Question

Please help, Access the Smiths current financial and tax situation Client Profile: Mary and Austin Smith have recently married and in planning their future have

Please help,

Access the Smiths current financial and tax situation

Client Profile:

Mary and Austin Smith have recently married and in planning their future have decided to solicit the services of a financial advisor with the aim of implementing their short and long-term lifestyle goals and financial plans. Mary and Austin are both aged 30.

For their immediate future, they have decided they want to purchase a new house and a new car. The house they want has a value of $800,000 and they are very excited as both Mary and Austin have never owned a home before. They would also like to buy a new BMW automobile for $80,000, however, are unsure whether to purchase the car outright or borrow in order to obtain the car. The dealer financing rate is 7.75%. They expect to travel approximately 35,000 km per year.

Austin works as a college instructor and earns $75,000 gross income, while Mary works for a local small manufacturing business as it chief accountant earns $115,000 gross income. They also enjoy taking holidays and plan to have a holiday each year to the value of $5,000 with an around the world trip planned for five years time to the value of $20,000. Mary and Austin are also keen to retire early (at age 60) and are quite willing to take on additional risk if this assists in them achieving their lifestyle goals faster. Two years ago, Mary received and inheritance from her late father. They invested $160,000 of the inheritance in a Government of Canada bond which pays annual interest of $4,250. They also contributed to a TSFA account and Marys RRSP totaling $20,000 The balance of the inheritance, $10,000, was invested a junior mining stock which was recommended by Austins co-worker who teaches geology at his college. Austin is planning to sell the stock as it has risen from $2.00 per share when he bought it to $4.00 per share currently. Austin and Mary are looking forward to your advice on how they should go about planning for their future lives together.

They have also heard from a friend that leveraging through borrowing can be a profitable and expedite way to achieve their goals.

Austins pension plan is expected to provide $50,000 per year in income at age 60. Mary does not have a pension plan. The couple estimates that they will require a retirement income totaling $100,000. (Both figures in todays money)

Using the information above

Provide Mary and Austin Smith financial Data:

Using Words

It should include:

1. Short Description of the Smiths current financial situation

2. Short Description and calculation of the Smiths income/cash flow resources based on current 2017 data. Please calculations should be shown using the TI BA II PLUS CALCULATION

3. Make recommendations to improve the Smiths financial situation/cash flow resources given their financial goals.Also, determine whether The Smiths current financial goals are realistic and achievable.

Some important information

Contribution Limits

RRSP

18% of previous years earned income

2017 max 26,010

Assume limits in 2018 and beyond are 26,230

TSFA

Annual limit $5,500

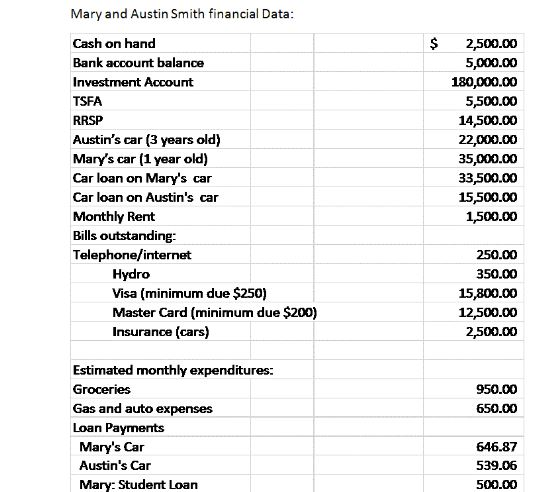

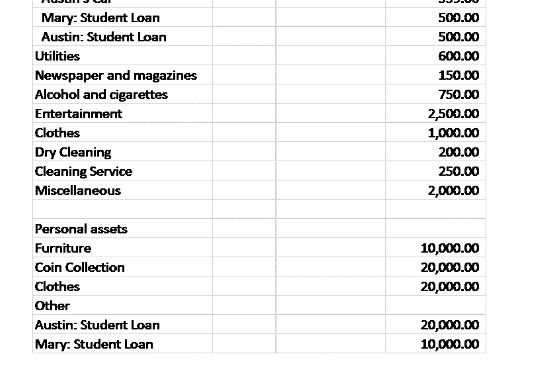

Assume no change in limit in future years

Mary and Austin Smith financial Data: Cash on hand Bank account balance Investment Account TSFA RRSP Austin's car (3 years old) Mary's car (1 year old) Car loan on Mary's car Car loan on Austin's car Monthly Rent Bills outstanding: Telephone/internet Hydro Visa (minimum due $250) Master Card (minimum due $200) insurance (cars) Estimated monthly expenditures: Groceries Gas and auto expenses Loan Payments Mary's Car Austin's Car Mary: Student Loan 2,500.00 5,000.00 180,000.00 5,500.00 14,500.00 22,000.00 35,000.00 33,500.00 15,500.00 1500.00 250.00 350.00 15,800.00 12,500.00 2,500.00 950.00 650.00 646.87 539.06 500.00 Mary and Austin Smith financial Data: Cash on hand Bank account balance Investment Account TSFA RRSP Austin's car (3 years old) Mary's car (1 year old) Car loan on Mary's car Car loan on Austin's car Monthly Rent Bills outstanding: Telephone/internet Hydro Visa (minimum due $250) Master Card (minimum due $200) insurance (cars) Estimated monthly expenditures: Groceries Gas and auto expenses Loan Payments Mary's Car Austin's Car Mary: Student Loan 2,500.00 5,000.00 180,000.00 5,500.00 14,500.00 22,000.00 35,000.00 33,500.00 15,500.00 1500.00 250.00 350.00 15,800.00 12,500.00 2,500.00 950.00 650.00 646.87 539.06 500.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started