Answered step by step

Verified Expert Solution

Question

1 Approved Answer

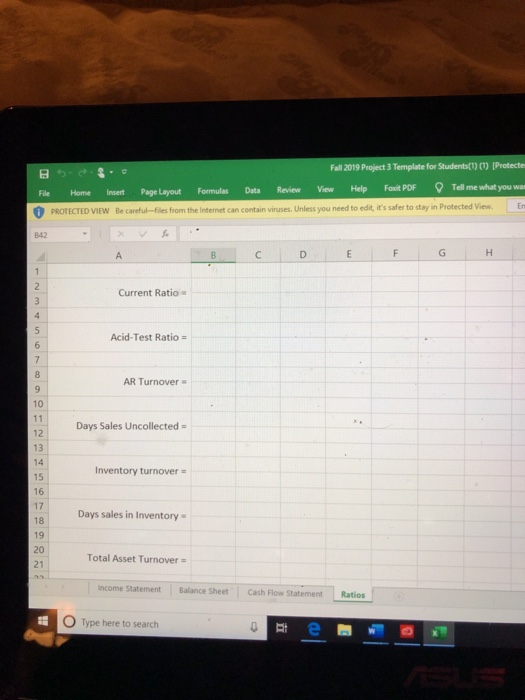

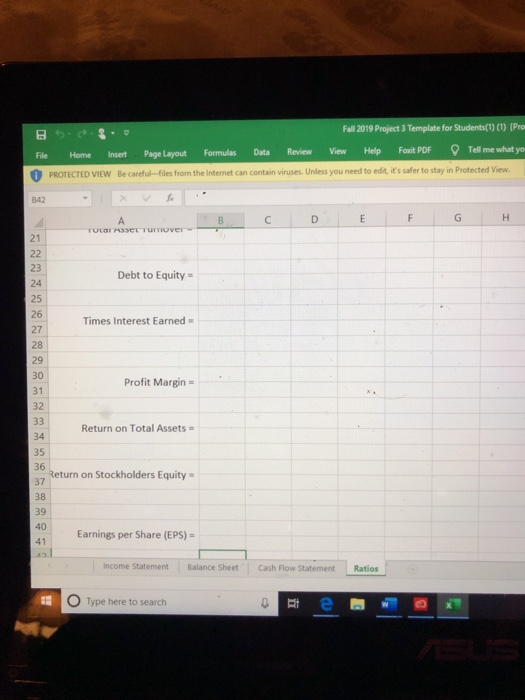

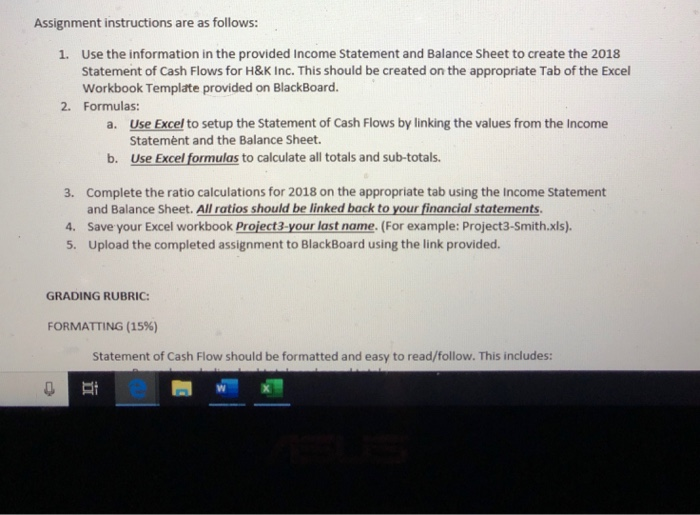

Please help! All information needed is provided in the attached pictures, instructions are also provided. Fall 2019 Project File Home Insert Page Layout Formulas Data

Please help!

All information needed is provided in the attached pictures, instructions are also provided.

