Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help all the questions with clear explanations. Thank you for your help! You are given the following information about possible investments: Asset Class Mean

Please help all the questions with clear explanations. Thank you for your help!

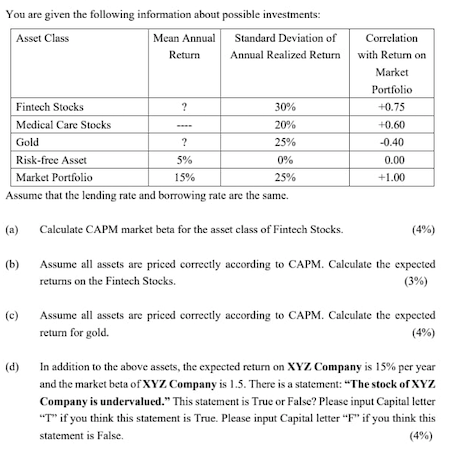

You are given the following information about possible investments: Asset Class Mean Annual Standard Deviation of Return Annual Realized Return Fintech Stocks ? 30% Medical Care Stocks 20% Gold ? 25% Risk-free Asset 5% 0% Market Portfolio 15% 25% Assume that the lending rate and borrowing rate are the same. Correlation with Return on Market Portfolio +0.75 +0.60 -0.40 0.00 +1.00 (a) Calculate CAPM market beta for the asset class of Fintech Stocks. (4%) (b) Assume all assets are priced correctly according to CAPM. Calculate the expected returns on the Fintech Stocks. (3%) (c) Assume all assets are priced correctly according to CAPM. Calculate the expected return for gold. (4%) (d) In addition to the above assets, the expected return on XYZ Company is 15% per year and the market beta of XYZ Company is 1.5. There is a statement: "The stock of XYZ Company is undervalued." This statement is True or False? Please input Capital letter "T" if you think this statement is True. Please input Capital letter "F" if you think this statement is False (4%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started