Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! a. The future value of lump-sum investment of $50,000 in eight years that earns 12 percent compounding interest each year. (4 pts) b.

Please help!

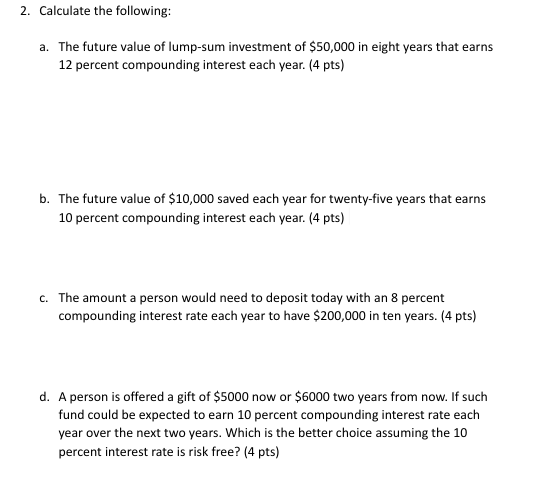

a. The future value of lump-sum investment of $50,000 in eight years that earns 12 percent compounding interest each year. (4 pts) b. The future value of $10,000 saved each year for twenty-five years that earns 10 percent compounding interest each year. (4 pts) c. The amount a person would need to deposit today with an 8 percent compounding interest rate each year to have $200,000 in ten years. (4 pts) d. A person is offered a gift of $5000 now or $6000 two years from now. If such fund could be expected to earn 10 percent compounding interest rate each year over the next two years. Which is the better choice assuming the 10 percent interest rate is risk free? ( 4 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started