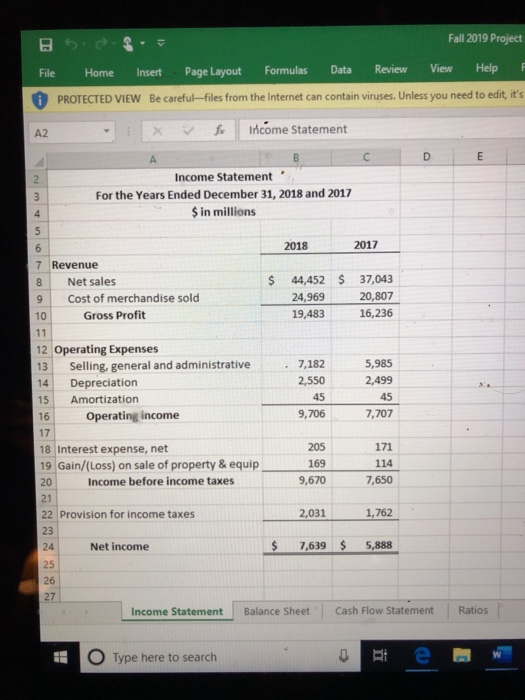

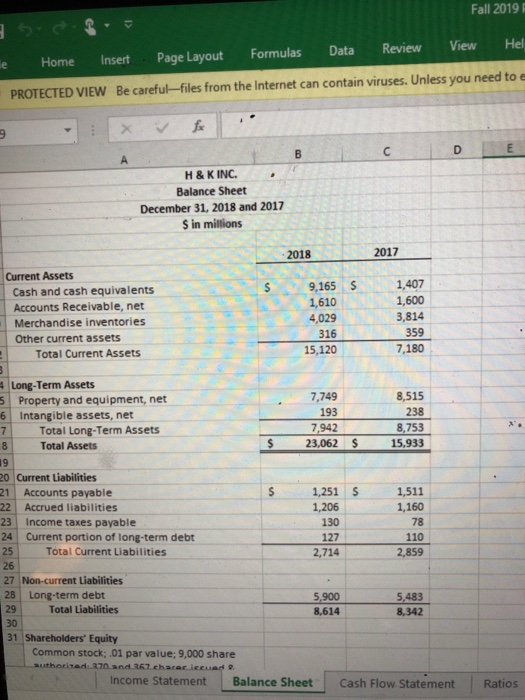

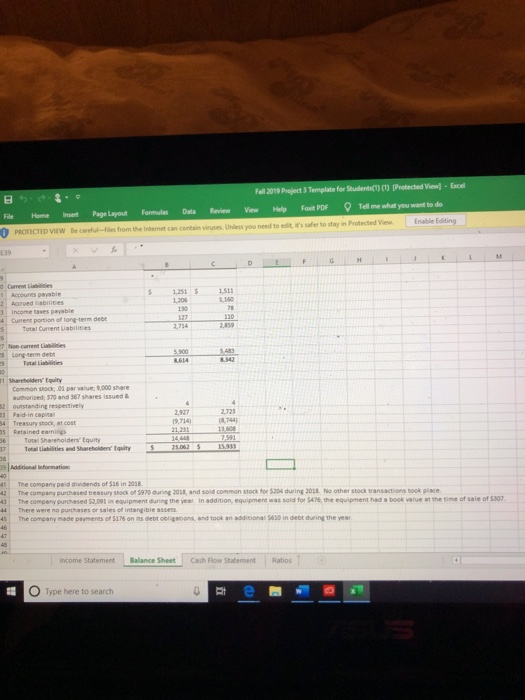

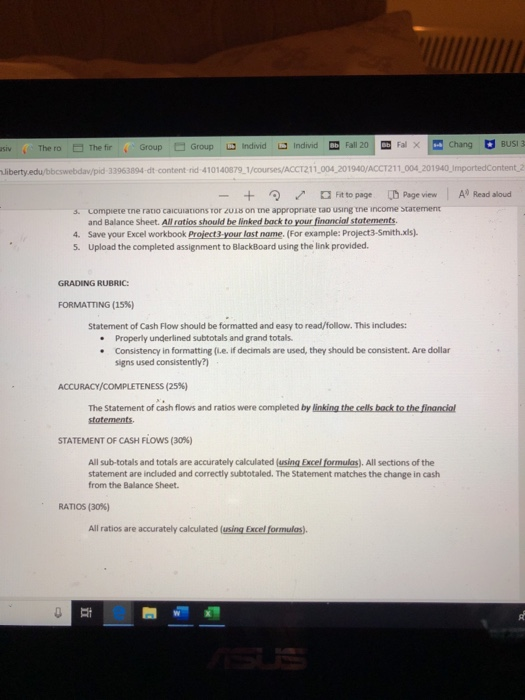

Fall 2019 Project File Home Insert Page Layout Formulas Data Review View Help O PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit, it's x fax Income Statement Income Statement For the Years Ended December 31, 2018 and 2017 $ in millions mo 2018 2017 $ $ 7 Revenue 8 Net sales 9 Cost of merchandise sold 10 Gross Profit 44,452 24.969 19,483 37,043 20,807 16,236 12 Operating Expenses Selling, general and administrative 14 Depreciation Amortization Operating income 7,182 2,550 45 9,706 5,985 2,499 45 7,707 205 171 18 Interest expense, net 19 Gain/(Loss) on sale of property & equip 20 Income before income taxes 114 169 9,670 7,650 22 Provision for income taxes 2,031 1,762 Net income $ 7,639 $ 5,888 Income Statement Balance Sheet Cash Flow Statement Ratios O Type here to search Fall 2019 le Home Insert Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to e - X Fax D H&K INC. Balance Sheet December 31, 2018 and 2017 Sin millions 2017 S 1,407 9,165 1,610 Current Assets Cash and cash equivalents Accounts Receivable, net Merchandise inventories Other current assets Total Current Assets 1,600 3,814 4,029 316 15,120 359 7,180 8,515 Long-Term Assets 5 Property and equipment, net 6 Intangible assets, net 7 Total Long-Term Assets 8 Total Assets 238 7,749 193 7,942 23,062 $ 8,753 15,933 19 5 1,511 1,160 20 Current Liabilities 21 Accounts payable 22 Accrued liabilities 23 Income taxes payable 24 Current portion of long-term debt 25 Total Current Liabilities 1,251 1,206 130 127 2,714 110 2,859 26 27 Non-current Liabilities 28 Long-term debt Total Liabilities 5,900 5,483 29 8.342 31 Shareholders' Equity Common stock:.01 par value; 9,000 share authorised 27 and 267 harer lend. Income Statement Balance Sheet Cash Flow Statement Ratios BS- Fall 2019 Project Template for Student Protected View - Excel Home Int Page Layout formules Dute Review View Map Fe POF Tell me what you want to do 1 PROTECTED VIEw to constat les from the internet can contain vins Unless you need to enter to stay in Protected View Current portion of long-term det Total Current abilities 1 Shaderity Commons 01 .000 share ESE 1 Paid in capital Tot e s and share wity The company aiddiends of 516 in 2018 The company purchased to uring and coo k for during the worst There were presses intangible The company made events of Sondebiti s and to o ls in der during the va O Type here to search Fall 2019 Project 3 Template for Students(1) (1) (P File Home Insert Page Layout Formulas