Answered step by step

Verified Expert Solution

Question

1 Approved Answer

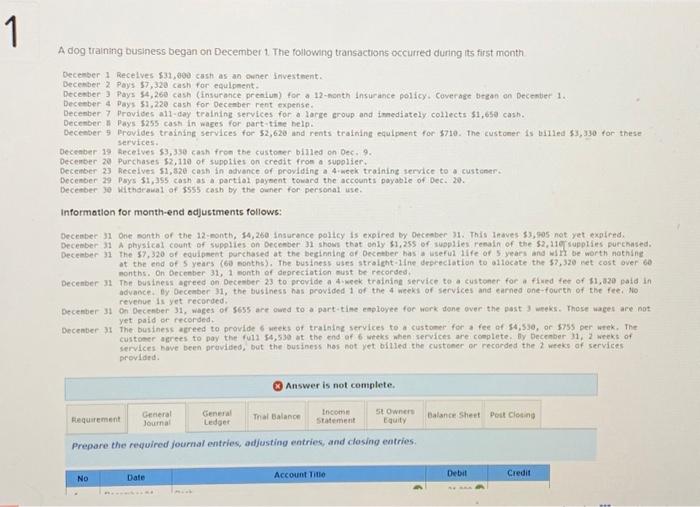

PLEASE HELP !!! A dog training business began on December 1. The following transactions occurred during its first month. December 1 Receives $31,000 cash as

