Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help and show me how (all)each number was calculated in the TABLE according to problem given. (ex, how pre-tax profit, profit after tax, operating

please help and show me how (all)each number was calculated in the TABLE according to problem given. (ex, how pre-tax profit, profit after tax, operating cashflow is being calculated?) if it too much, show as many as you can. thank you so much in advance

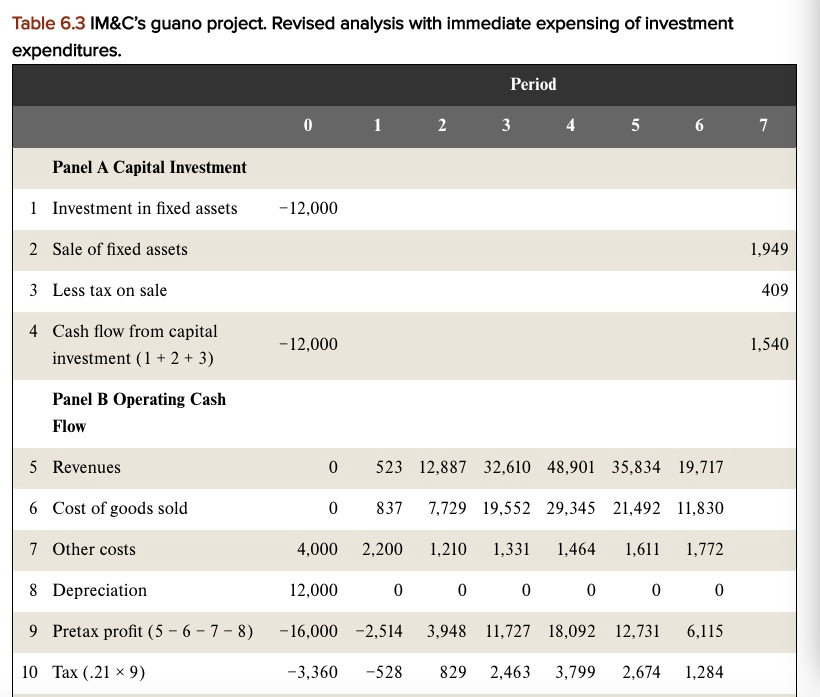

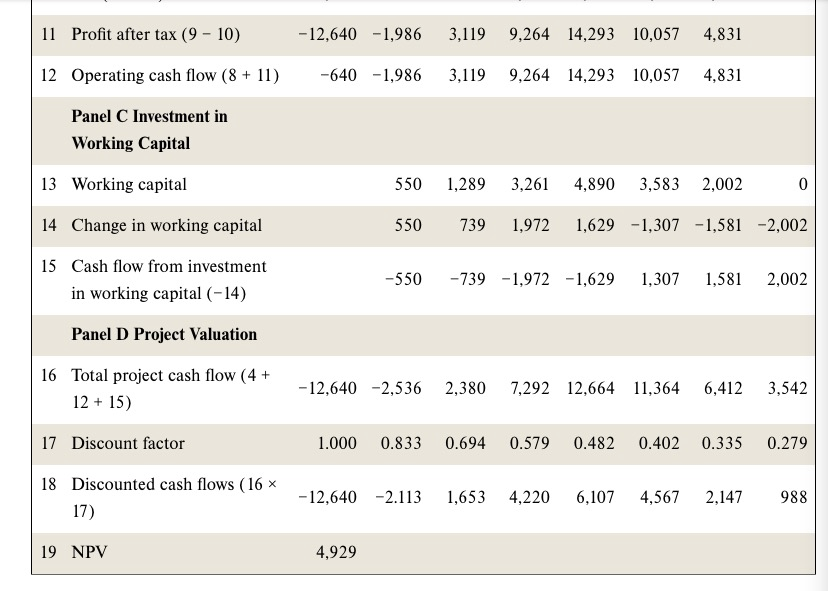

From 1986 to the end of 2017, U.S. companies used a slight variation of the double-declining balance method, called Page 149 the modified accelerated cost recovery system (MACRS).8 But the 2017 Tax Cuts and Jobs BEYOND THE PAGE Act offered companies bonus depreciation sufficient to write off 100% of their investment expenditures in the year that they come on line. Table 6.3 recalculates the NPV of the MACRS depreciation sy guano project, assuming that the full $12 million investment can be depreciated stem immediately We initially assumed that the guano project could be depreciated straight-line over six years. This resulted in an NPV of $3.806 million. We then calculated that if IM&C could use the double-declining-balance method, NPV would increase by $212,000 to $4.018 million Finally, Table 6.3 shows that full first-year expensing introduced in the 2017 tax reform would increase NPV further to $4.929 million mhhe.com/brealey13e Table 6.3 IM&C's guano project. Revised analysis with immediate expensing of investment expenditures. Table 6.3 IM&C's guano project. Revised analysis with immediate expensing of investment expenditures. Period 0 1 2 3 5 6 7 Panel A Capital Investment 1 Investment in fixed assets -12,000 2 Sale of fixed assets 1,949 3 Less tax on sale 409 4 Cash flow from capital -12,000 1,540 investment (1 2+3) Panel B Operating Cash Flow 5 Revenues 0 523 12,887 32,610 48,901 35,834 19,717 837 7,729 19,552 29,345 21,492 11,830 6 Cost of goods sold 0 7 Other costs 1,210 1,331 1,611 4,000 2,200 1,464 1,772 8 Depreciation 12,000 0 0 0 0 0 Pretax profit (5- 6 7-8) -16,000 -2,514 3,948 11,727 18,092 12,731 6,115 9 10 Tax (21 x 9) 829 2,463 3,799 2,674 -3,360 -528 1,284 Profit after tax (9 10) 3,119 9,264 14,293 10,057 4,831 11 -12,640 -1,986 12 Operating cash flow (8 11 -640,986 3,119 9,264 14,293 10,057 4,831 Panel C Investment in Working Capital 3,261 4,890 13 Working capital 550 1,289 3,583 2,002 0 14 Change in working capital 550 739 1,629 -1,307 -1,581 -2,002 1,972 15 Cash flow from investment -550 1,307 1,581 -7391,972-1,629 2,002 in working capital (-14) Panel D Project Valuation 16 Total project cash flow (4 12 15) 2,380 7,292 12,664 11,364 -12,640 -2,536 6,412 3,542 17 Discount factor 0.694 0.482 0.279 1.000 0.833 0.579 0.402 0.335 18 Discounted cash flows (16 x 12,6402.113 6,107 2,147 988 1,653 4,220 4,567 17) 19 NPV 4,929Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started