Answered step by step

Verified Expert Solution

Question

1 Approved Answer

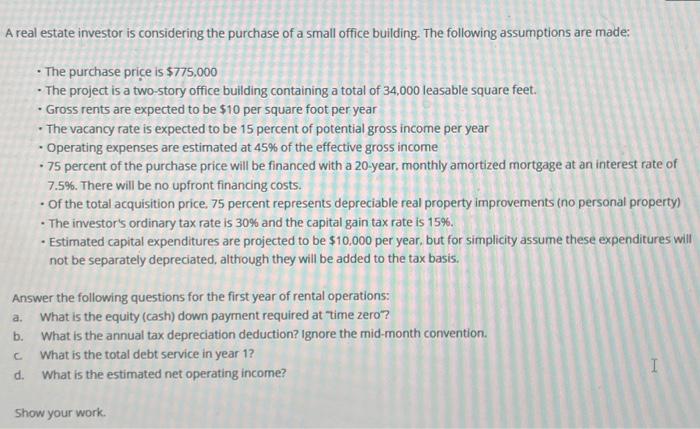

please help A real estate investor is considering the purchase of a small office building. The following assumptions are made: - The purchase price is

please help

A real estate investor is considering the purchase of a small office building. The following assumptions are made: - The purchase price is $775.000 - The project is a two-story office building containing a total of 34,000 leasable square feet. - Gross rents are expected to be $10 per square foot per year - The vacancy rate is expected to be 15 percent of potential gross income per year - Operating expenses are estimated at 45% of the effective gross income - 75 percent of the purchase price will be financed with a 20-year, monthly amortized mortgage at an interest rate of 7.5\%. There will be no upfront financing costs. - Of the total acquisition price. 75 percent represents depreciable real property improvements (no personal property) - The investor's ordinary tax rate is 30% and the capital gain tax rate is 15%. - Estimated capital expenditures are projected to be $10,000 per year, but for simplicity assume these expenditures will not be separately depreciated, although they will be added to the tax basis. Answer the following questions for the first year of rental operations: a. What is the equity (cash) down payment required at time zero? b. What is the annual tax depreciation deduction? Ignore the mid-month convention. c. What is the total debt service in year 1 ? d. What is the estimated net operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started