Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help and fill out excel sheets. question and requirements are in the photos. will upvote for right answer The following information was not included

Please help and fill out excel sheets. question and requirements are in the photos. will upvote for right answer

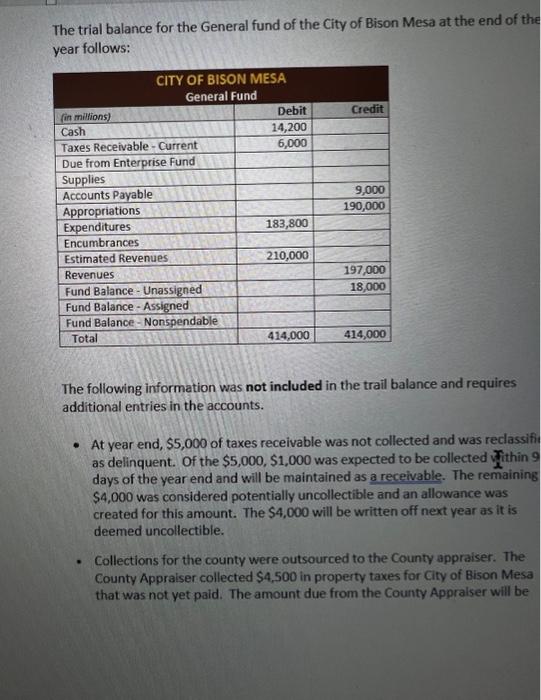

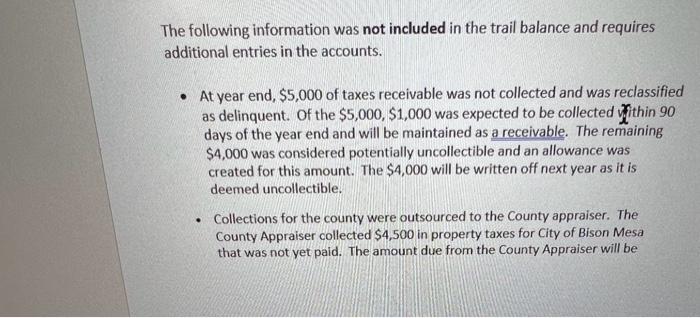

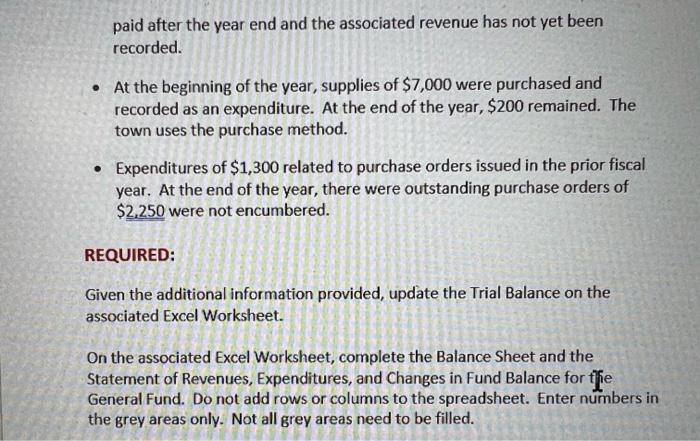

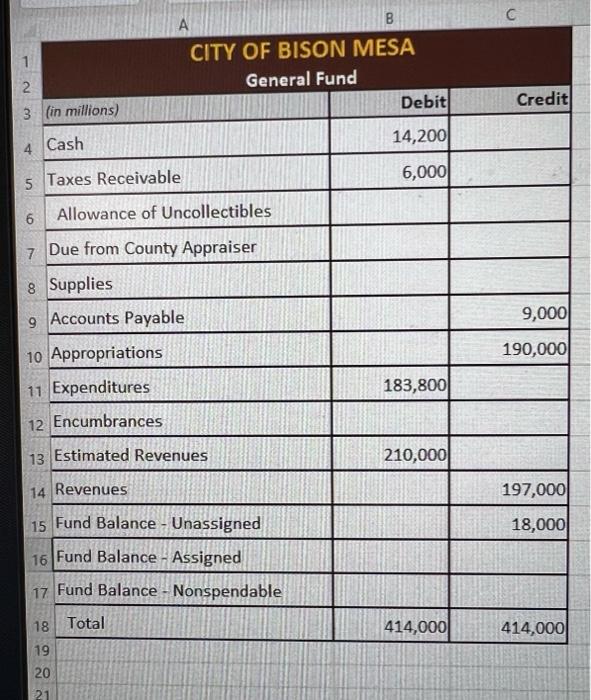

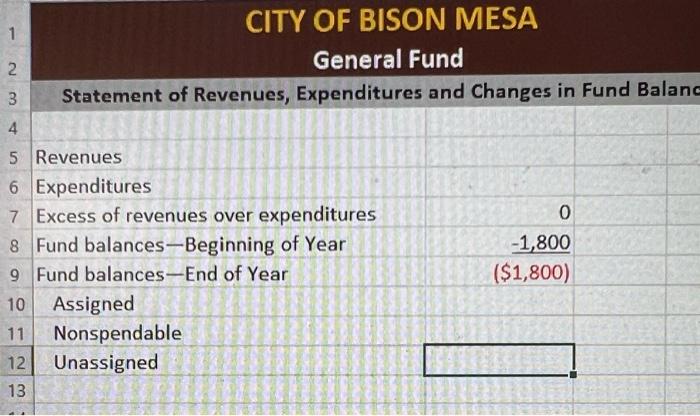

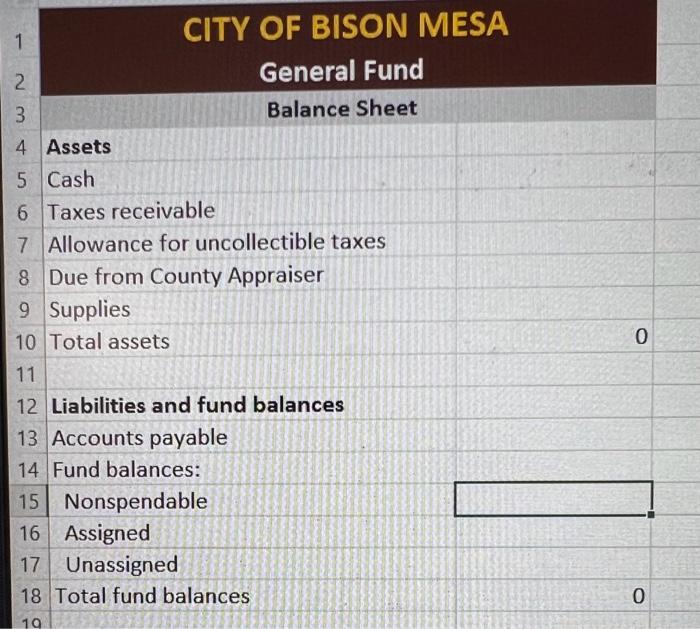

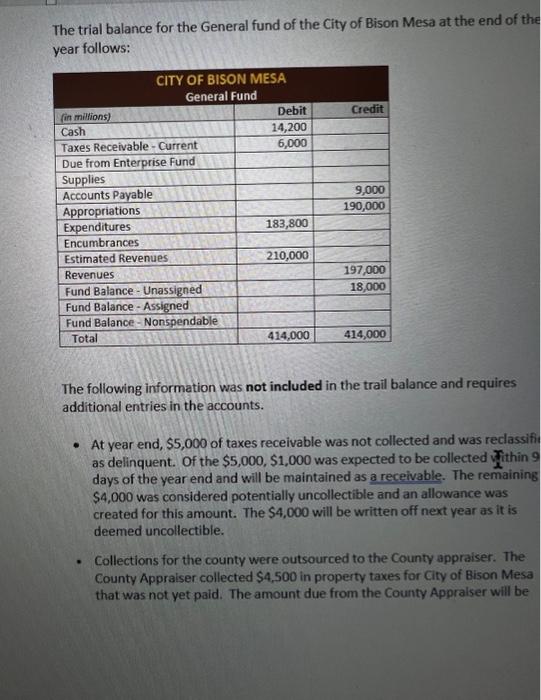

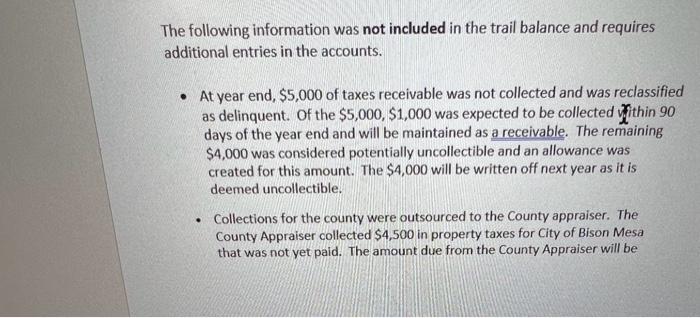

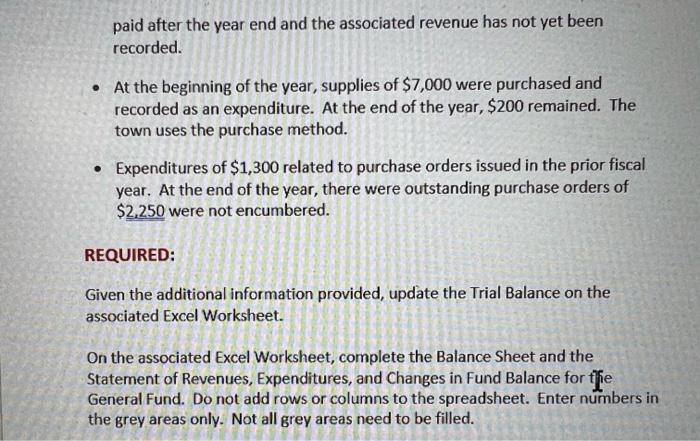

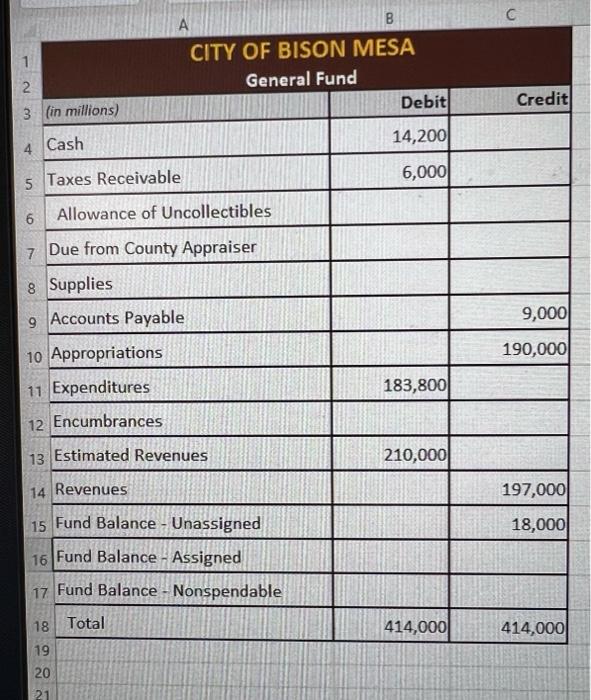

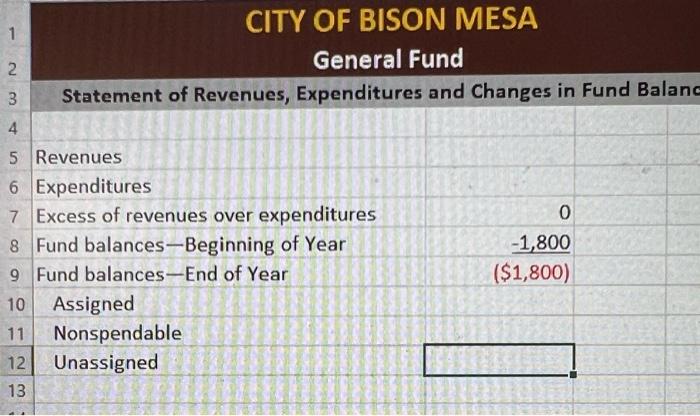

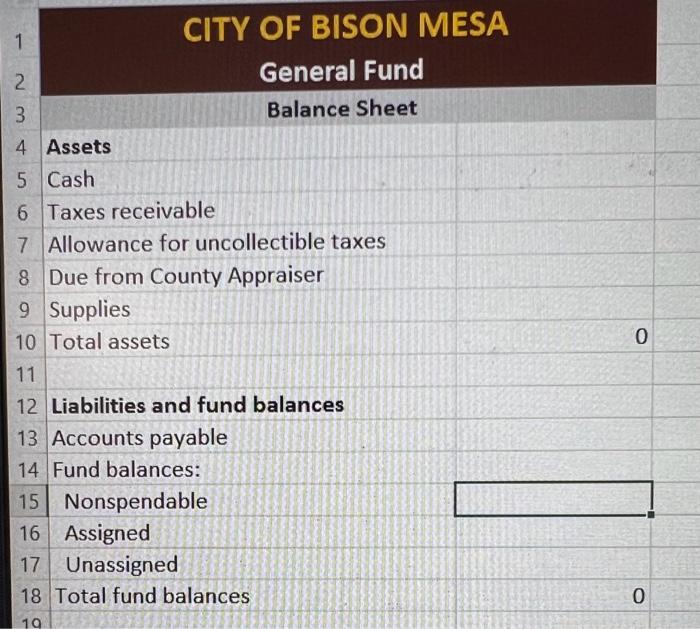

The following information was not included in the trail balance and requires additional entries in the accounts. - At year end, $5,000 of taxes receivable was not collected and was reclassified as delinquent. Of the $5,000,$1,000 was expected to be collected i ithin 90 days of the year end and will be maintained as a receivable. The remaining $4,000 was considered potentially uncollectible and an allowance was created for this amount. The $4,000 will be written off next year as it is deemed uncollectible. - Collections for the county were outsourced to the County appraiser. The County Appraiser collected $4,500 in property taxes for City of Bison Mesa that was not yet paid. The amount due from the County Appraiser will be The trial balance for the General fund of the City of Bison Mesa at the end of the year follows: The