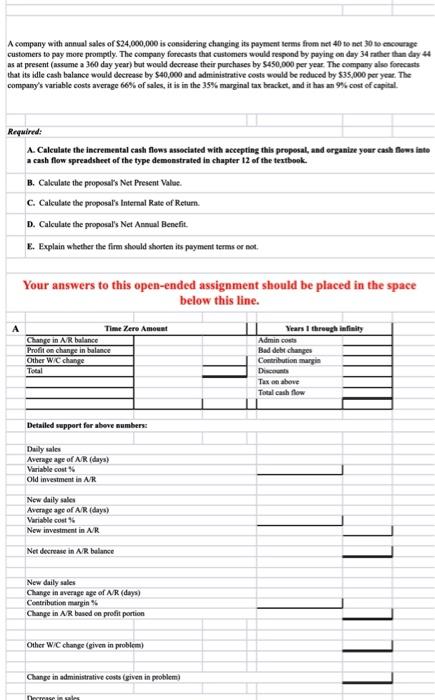

please help. A company with annual sales of $24,000,000 is considering changing its payment terms from net 40 to net 30 to cacoerage customers to

please help.

A company with annual sales of \$24,000,000 is considering changing its payment terms from net 40 to net 30 to cacoerage customers to pay more promptly. The company forecasts that customers would respond by paying on day 34 rather than diy 44 as at peesent (assume a 360 day year) but would decrease their purchases by $450,000 per year. The coempany also foeecarts that its idle cash balanee would deerease by $40,000 and administrative costs woald be reduced by $35.000 per year. The company's variable costs average 66% of sales, it is in the 35% marginal tax beackct, and it has an 9% cost of capital. Recuired: Your answers to this open-ended assignment should be placed in the space helow this line. A company with annual sales of \$24,000,000 is considering changing its payment terms from net 40 to net 30 to cacoerage customers to pay more promptly. The company forecasts that customers would respond by paying on day 34 rather than diy 44 as at peesent (assume a 360 day year) but would decrease their purchases by $450,000 per year. The coempany also foeecarts that its idle cash balanee would deerease by $40,000 and administrative costs woald be reduced by $35.000 per year. The company's variable costs average 66% of sales, it is in the 35% marginal tax beackct, and it has an 9% cost of capital. Recuired: Your answers to this open-ended assignment should be placed in the space helow this line

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started