Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help and please answer all The Item List displays each of the following except Select one: a. Item type b. price (rate) c. job

please help and please answer all

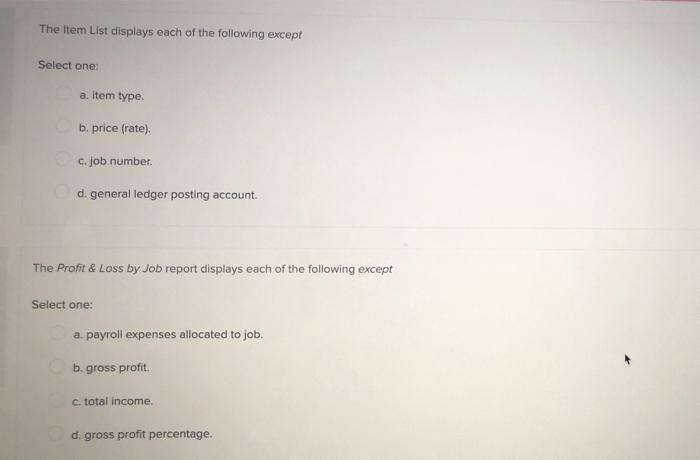

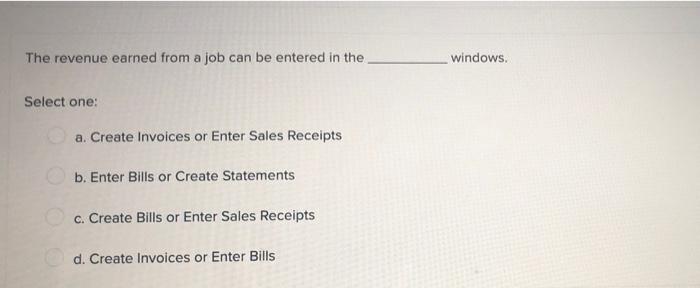

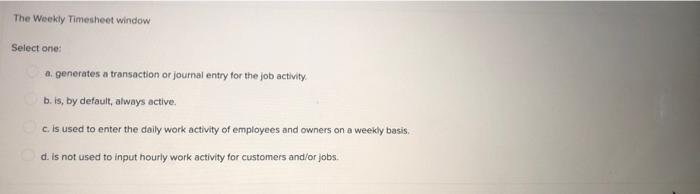

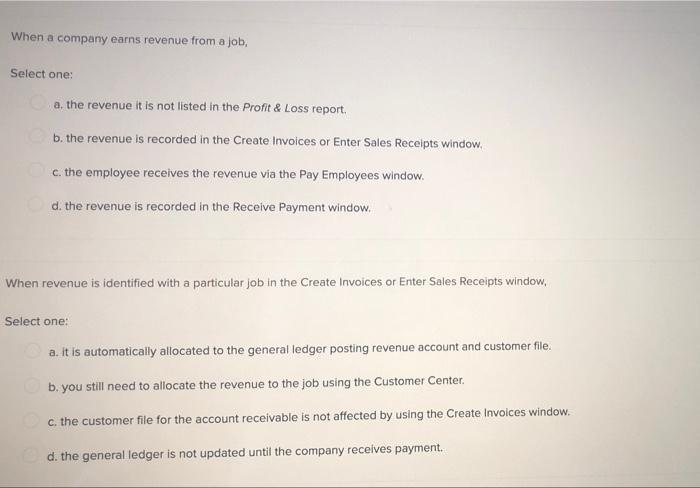

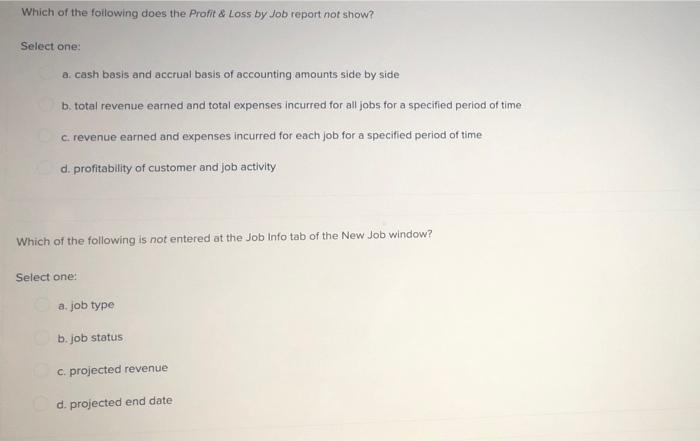

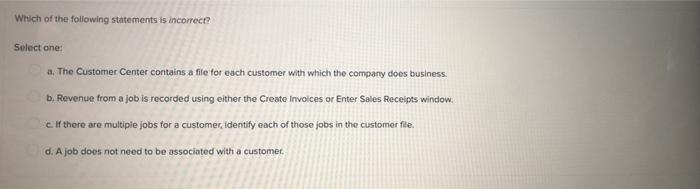

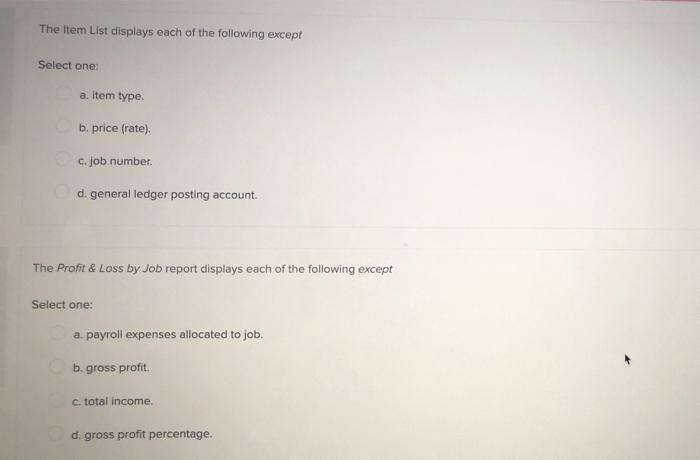

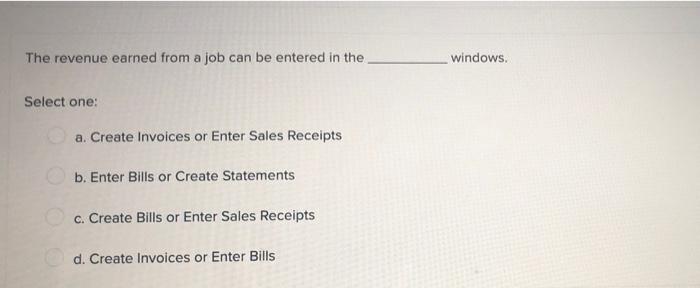

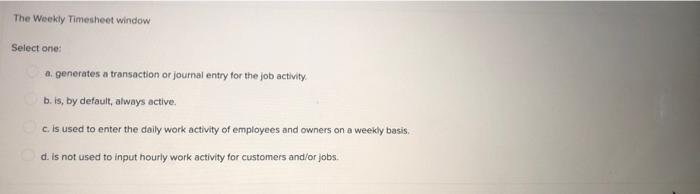

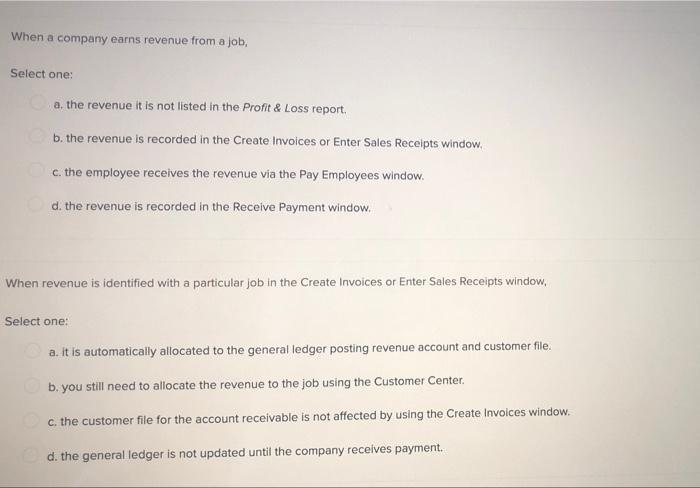

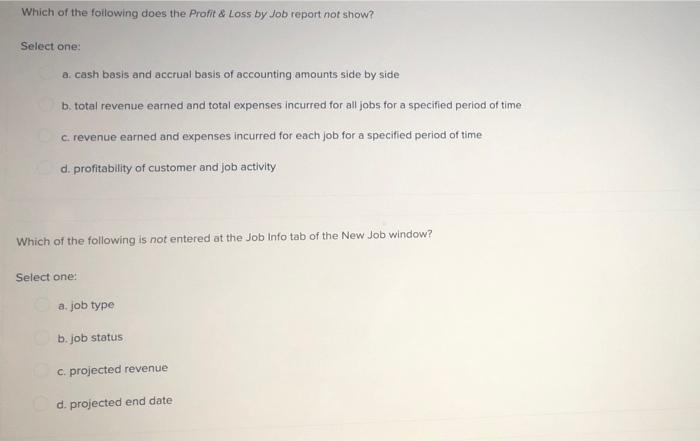

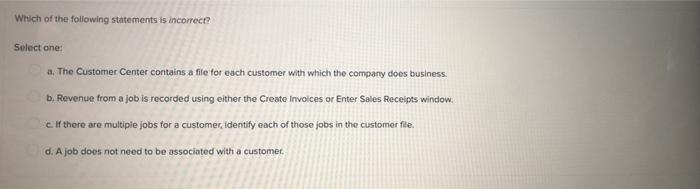

The Item List displays each of the following except Select one: a. Item type b. price (rate) c. job number, d. general ledger posting account. The Profit & Loss by Job report displays each of the following except Select one: a. payroll expenses allocated to job. b.gross profit c. total income d. gross profit percentage. The revenue earned from a job can be entered in the windows Select one: