Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! An all-equity business has 105 million shares outstanding selling for $20 a share. Management believes that interest rates are unreasonably low and decides

please help!

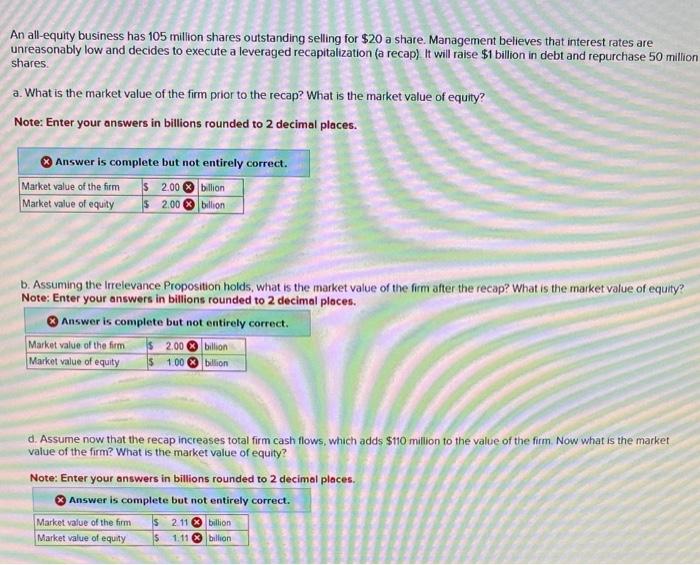

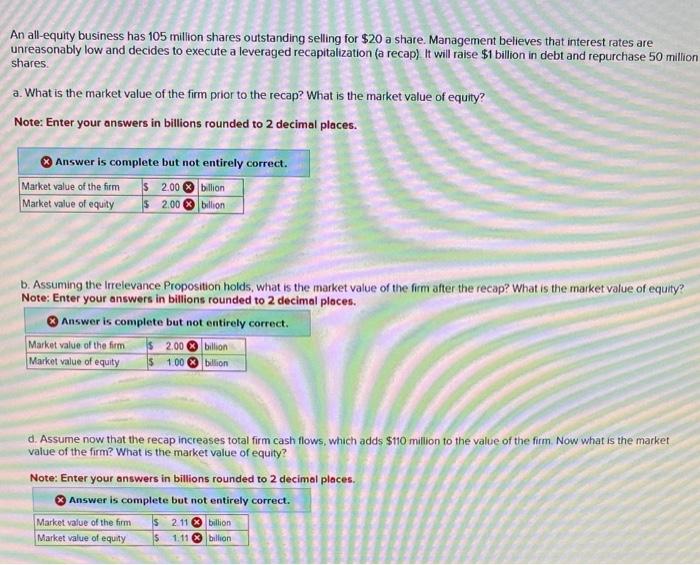

An all-equity business has 105 million shares outstanding selling for $20 a share. Management believes that interest rates are unreasonably low and decides to execute a leveraged recapitalization (a recap) It will raise $1 billion in debt and repurchase 50 million shares. a. What is the market value of the firm prior to the recap? What is the market value of equity? Note: Enter your answers in billions rounded to 2 decimal places. Answer is complete but not entirely correct. b. Assuming the Irrelevance Proposition holds, what is the market value of the firm after the recap? What is the market value of equity? Note: Enter your answers in billions rounded to 2 decimal ploces. Answer is complete but not entirely correct. d. Assume now that the recap increases total firm cash flows, which adds $110 million to the value of the firm. Now what is the market value of the firm? What is the market value of equity? Note: Enter your answers in billions rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started