Data Review View Help Font PDF Tell me what y O PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View B42 TULOS Y er Debt to Equity - Times Interest Earned Profit Margin- Return on Total Assets - 27 Return on Stockholders Equity - Earnings per Share (EPS) = Income Statement Balance sheet Cash Flow Statement Ratios Type here to search e Assignment instructions are as follows: 1. Use the information in the provided Income Statement and Balance Sheet to create the 2018 Statement of Cash Flows for H&K Inc. This should be created on the appropriate Tab of the Excel Workbook Template provided on BlackBoard. 2. Formulas: a. Use Excel to setup the Statement of Cash Flows by linking the values from the Income Statement and the Balance Sheet. b. Use Excel formulas to calculate all totals and sub-totals. 3. Complete the ratio calculations for 2018 on the appropriate tab using the income Statement and Balance Sheet. All ratios should be linked back to your financial statements. 4. Save your Excel workbook Project3-your last name. (For example: Project3-Smith.xls). 5. Upload the completed assignment to BlackBoard using the link provided. GRADING RUBRIC: FORMATTING (15%) Statement of Cash Flow should be formatted and easy to read/follow. This includes: asiv (Thero The fir (Group Group Individ Individ Bb Fall 20 m Fal - Chang BUS 3 liberty.edu/bbcswebdav/pid 33963894 dt content-rid-410140879_1/courses/ACCT211_004201940/ACCT211_004_201940 Imported Content 2 A Read aloud - + Fit to page . D Page view 3. compiere the ratio calculations Tor 2018 on the appropriate to using the income statement and Balance Sheet All ratios should be linked back to your financial statements. 4. Save your Excel Workbook Project3-your last name. (For example: Project3-Smith.xls). 5. Upload the completed assignment to BlackBoard using the link provided. GRADING RUBRIC: FORMATTING (15%) Statement of Cash Flow should be formatted and easy to read/follow. This includes: Properly underlined subtotals and grand totals. Consistency in formatting (e. if decimals are used, they should be consistent. Are dollar signs used consistently?) ACCURACY/COMPLETENESS (25%) The Statement of cash flows and ratios were completed by linking the cells back to the financial statements STATEMENT OF CASH FLOWS (30%) All sub-totals and totals are accurately calculated using Excel formulas). All sections of the statement are included and correctly subtotaled. The Statement matches the change in cash from the Balance Sheet. RATIOS (30%) All ratios are accurately calculated using Excel formulas) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started