following information was not included in the trail balance and requires additional entries in the accounts. - At year end, $5,000 of taxes receivable was not collected and was reclassifi days of the year end and will be maintained as a receivable. The remaining $4,000 was considered potentially uncollectible and an allowance was created for this amount. The $4,000 will be written off next year as it is deemed uncollectible. - Collections for the county were outsourced to the County appraiser. The County Appraiser collected $4,500 in property taxes for City of Bison Mesa that was not yet paid. The amount due from the County Appraiser will be CITY OF BISON MESA General Fund Balance Sheet Assets Cash Taxes receivable Allowance for uncollectible taxes Due from County Appraiser Supplies Total assets 0 Liabilities and fund balances Accounts payable Fund balances: Nonspendable Assigned Unassigned Total fund balances 0 \begin{tabular}{|c|c|c|c|} \hline & \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{r} CITY OF BISON N \\ General Fund \end{tabular}}} \\ \hline & (in millions) & Debit & \\ \hline & Cash & 14,200 & \\ \hline & Taxes Receivable & 6,000 & . \\ \hline & Allowance of Uncollectibles & & \\ \hline & Due from County Appraiser & & \\ \hline & Supplies & & \\ \hline & Accounts Payable & & 9,000 \\ \hline 0 & Appropriations & & 190,000 \\ \hline & Expenditures & 183,800 & \\ \hline & Encumbrances & & \\ \hline 13 & Estimated Revenues & 210,000 & \\ \hline 14 & Revenues & & 197,000 \\ \hline 15 & Fund Balance - Unassigned & & 18,000 \\ \hline & Fund Balance - Assigned & & \\ \hline 17 & Fund Balance - Nonspendable & & \\ \hline 