Please help!

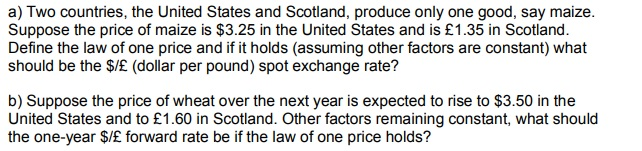

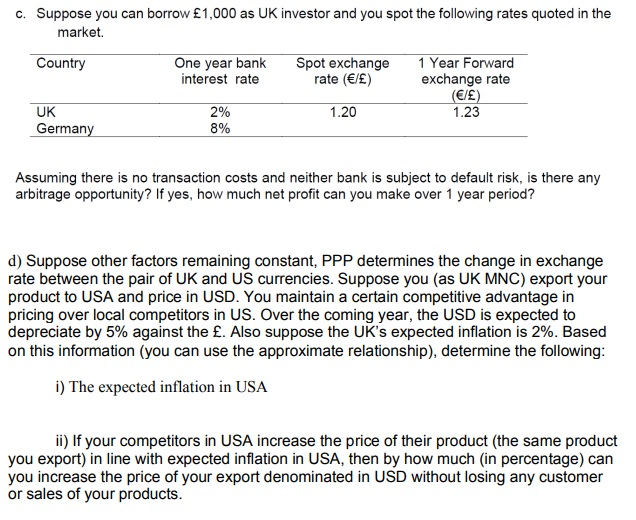

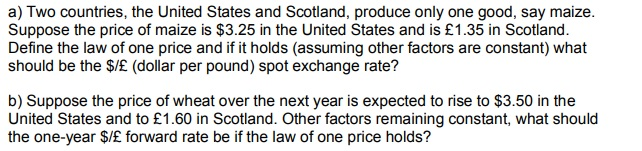

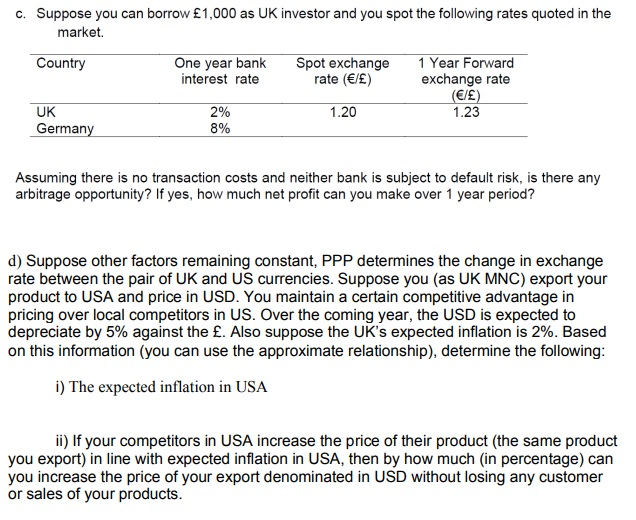

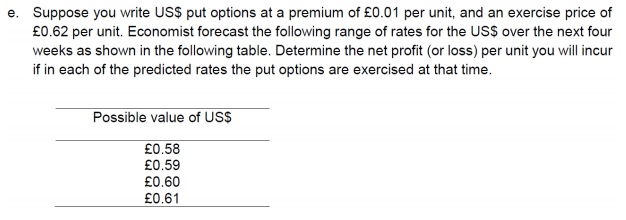

a) Two countries, the United States and Scotland, produce only one good, say maize. Suppose the price of maize is $3.25 in the United States and is 1.35 in Scotland. Define the law of one price and if it holds (assuming other factors are constant) what should be the $/ (dollar per pound) spot exchange rate? b) Suppose the price of wheat over the next year is expected to rise to $3.50 in the United States and to 1.60 in Scotland. Other factors remaining constant, what should the one-year $/ forward rate be if the law of one price holds? c. Suppose you can borrow 1,000 as UK investor and you spot the following rates quoted in the market. Country One year bank interest rate Spot exchange rate (/) 1 Year Forward exchange rate (/) 1.23 UK Germany 2% 8% 1.20 Assuming there is no transaction costs and neither bank is subject to default risk, is there any arbitrage opportunity? If yes, how much net profit can you make over 1 year period? d) Suppose other factors remaining constant, PPP determines the change in exchange rate between the pair of UK and US currencies. Suppose you (as UK MNC) export your product to USA and price in USD. You maintain a certain competitive advantage in pricing over local competitors in US. Over the coming year, the USD is expected to depreciate by 5% against the . Also suppose the UK's expected inflation is 2%. Based on this information (you can use the approximate relationship), determine the following: i) The expected inflation in USA ii) If your competitors in USA increase the price of their product (the same product you export) in line with expected inflation in USA, then by how much (in percentage) can you increase the price of your export denominated in USD without losing any customer or sales of your products. e. Suppose you write US$ put options at a premium of 0.01 per unit, and an exercise price of 0.62 per unit. Economist forecast the following range of rates for the US$ over the next four weeks as shown in the following table. Determine the net profit (or loss) per unit you will incur if in each of the predicted rates the put options are exercised at that time. Possible value of US$ 0.58 0.59 0.60 0.61