Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help Acme, Inc. plans to issue a 25-year semiannual bond with a face value of $160,000 with a coupon rate of 8%. On the

Please help

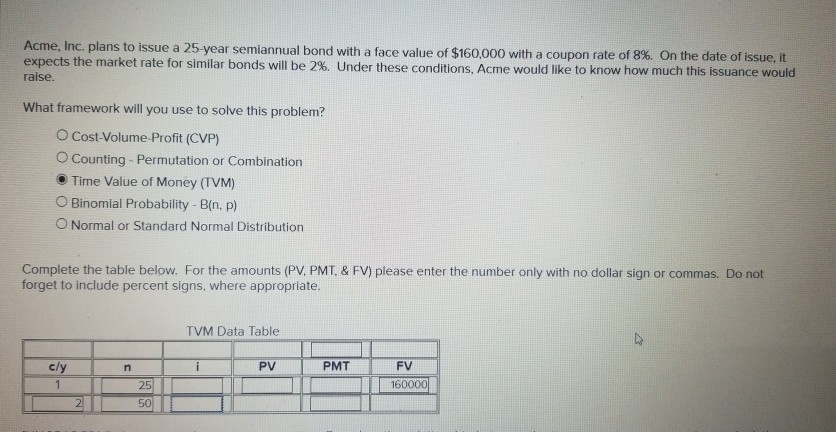

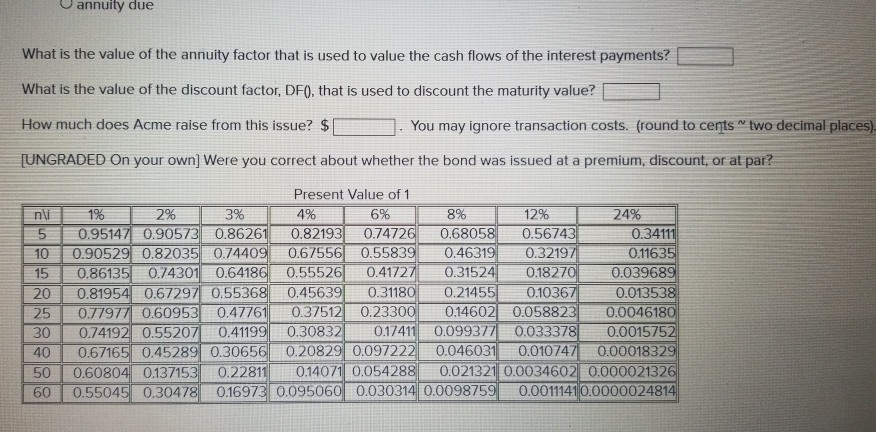

Acme, Inc. plans to issue a 25-year semiannual bond with a face value of $160,000 with a coupon rate of 8%. On the date of issue, it expects the market rate for similar bonds will be 2%. Under these conditions, Acme would like to know how much this issuance would raise. What framework will you use to solve this problem? O Cost-Volume-Profit (CVP) O Counting - Permutation or Combination Time Value of Money (TVM) O Binomial Probability - Bin, p) Normal or Standard Normal Distribution Complete the table below. For the amounts (PV, PMT, & FV) please enter the number only with no dollar sign or commas. Do not forget to include percent signs, where appropriate. TVM Data Table cly n PV PMT FV 160000 1 25 2 50 annuity due What is the value of the annuity factor that is used to value the cash flows of the interest payments? What is the value of the discount factor, DFO), that is used to discount the maturity value? How much does Acme raise from this issue? $ You may ignore transaction costs. (round to cents two decimal places) [UNGRADED On your own] Were you correct about whether the bond was issued at a premium, discount, or at par? ni 5 10 15 20 25 30 40 50 60 Present Value of 1 1% 2% 3% 4% 6% 8% 12% 24% 0.95147 0.90573 0.86261 0.82193 0.74726 0.68058 0.56743 0.34111 0.90529 0.82035 0.74409 0.67556 0.55839 0.46319 0.32197 0.11635 0.86135 0.74301 0.64186 0.55526 0.41727 0.31524 0.18270 0.039689 0.81954 0.67297 0.55368 0.45639 0.31180 0.21455 0.10367 0.013538 0.77977 0.60953 0.47761 0.37512 0.23300 0.14602 0.058823 0.0046180 0.74192 0.55207 0.41199 0.30832 0.17411 0.099377 0.033378 0.0015752 0.67165 0.45289 0.30656 0.20829 0.097222 0.046031 0.010747 0.00018329 0.60804 0.137153 0.22811 0.14071 0.054288 0.021321 0.0034602 0.000021326 0.55045 0.30478|| 0.16973 0.095060 0.030314 0.0098759 0.0011141 0.0000024814 Acme, Inc. plans to issue a 25-year semiannual bond with a face value of $160,000 with a coupon rate of 8%. On the date of issue, it expects the market rate for similar bonds will be 2%. Under these conditions, Acme would like to know how much this issuance would raise. What framework will you use to solve this problem? O Cost-Volume-Profit (CVP) O Counting - Permutation or Combination Time Value of Money (TVM) O Binomial Probability - Bin, p) Normal or Standard Normal Distribution Complete the table below. For the amounts (PV, PMT, & FV) please enter the number only with no dollar sign or commas. Do not forget to include percent signs, where appropriate. TVM Data Table cly n PV PMT FV 160000 1 25 2 50 annuity due What is the value of the annuity factor that is used to value the cash flows of the interest payments? What is the value of the discount factor, DFO), that is used to discount the maturity value? How much does Acme raise from this issue? $ You may ignore transaction costs. (round to cents two decimal places) [UNGRADED On your own] Were you correct about whether the bond was issued at a premium, discount, or at par? ni 5 10 15 20 25 30 40 50 60 Present Value of 1 1% 2% 3% 4% 6% 8% 12% 24% 0.95147 0.90573 0.86261 0.82193 0.74726 0.68058 0.56743 0.34111 0.90529 0.82035 0.74409 0.67556 0.55839 0.46319 0.32197 0.11635 0.86135 0.74301 0.64186 0.55526 0.41727 0.31524 0.18270 0.039689 0.81954 0.67297 0.55368 0.45639 0.31180 0.21455 0.10367 0.013538 0.77977 0.60953 0.47761 0.37512 0.23300 0.14602 0.058823 0.0046180 0.74192 0.55207 0.41199 0.30832 0.17411 0.099377 0.033378 0.0015752 0.67165 0.45289 0.30656 0.20829 0.097222 0.046031 0.010747 0.00018329 0.60804 0.137153 0.22811 0.14071 0.054288 0.021321 0.0034602 0.000021326 0.55045 0.30478|| 0.16973 0.095060 0.030314 0.0098759 0.0011141 0.0000024814Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started