Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help and ease include solution. Tia 3. How might Sander's managers use the new cost information from its activity OST per u or each

Please help and ease include solution. Tia

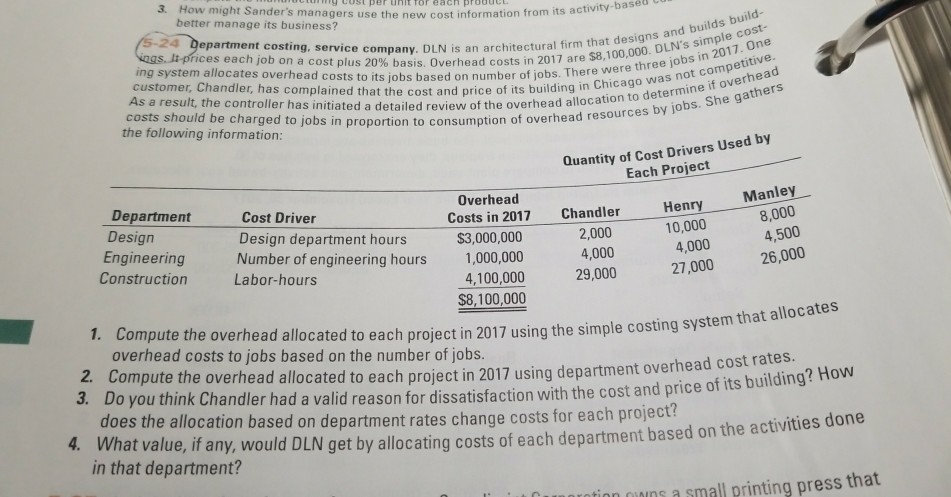

3. How might Sander's managers use the new cost information from its activity OST per u or each prood better manage its business? based Department costing, service company. DLN is an architectural m00. DLN'S s ices each job on a cost plus 20% basis. Overhead costs in 2017 are that designs and builds build- $8,100,000. DLN's simple cost- I f ing system allocates overhead costs to its jobs based on number of jobs. There w customer, Chandler, has complained that the cost and price of its building in As a result, the controller has initiated a detailed review of the overhead allocatio were three jobs in 2017. One Chicago was not compe 2017 costs should be charged to jobs in proportion to consumption of overhead resour the following information: to determine if overhead by jobs. She gathers Quantity of Cost Drivers Used by Each Project DepartmentCost Driver Design Engineering Overhead Manle Design department hours Number of engineering hours Costs in 2017 Chandler Henry 10,000 4,000 27,000 2,000 4,000 29,000 8,000 4,500 26,000 $3,000,000 1,000,000 4,100,000 $8,100,000 ConstructionLabor-hours 1. Compute the overhead allocated to each project overhead costs to jobs based on the number of jobs. t in 2017 using the simple costing system that allocates 2. Compute the overhead allocated to each project in 201 3. Do 7 using department overhead cost rates you think Chandler had a valid reason for dissatisfaction with the cost and price of its building? How does the allocation based on department rates change costs for each project? 4. What value, if any, would DLN get by allocating costs of each department based on the activities done in that department? ns a small printing press thatStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started