Please Help and Show calculations to understand.

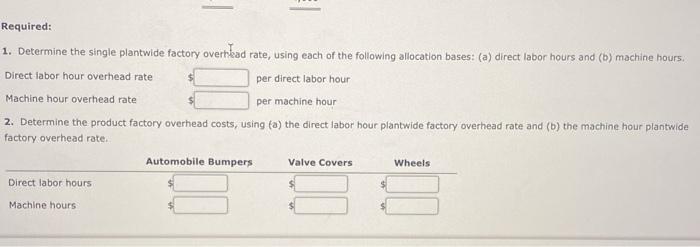

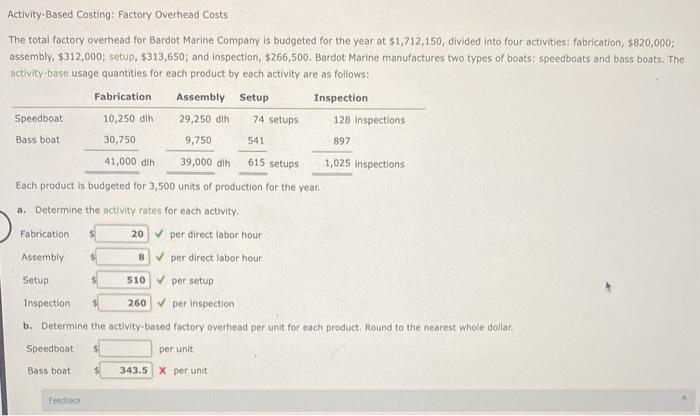

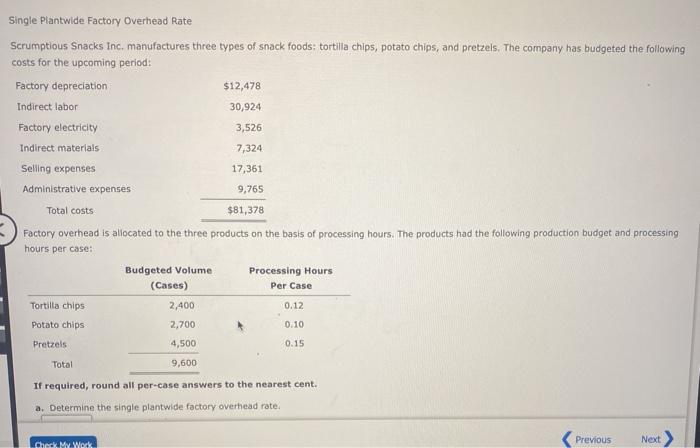

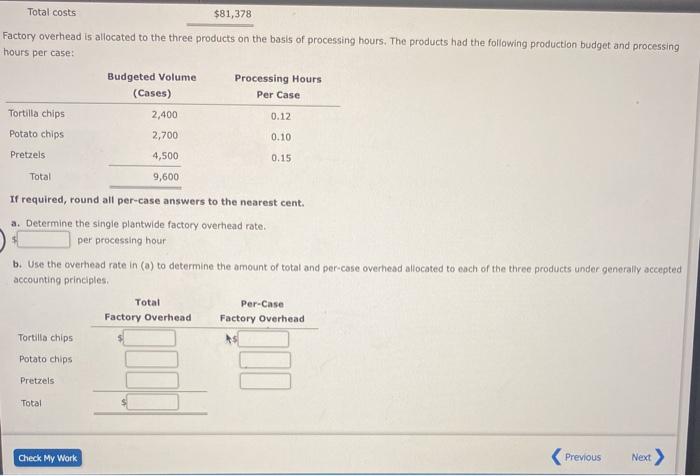

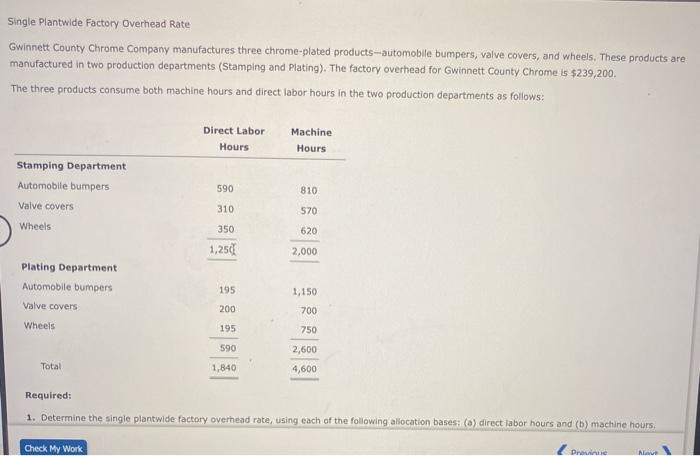

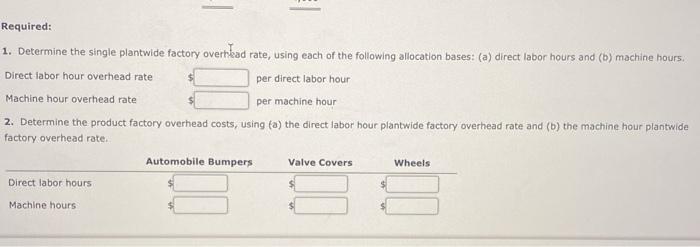

Activity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,712,150, divided into four activities: fabrication, $820,000; assembly, $312,000; setup, $313,650; and inspection, $266,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 10,250 din 29,250 din 74 setups 128 Inspections Bass boat 30,750 9,750 541 897 41,000 din 39,000 din 615 setups 1,025 inspections Each product is budgeted for 3,500 units of production for the year a. Determine the activity rates for each activity Fabrication 20 per direct labor hour Assembly 8 per direct labor hour Setup 510 per setup Inspection 260 per inspection b. Determine the activity-based factory overhead per unit for each product, Round to the nearest whole dollar Speedboat per unit Bass boat 343.5 X per unit Food Single Plantwide Factory Overhead Rate Scrumptious Snacks Inc. manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation $12,478 Indirect labor 30,924 Factory electricity 3,526 Indirect materials 7,324 Selling expenses 17,361 Administrative expenses 9,765 Total costs $81,378 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Processing Hours Per Case Tortilla chips 0.12 Budgeted Volume (Cases) 2,400 2,700 4,500 9,600 Potato chips 0.10 Pretzels 0.15 Total If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. Previous Next Check My Work Total costs $81,378 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Budgeted Volume Processing Hours (Cases) Per Case Tortilla chips 2,400 0.12 Potato chips 2,700 0.10 Pretzels 4,500 0.15 Total 