18 & Total & 414,000 & 414,000 \\ \hline \end{tabular} paid after the year end and the associated revenue has not yet been recorded. - At the beginning of the year, supplies of $7,000 were purchased and recorded as an expenditure. At the end of the year, $200 remained. The town uses the purchase method. - Expenditures of $1,300 related to purchase orders issued in the prior fiscal year. At the end of the year, there were outstanding purchase orders of $2.250 were not encumbered. REQUIRED: Given the additional information provided, update the Trial Balance on the associated Excel Worksheet. On the associated Excel Worksheet, complete the Balance Sheet and the Statement of Revenues, Expenditures, and Changes in Fund Balance for tfie General Fund. Do not add rows or columns to the spreadsheet. Enter numbers in the grey areas only. Not all grey areas need to be filled. CITY OF BISON MESA General Fund Statement of Revenues, Expenditures and Changes in Fund Balanc Revenues Expenditures \begin{tabular}{|lr} \hline Excess of revenues over expenditures & 0 \\ \hline Fund balances-Beginning of Year & 1,800 \\ \hline Fund balances-End of Year & ($1,800) \end{tabular} Assigned Nonspendable Unassigned The following information was not included in the trail balance and requires additional entries in the accounts. - At year end, $5,000 of taxes receivable was not collected and was reclassified as delinquent. Of the $5,000,$1,000 was expected to be collected i ithin 90 days of the year end and will be maintained as a receivable. The remaining $4,000 was considered potentially uncollectible and an allowance was created for this amount. The $4,000 