a. Create Invoices or Enter Sales Receipts b. Enter Bills or Create Statements c. Create Bills or Enter Sales Receipts d. Create Invoices or Enter Bills The Weekly Timesheet window Select one: a. generates a transaction or journal entry for the job activity b. is, by default, always active. c. is used to enter the daily work activity of employees and owners on a weekly basis. d. is not used to input hourly work activity for customers and/or jobs. When a company earns revenue from a job, Select one: a. the revenue it is not listed in the Profit & Loss report, b. the revenue is recorded in the Create Invoices or Enter Sales Receipts window. c. the employee receives the revenue via the Pay Employees window. d. the revenue is recorded in the Receive Payment window. When revenue is identified with a particular job in the Create Invoices or Enter Sales Receipts window, Select one: a. It is automatically allocated to the general ledger posting revenue account and customer file. b. you still need to allocate the revenue to the job using the Customer Center c. the customer file for the account receivable is not affected by using the Create Invoices window. d. the general ledger is not updated until the company receives payment. Which of the following does the Profit & Loss by Job report not show? Select one: a. cash basis and accrual basis of accounting amounts side by side b. total revenue earned and total expenses incurred for all jobs for a specified period of time c. revenue earned and expenses incurred for each job for a specified period of time d. profitability of customer and job activity Which of the following is not entered at the Job Info tab of the New Job window? Select one: a job type b. job status c. projected revenue d. projected end date Which of the following statements is incorrect? Select one: a. The Customer Center contains a file for each customer with which the company does business. b. Revenue from a job is recorded using either the Create Invoices or Enter Sales Receipts window c. If there are multiple jobs for a customer, identify each of those jobs in the customer file. d. A job does not need to be associated with a customer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started