Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help all questions related A property is expected to generate net cash flows of $17.000 in the first year and increasing (growing) by 2%,4%

please help all questions related

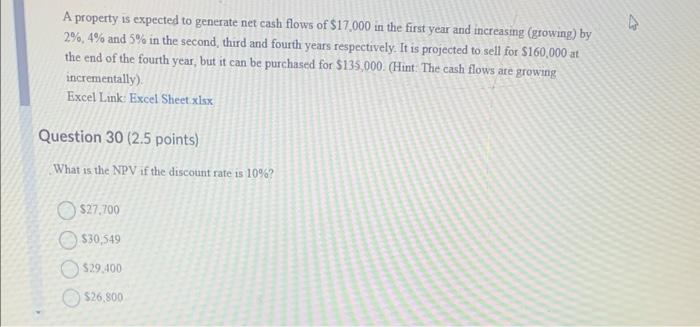

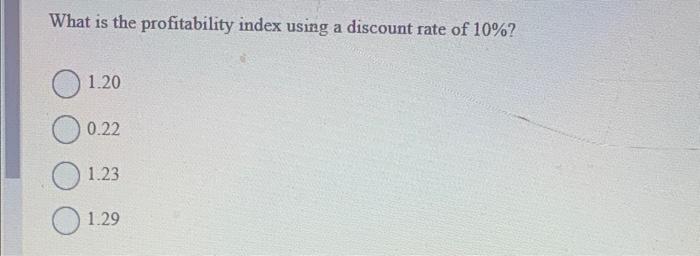

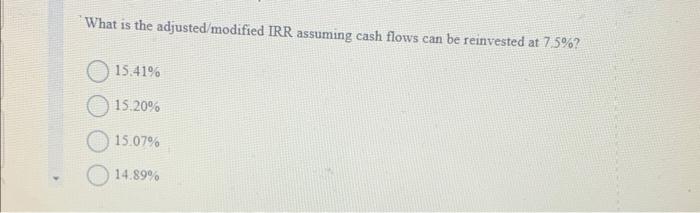

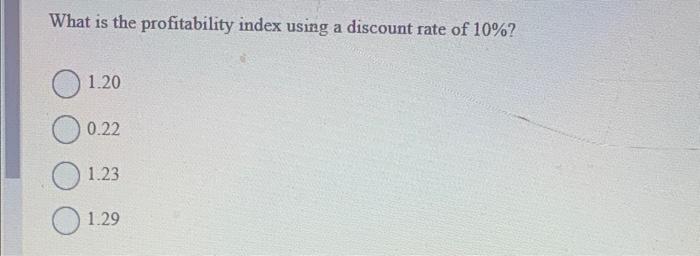

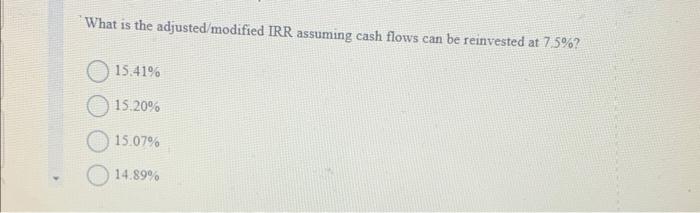

A property is expected to generate net cash flows of $17.000 in the first year and increasing (growing) by 2%,4% and 5% in the second, third and fourth years respectively. It is projected to sell for $160,000 at the end of the fourth year, but it can be purchased for $135,000. (Hint: The cash flows ate growing incrementally) Excel Link: Excel Sheet x lsx Question 30 (2.5 points) What is the NPV if the discount rate is 10%? $27,700 530,549 $29.400 $26,800 What is the profitability index using a discount rate of 10% ? 1.20 0.22 1.23 1.29 What is the adjusted/modified IRR assuming cash flows can be reinvested at 75% ? 15.41%15.20%15.07%14.89%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started