please help

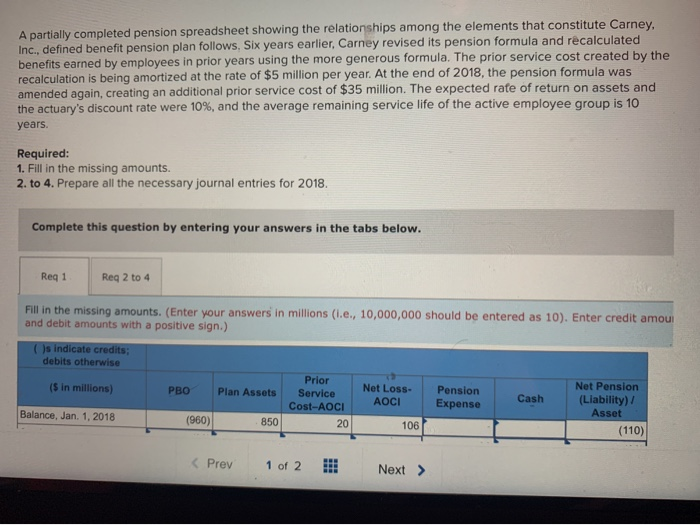

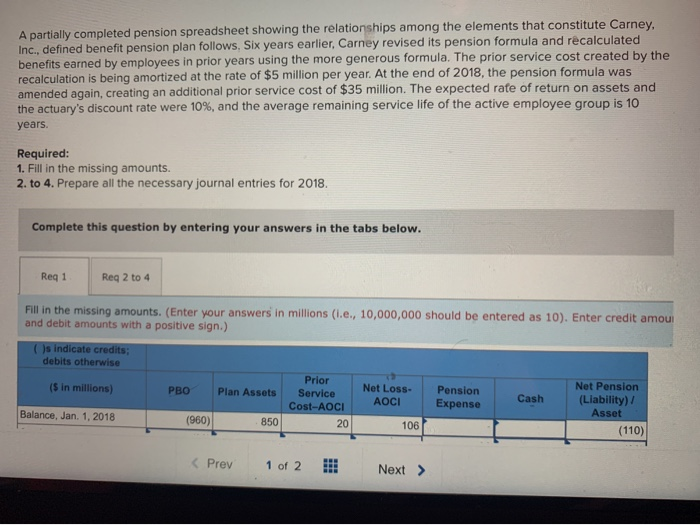

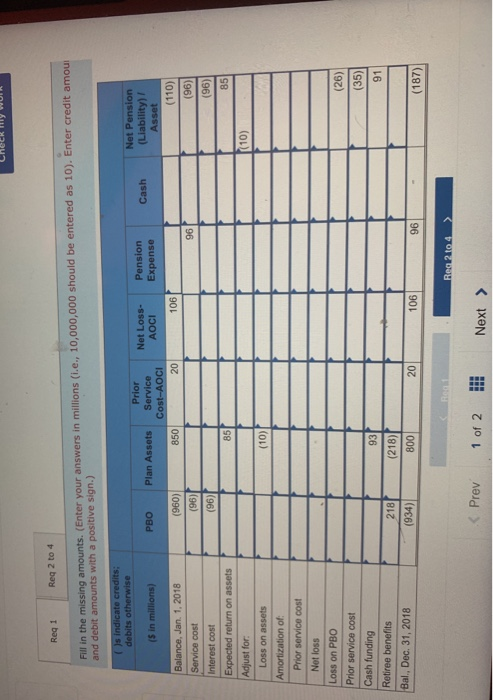

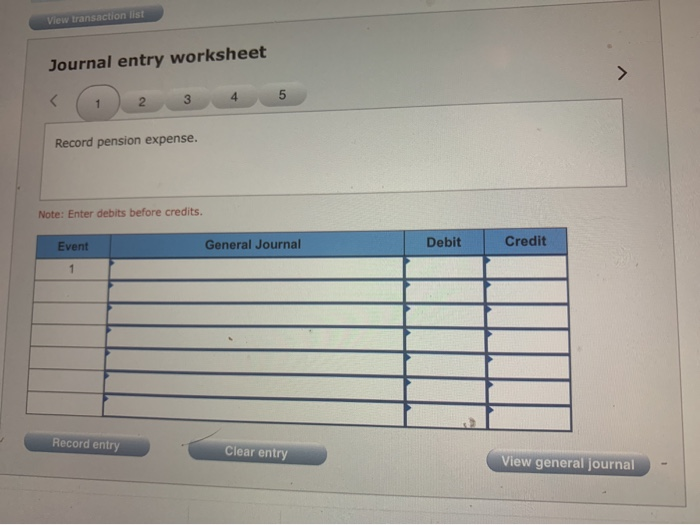

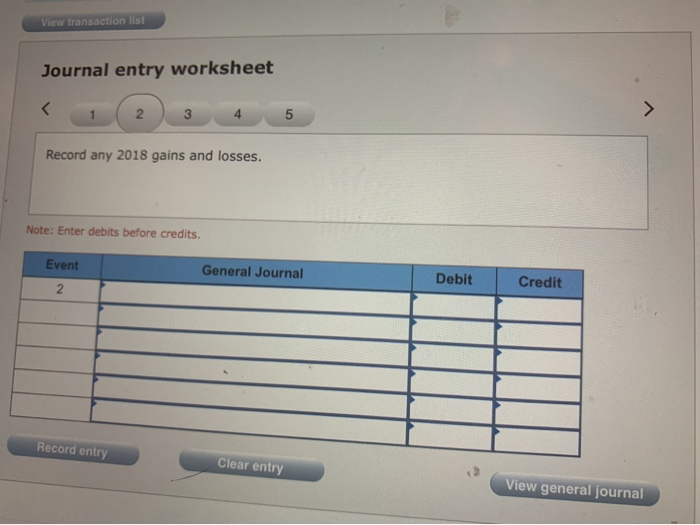

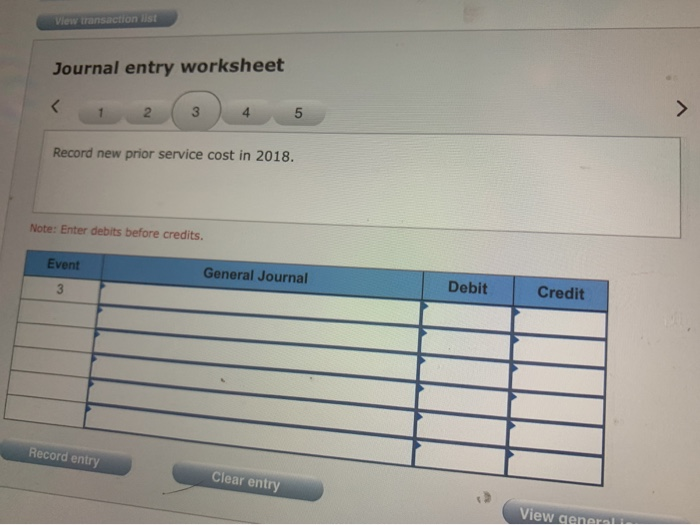

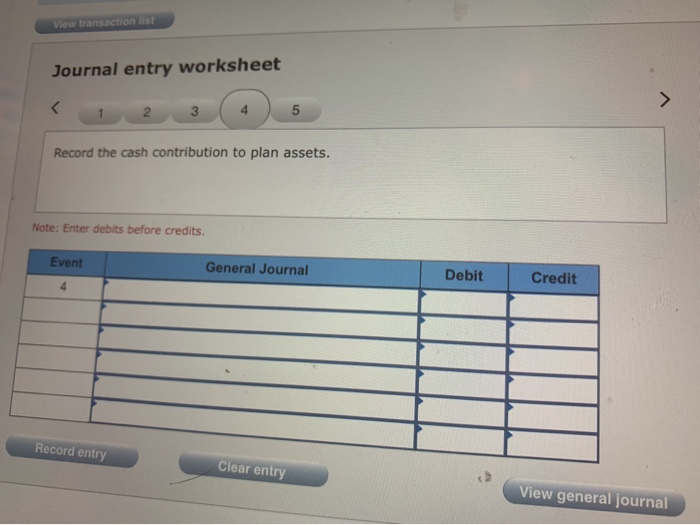

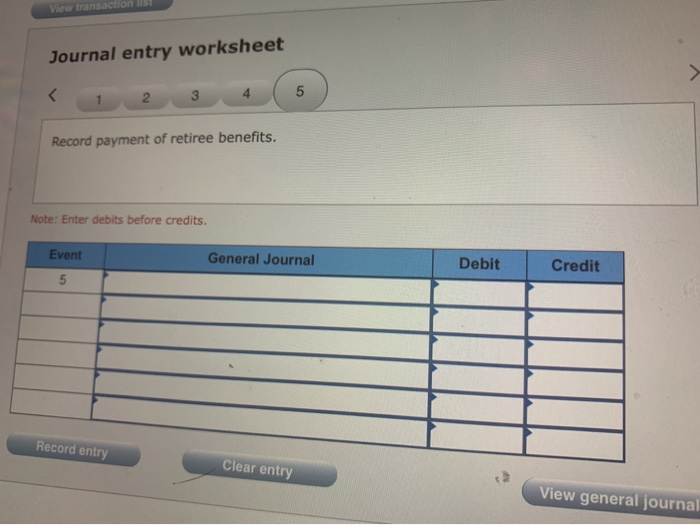

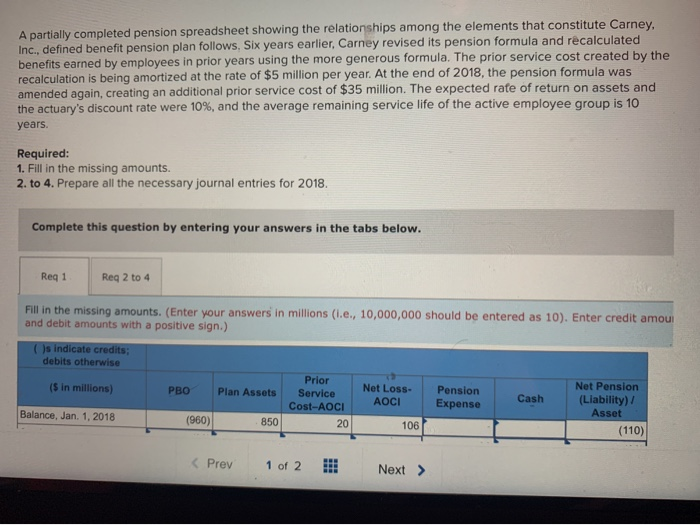

A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney. Inc., defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits earned by employees in prior years using the more generous formula. The prior service cost created by the recalculation is being amortized at the rate of $5 million per year. At the end of 2018, the pension formula was amended again, creating an additional prior service cost of $35 million. The expected rate of return on assets and the actuary's discount rate were 10%, and the average remaining service life of the active employee group is 10 years. Required: 1. Fill in the missing amounts. 