9,600 If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. per processing hour b. Use the overhead rate in (a) to determine the amount of total and percase overhead allocated to each of the three products under generally accepted accounting principles Total Per-Case Factory Overhead Factory Overhead Tortilla chips Potato chips Pretzels Total Check My Work Previous Next) Single Plantwide Factory Overhead Rate Gwinnett County Chrome Company manufactures three chrome-plated products-automobile bumpers, valve covers, and wheels. These products are manufactured in two production departments (Stamping and Plating). The factory overhead for Gwinnett County Chrome is $239,200. The three products consume both machine hours and direct labor hours in the two production departments as follows: Direct Labor Hours Machine Hours Stamping Department Automobile bumpers 590 810 Valve covers 310 570 Wheels 350 620 1,250 2,000 Plating Department Automobile bumpers 195 1,150 Valve covers 200 700 Wheels 195 750 590 2,600 4,600 Total 1,840 Required: 1. Determine the single plantwide factory overhead rate, using each of the following allocation bases: (a) direct labor hours and (b) machine hours. Check My Work Draine Alave Required: 1. Determine the single plantwide factory over kad rate, using each of the following allocation bases: (a) direct labor hours and (b) machine hours. Direct labor hour overhead rate per direct labor hour Machine hour overhead rate per machine hour 2. Determine the product factory overhead costs, using (a) the direct labor hour plantwide factory overhead rate and (b) the machine hour plantwide factory overhead rate Automobile Bumpers Valve Covers Wheels Direct labor hours Machine hours

Please Help and Show calculations to understand.

Please Help and Show calculations to understand.