will be written off next year as it is deemed uncollectible. - Collections for the county were outsourced to the County appraiser. The County Appraiser collected $4,500 in property taxes for City of Bison Mesa that was not yet paid. The amount due from the County Appraiser will be The trial balance for the General fund of the City of Bison Mesa at the end of the year follows: The following information was not included in the trail balance and requires additional entries in the accounts. - At year end, $5,000 of taxes receivable was not collected and was reclassifi days of the year end and will be maintained as a receivable. The remaining $4,000 was considered potentially uncollectible and an allowance was created for this amount. The $4,000 will be written off next year as it is deemed uncollectible. - Collections for the county were outsourced to the County appraiser. The County Appraiser collected $4,500 in property taxes for City of Bison Mesa that was not yet paid. The amount due from the County Appraiser will be CITY OF BISON MESA General Fund Balance Sheet Assets Cash Taxes receivable Allowance for uncollectible taxes Due from County Appraiser Supplies Total assets 0 Liabilities and fund balances Accounts payable Fund balances: Nonspendable Assigned Unassigned Total fund balances 0 \begin{tabular}{|c|c|c|c|} \hline & \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{r} CITY OF BISON N \\ General Fund \end{tabular}}} \\ \hline & (in millions) & Debit & \\ \hline & Cash & 14,200 & \\ \hline & Taxes Receivable & 6,000 & . \\ \hline & Allowance of Uncollectibles & & \\ \hline & Due from County Appraiser & & \\ \hline & Supplies & & \\ \hline & Accounts Payable & & 9,000 \\ \hline 0 & Appropriations & & 190,000 \\ \hline & Expenditures & 183,800 & \\ \hline & Encumbrances & & \\ \hline 13 & Estimated Revenues & 210,000 & \\ \hline 14 & Revenues & & 197,000 \\ \hline 15 & Fund Balance - Unassigned & & 18,000 \\ \hline & Fund Balance - Assigned & & \\ \hline 17 & Fund Balance - Nonspendable & & \\ \hline 18 & Total & 414,000 & 414,000 \\ \hline \end{tabular} paid after the year end and the associated revenue has not yet been recorded. - At the beginning of the year, supplies of $7,000 were purchased and recorded as an expenditure. At the end of the year, $200 remained. The town uses the purchase method. - Expenditures of $1,300 related to purchase orders issued in the prior fiscal year. At the end of the year, there were outstanding purchase orders of $2.250 were not encumbered. REQUIRED: Given the additional information provided, update the Trial Balance on the associated Excel Worksheet. On the associated Excel Worksheet, complete the Balance Sheet and the Statement of Revenues, Expenditures, and Changes in Fund Balance for tfie General Fund. Do not add rows or columns to the spreadsheet. Enter numbers in the grey areas only. Not all grey areas need to be filled. CITY OF BISON MESA General Fund Statement of Revenues, Expenditures and Changes in Fund Balanc Revenues Expenditures \begin{tabular}{|lr} \hline Excess of revenues over expenditures & 0 \\ \hline Fund balances-Beginning of Year & 1,800 \\ \hline Fund balances-End of Year & ($1,800) \end{tabular} Assigned Nonspendable Unassigned

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started