please help and be neat!

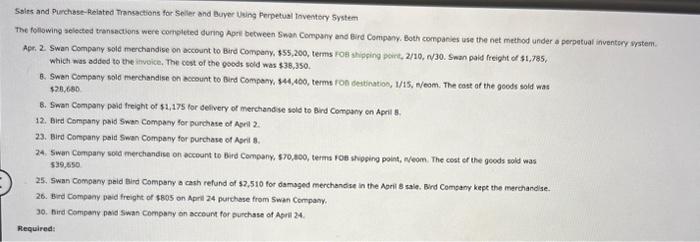

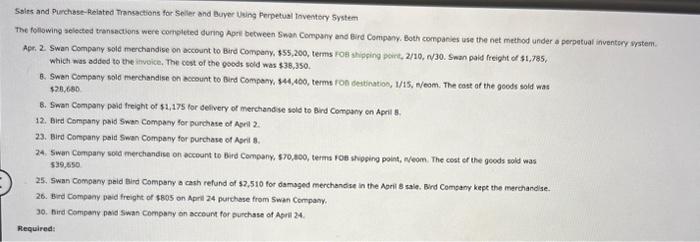

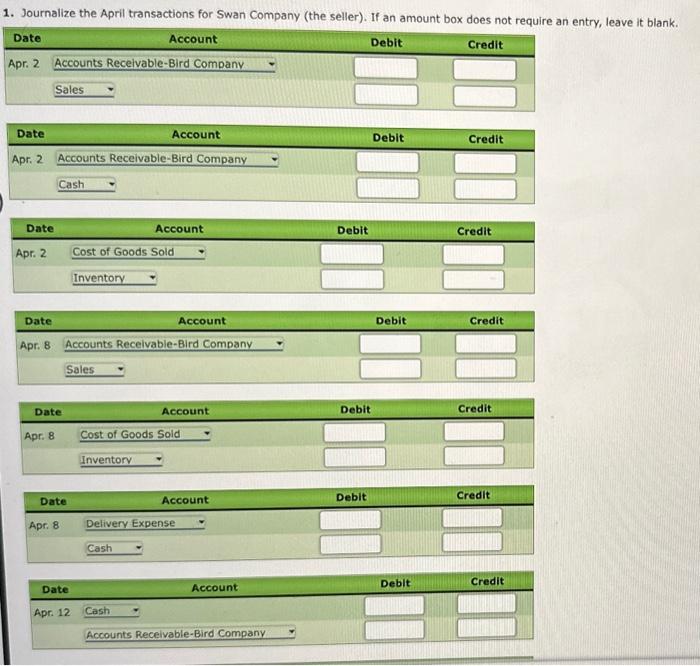

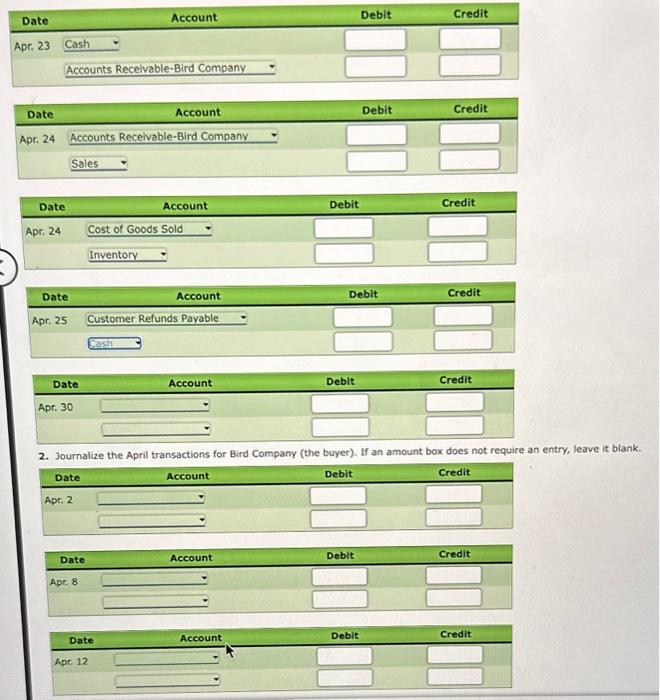

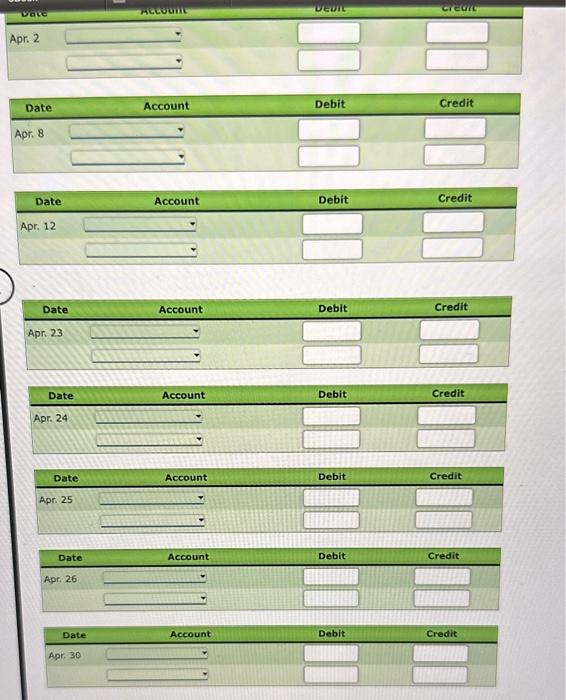

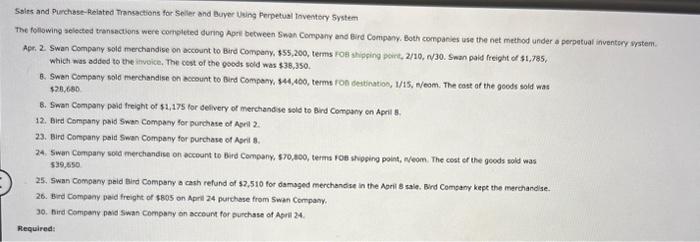

Ssins and Purchbse-Reiatnd Trancactions for Selter and buyer Uwing Ferpetual toventory 5ystem The following seleded transections were completed during Apri between Sman Company and Bird Company. Both comparies use the net method under a perpetual inventory watem. Apr. 2 Swan Company sold merchandise on account to Bird Company, 555,200 , terms fos atipping point, 2/10, N30. Sman paid freight of 31,785 , which mas added to the itrvoice, The cest of the goods sold was 438,350 . 8. Swen Company sold merchandise on account to Bird Compary, 344,400, terms foo destination, 1/15, deom. The cost of the goods sald was 138,680 8. Swan Company poid freight of $2,175 for delivery of merchandse sold to Bird Conomy on April 8. 12. Bird Company paid Swan Company for purchase of Asnil 2 . 23. Bire Company poid Swan Company for purchase of Asrit 8 . 539,650 25. Swan Company paid Bird Company a cash refund of 97,510 for damaged merchandse in the Aocil 8 saie, Bird Comsany kepe the marchandise. 26. Brid Company peid freight of $805 on Apret 24 purchase from Swan Company. 30. Dird Company paid Swan Company on account for purchsse of Apill 24. Required: 1. Journalize the April transactions for Swan Company (the seller). If an amount box does not require an entry, leave it blank. \begin{tabular}{|crc|c|} \hline \multicolumn{1}{c}{ Date } & Account & Debit & Credit \\ \hline Apr. 8 & Cost of Goods Sold & \\ \hline & & & \\ \hline Inventory & & \\ \hline \end{tabular} \begin{tabular}{|cr|c|c|c|} \hline \multicolumn{1}{|r|}{ Date } & Account & Debit & Credit \\ \hline Apr. 8 & Delivery Expense & & \\ \hline & & & \\ \hline Cash & & & \\ \hline \end{tabular} \begin{tabular}{|cc|c|c|c|} \hline & Account & Deblt & Credit \\ \hline Date & & \\ \hline Apr. 12 & Cash & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{ccccc|} \hline & Account & Debit & Credit \\ \hline Date & & \\ \hline Apr. 23 & Cash & & \\ \hline & Accounts Recelvable-Bird Company & \\ \hline \end{tabular} \begin{tabular}{|cccc|} \hline \multicolumn{1}{c}{ Date } & Account & Debit & Credit \\ \hline Apr. 24 & Accounts Recelvable-Bird Company & \\ \hline \end{tabular} \begin{tabular}{|crcc|} \hline \multicolumn{1}{c}{ Date Account } & Debit & Credit \\ \hline Apr. 24 & Cost of Goods Sold \\ & Inventory & \\ \hline \end{tabular} \begin{tabular}{|rccc|} \hline \multicolumn{1}{c}{ Date } & Account & Debit & Credit \\ \hline Apr. 25 & Customer Refunds Payable \\ \hline Date & Account & \\ \hline Apr. 30 & Deblt & \\ \hline \end{tabular} 2. Journalize the April transactions for Bird Company (the buyer). If an amount box does not require an entry, leave it blank. \begin{tabular}{|llll|} \hline Date & Account & Debit & Credit \\ \hline Apr. 2 & & \\ \hline \end{tabular} \begin{tabular}{|crrc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 8 & & \\ \hline \end{tabular} \begin{tabular}{cccc} Date & Account & Debit & Credit \\ \hline Apr. 12 & & \\ \hline \end{tabular} Apr. 2 \begin{tabular}{|llll|} \hline Date & Account & Debit & Credit \\ \hline Apr. 12 & \\ \hline \end{tabular} \begin{tabular}{|lrrr|} \hline Date & Account & Deblt & Credit \\ \hline Apr. 23 & & \\ \hline \end{tabular} \begin{tabular}{|lr|r|r|} \hline Date & Account & Debit & Credit \\ \hline Apr. 26 & & & \\ & & & \\ \hline \end{tabular}