2. to 4. Prepare all the necessary journal entries for 2018. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Fill in the missing amounts. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amous and debit amounts with a positive sign.) ()s indicate credits: debits otherwise (5 in millions) PBO Plan Assets Prior Service Cost-AOCI Net Loss AOCI 106 Pension Expense Balance, Jan 1, 2018 Cash (960) Net Pension (Liability) Asset (110) 050 850 20 CLOCKWUN Reg 1 Reg 2 to 4 Fill in the missing amounts. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amoul and debit amounts with a positive sign.) ()s indicate credits; debits otherwise PBO Plan Assets Prior Service Cost-AOCI Net Loss- AOCI Pension Expense (5 in millions) Cash Net Pension (Liability) Asset (110) 850 106 96 (960) (96) (96) (96) (96) 85 (10) Balance, Jan. 1. 2018 Service cost Interest cost Expected return on assets Adjust for: Loss on assets Amortization of: Prior service cost Not loss Loss on PBO Prior service cost Cash funding Retiree benefits Bal., Dec 31, 2018 (35) 93 2187 (934) (218) 800 20 96 (187) Reg 2 to 4 > View transaction list Journal entry worksheet ( 1) 2 3 4 5 Record pension expense. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal View transaction ist Journal entry worksheet CLOCKWUN Reg 1 Reg 2 to 4 Fill in the missing amounts. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amoul and debit amounts with a positive sign.) ()s indicate credits; debits otherwise PBO Plan Assets Prior Service Cost-AOCI Net Loss- AOCI Pension Expense (5 in millions) Cash Net Pension (Liability) Asset (110) 850 106 96 (960) (96) (96) (96) (96) 85 (10) Balance, Jan. 1. 2018 Service cost Interest cost Expected return on assets Adjust for: Loss on assets Amortization of: Prior service cost Not loss Loss on PBO Prior service cost Cash funding Retiree benefits Bal., Dec 31, 2018 (35) 93 2187 (934) (218) 800 20 96 (187) Reg 2 to 4 > View transaction list Journal entry worksheet ( 1) 2 3 4 5 Record pension expense. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal View transaction ist Journal entry worksheet