Answered step by step

Verified Expert Solution

Question

1 Approved Answer

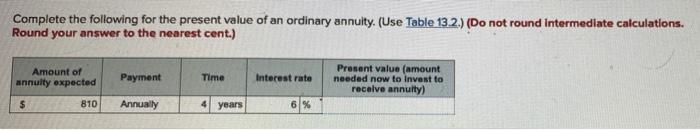

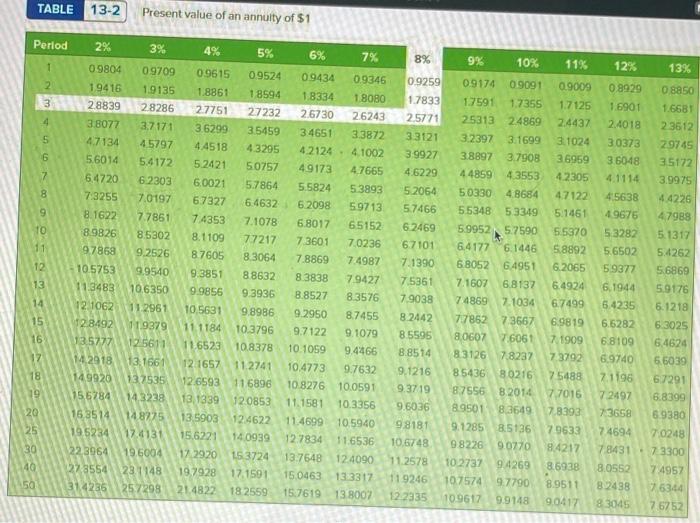

please help all answers are wrong Complete the following for the present value of an ordinary annuity. (Use Table 13.2.) (Do not round Intermediate calculations.

please help all answers are wrong

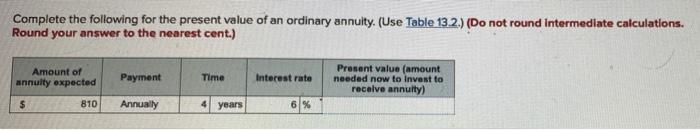

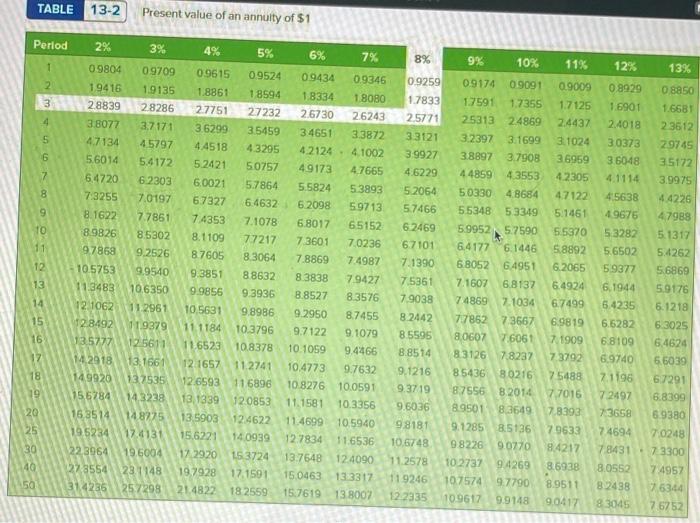

Complete the following for the present value of an ordinary annuity. (Use Table 13.2.) (Do not round Intermediate calculations. Round your answer to the nearest cent.) Amount of annuity oxpected Payment Time Interest rate Present value (amount needed now to invest to receive annuity) 810 Annually 4 years 6% TABLE 13-2 Present value of an annulty of $1 Period 6% 7% 8% 9% 1 10% 11% 12% 13% 0.9259 0.9009 2 3 08850 4 1.7125 2.4437 3. 1024 36959 42305 TO 11 2% 3% 09804 09709 1.9416 1.9135 28839 28286 3.8077 3.7171 47134 45797 5.6014 5.4172 64720 62303 7.3255 7,0197 8.1622 7.7851 8.9826 8.5302 97868 9.2526 10.5753 9.9540 11.3483 10.6350 12 1062 11 2961 12.8492 119379 13.5777 12 5611 14.2018 13.1661 149920 132535 15.5784 143228 163514 148275 195234 124131 1223964 19.6004 223554 23. 1148 31,4236 257299 12 4% 5% 0.9615 0.9524 1.8861 1 8594 27751 27232 36299 35459 4.4518 43295 52421 50757 60021 5.7864 67327 6.4632 7.4353 7.1078 8.1109 7.7217 87605 83064 9.3851 88632 9.9856 9.3936 10.5631 9.8986 11 1184 10.3796 116523 10.8378 12 1657 112741 72 6593 116896 13.1339 920853 13.5903 124622 15.6221 14 0939 17.2920 153724 19.7928 17.1591 21.4822 18 2559 4.7122 5.1461 5.5370 5.8892 6.2065 13 09434 0.9346 18334 1.8080 26730 26243 34651 33872 4.21244.1002 49173 4.7665 5.5824 5.3893 6 2098 59713 6 8017 65152 7 3601 7,0236 7.8869 7.4987 8.3838 79427 8.8527 8.3576 9.2950 8.7455 9.7122 9.1079 10.1059 9.4466 10.4773 9.7632 10.8276 10.0591 11.1581 10.3356 11.4699 10.5940 12.7834 116536 13.7648 12 4090 15 0463 13 3317 15.761913 8007 0.9174 09091 1.7591 1.7355 2531324869 3.2397 3.1699 3.8897 3.7908 44859 4.3553 50330 4.8684 55348 53349 599525.7590 6.4177 6.1446 6805264951 7. 1607 6.8137 74869 21034 77852 73667 80602 7.6061 8.3126 7.8237 8543680216 87556 8 2014 8.9501 83649 9.1285 8.5136 98226 9.0770 102737 94269 107574 97790 10.9617 9.9148 1.7833 25771 33121 39927 4.6229 5.2064 5.7466 6.2469 67101 7.1390 7.5351 79038 8 2442 8.5595 8.8514 9.1216 93719 9.6036 9.8181 10.6748 11.2578 11 9246 12.2335 0.8929 1.6901 2.4018 30373 3 6048 4.1114 45638 4.9676 53282 5.6502 59377 6.1944 6.4235 6.6282 6.8109 6.9740 21196 7.2497 73658 74694 78431 8.0552 8.2438 83045 1.6681 23612 29745 3.5172 3.9975 4.4226 47988 5.1317 5.4262 5.6869 59176 6.1218 6.3025 6.4624 6.6039 67291 6.8399 8 9380 710248 7 3300 6.4924 6.7499 14 15 16 17 18 19 20 25 69819 7. 1909 73792 75488 7.7016 7.8393 79633 84217 86938 8.9511 90417 30 40 50 7.4957 7.5344 76752

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started