Answered step by step

Verified Expert Solution

Question

1 Approved Answer

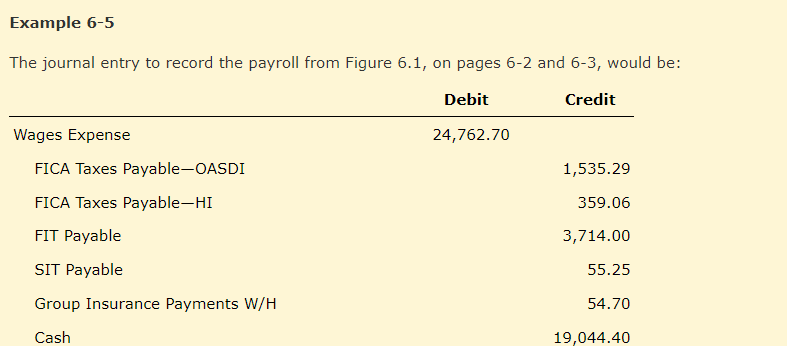

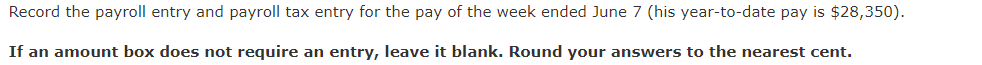

Please help and explain if you can! Thank you! The journal entry to record the payroll from Figure 6.1 , on pages 62 and 63,

Please help and explain if you can! Thank you!

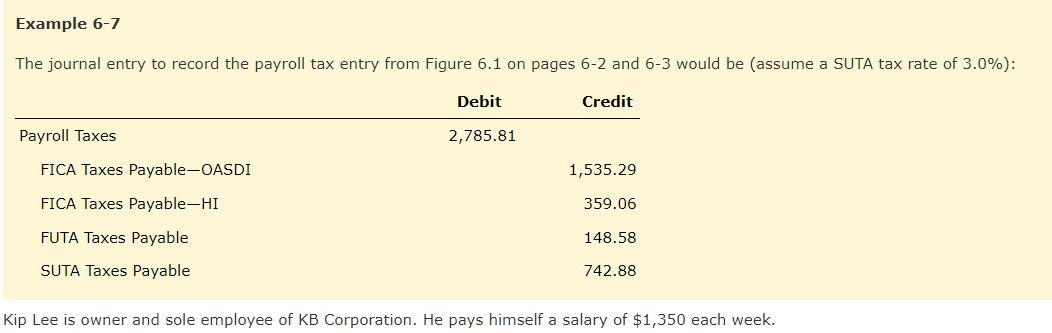

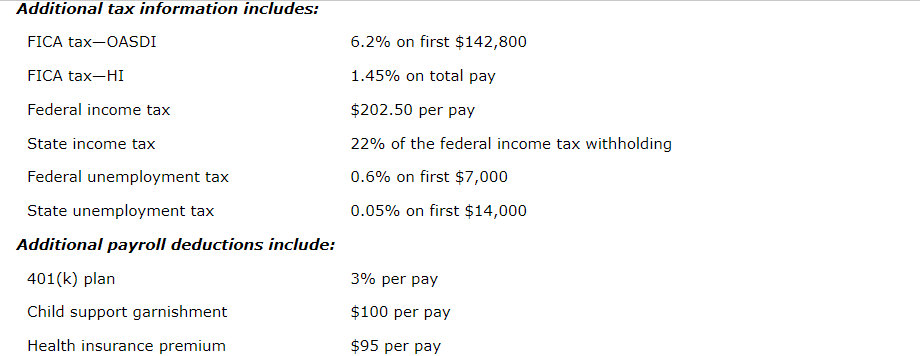

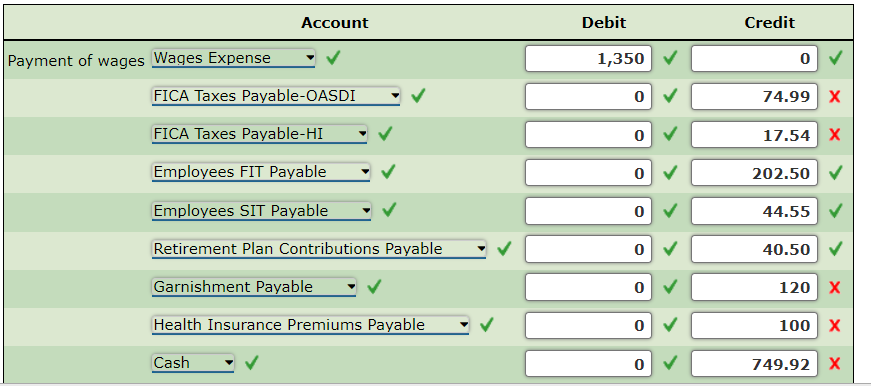

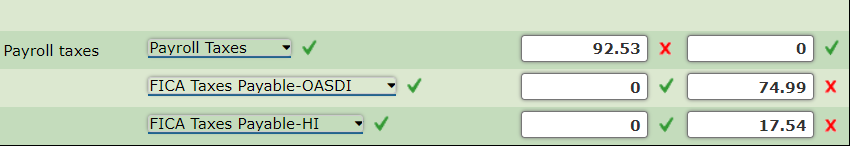

The journal entry to record the payroll from Figure 6.1 , on pages 62 and 63, would be: Example 6-7 The journal entry to record the payroll tax entry from Figure 6.1 on pages 62 and 63 would be (assume a SUTA tax rate of 3.0% ): Additional tax information includes: FICA tax-OASDI 6.2% on first $142,800 FICA tax-HI 1.45% on total pay Federal income tax $202.50 per pay State income tax 22% of the federal income tax withholding Federal unemployment tax 0.6% on first $7,000 State unemployment tax 0.05% on first $14,000 Additional payroll deductions include: 401(k) plan 3% per pay Child support garnishment $100 per pay Health insurance premium $95 per pay Record the payroll entry and payroll tax entry for the pay of the week ended June 7 (his year-to-date pay is $28,350 ). If an amount box does not require an entry, leave it blank. Round your answers to the nearest centStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started