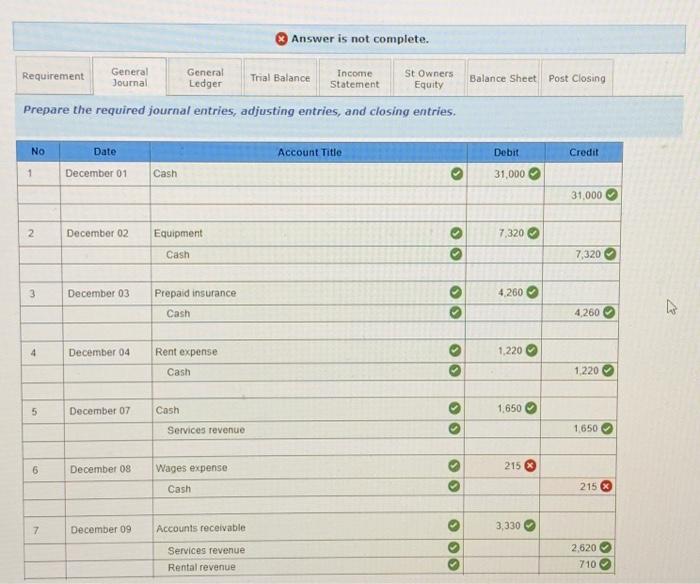

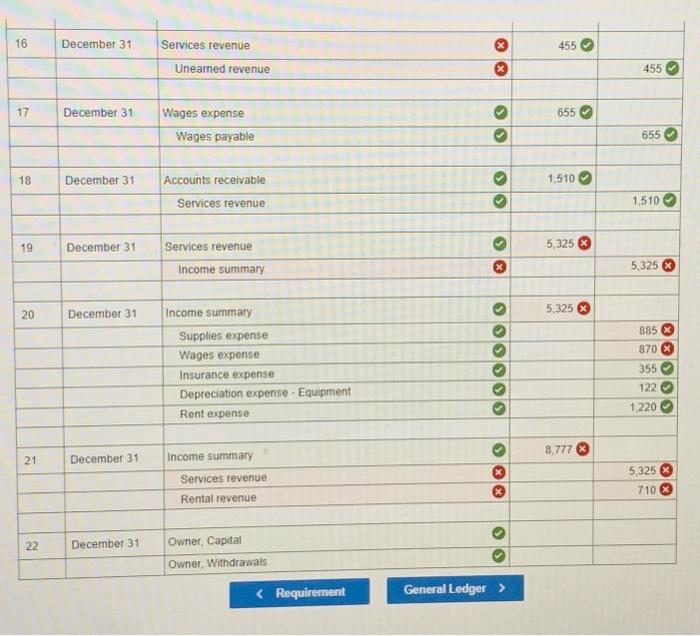

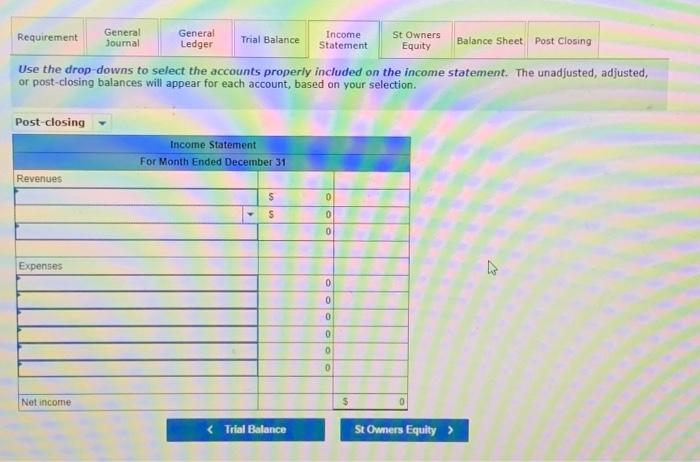

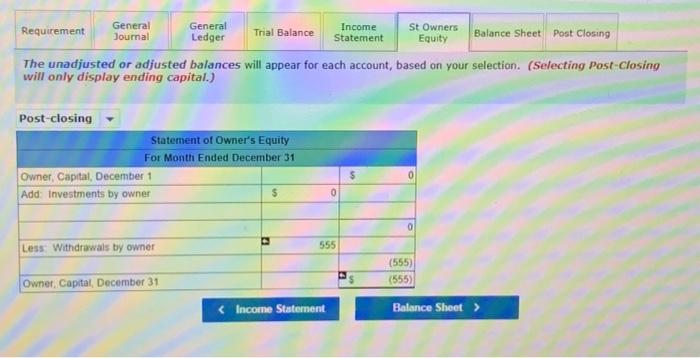

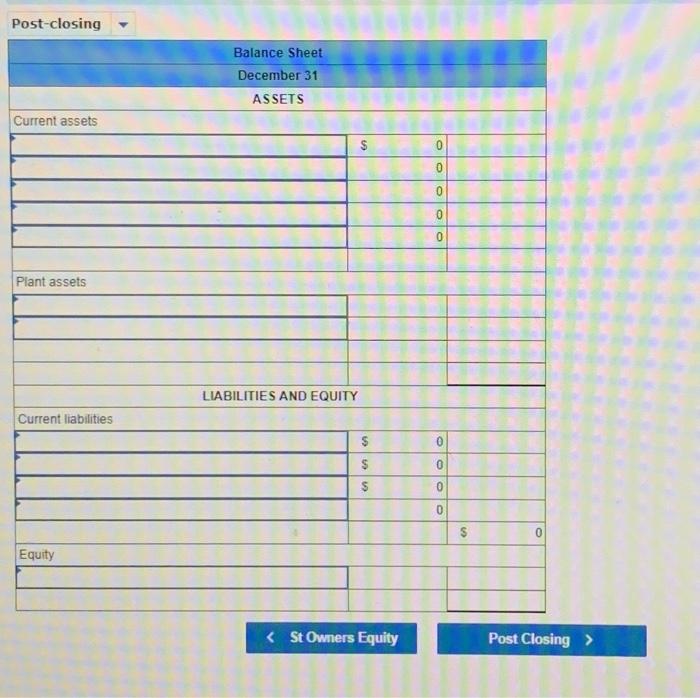

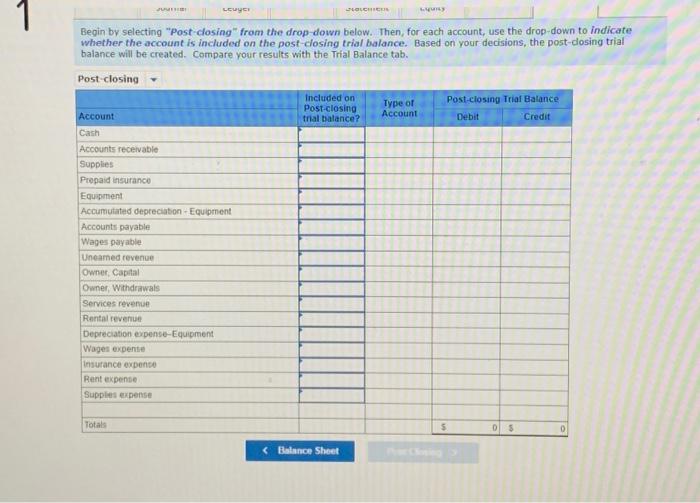

PLEASE HELP !!! A dog training business began on December 1. The following transactions occurred during its first month. December 1 Receives $31,000 cash as an owner investment. December 2 Pays $7,320 cash for equipment. December 3 Pays $4,260 cash (insurance premium) for a 12-month insurance policy. Coverage began on December 1. December 4 Pays $1,220 cash for December rent expense. December 7 Provides all-day training services for a large group and immediately collects $1,650 cash. December 8 Pays $255 cash in wages for part-time help. December 9 Provides training services for $2,620 and rents training equipment for $710. The customer is billed $3,330 for these services. December 19 Receives $3,330 cash from the customer billed on Dec. 9. December 20 Purchases $2,110 of supplies on credit from a supplier. December 23 Receives $1,820 cash in advance of providing a 4-week training service to a customer. December 29 Pays $1,355 cash as a partial payment toward the accounts payable of Dec. 20. December 30 Withdrawal of $555 cash by the owner for personal use. Information for month-end adjustments follows: December 31 One month of the 12-month, $4,260 insurance policy is expired by December 31. This leaves $3,905 not yet expired. December 31 A physical count of supplies on December 31 shows that only $1,255 of supplies remain of the $2,110 supplies purchased. December 31 The $7,320 of equipment purchased at the beginning of December has a useful life of 5 years and will be worth nothing at the end of 5 years (60 months). The business uses straight-line depreciation to allocate the $7,320 net cost over 60 months. On December 31, 1 month of depreciation must be recorded. December 31 The business agreed on December 23 to provide a 4-week training service to a customer for a fixed fee of $1,820 paid in advance. By December 31, the business has provided 1 of the 4 weeks of services and earned one-fourth of the fee. No revenue is yet recorded. December 31 On December 31, wages of $655 are owed to a part-time employee for work done over the past 3 weeks. Those wages are not yet paid or recorded. December 31 The business agreed to provide 6 weeks of training services to a customer for a fee of $4,530, or $755 per week. The customer agrees to pay the full $4,530 at the end of 6 weeks when services are complete. By December 31, 2 weeks of services have been provided, but the business has not yet billed the customer or recorded the 2 weeks of services provided. General Ledger Income Statement St Owners Equity Prepare the required journal entries, adjusting entries, and closing entries. Requirement No General Journal Date Answer is not complete. --- 24 Trial Balance Account Title Balance Sheet Post Closing Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started