Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. All info in the images Exercise 2-20 (Algo) Computing overhead rate and direct materials LO P3 Tasty Bakery applies overhead based on direct

Please help. All info in the images

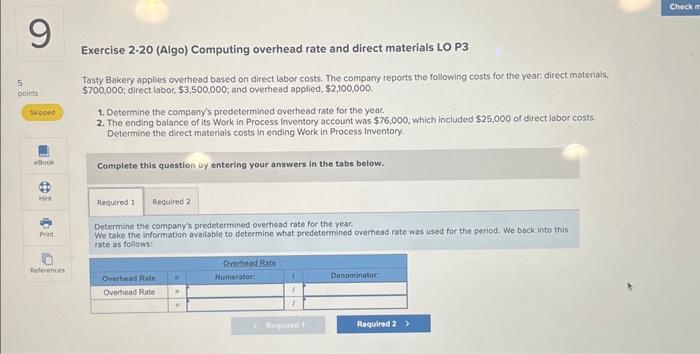

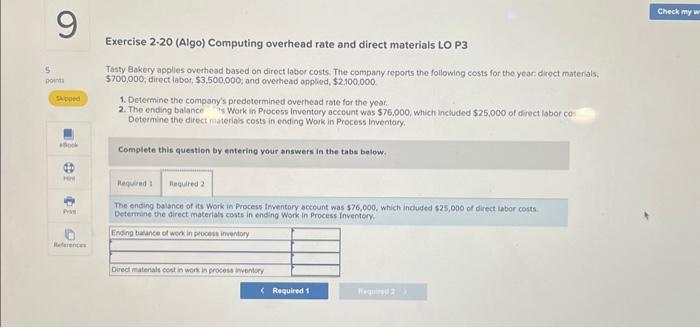

Exercise 2-20 (Algo) Computing overhead rate and direct materials LO P3 Tasty Bakery applies overhead based on direct labor costs. The company reports the following costs for the year: direct materials: $700,000; direct labor, $3,500,000; and overhead applied, $2,100,000. 1. Determine the company's predetermined overhead rate for the yeac. 2. The ending balance of its Work in Process Inventory account was $76,000, which included $25,000 of direct labor costs Determine the direct materials costs in ending Work in Process inventory. Complete this question uy entering your answers in the tabs below. Determine the company's predetermined overhead rate for the year. We take the information available to determine what predetermined overhead rote was used for the period. We back into this rate as follows: Exercise 2.20 (Algo) Computing overhead rate and direct materials LO P3 Tasty Bakery applies overtiead based on direct labor costs. The company roports the following costs for the year diroct materals. $700,000, direct labor, $3,500,000, and overthead appled, $2,100,000 1. Determine the company's predetermined overhead rate for the year. 2. The ending balance is Work in Process inventory account was $76,000, which included $25,000 of direct lobor co: Determine the direct materials costs in ending Work in Process Inventory. Complete this question by entering your answers in the tabs below. The ending balance of its Work in Process Invertary occount was $76,000, which included $25,000 of divect tabor costs Determine the direct materials costs in ending Work in Process Inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started