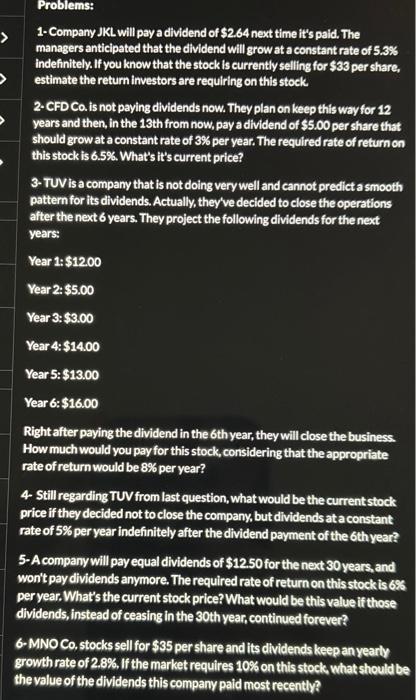

please help and show steps

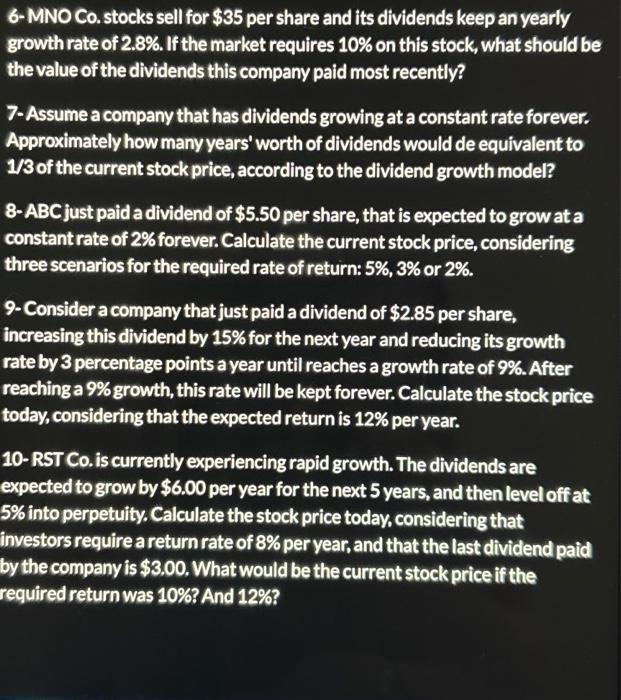

Problems: 1. Company JKL will pay a dividend of $2.64 next time it's paid. The managers anticipated that the dividend will grow at a constant rate of 5.3% indefinitely. If you know that the stock is currently selling for $33 per share, estimate the return investors are requiring on this stock. 2. CFD Ca. is not paying dividends now. They plan on keep this way for 12 years and then, in the 13 th from now, pay a dividend of $5.00 per share that should grow at a constant rate of 3% per year. The required rate of return on this stock is 6.5%. What's it's current price? 3-TUV is a company that is not doing very well and cannot predict a smooth pattern for its dividends. Actually, they've decided to close the operations after the next 6 years. They project the following dividends for the next years: Year 1:\$1200 Year 2: $5.00 Year 3: $3.00 Year 4:\$14:00 Year 5: $13.00 Year 6: $16.00 Right after paying the dividend in the 6th year, they will close the business. How much would you pay for this stock, considering that the appropriate rate of return would be 8% per year? 4- Still regarding TUV from last question, what would be the current stock price if they decided not to close the company, but dividends at a constant rate of 5% per year indefinitely after the dividend payment of the 6 th year? 5-A company will pay equal dividends of $12.50 for the next 30 years, and won't pay dividends anymore. The required rate of return on this stock is 685 per year. What's the current stock price? What would be this value if those dividends, instead of ceasing in the 30 th year, continued forever? 6- MNO Co, stocks sell for $35 per share and lits dividends keep an yearly growth rate of 2.8%. If the market requires 10% on this stock, what should be the value of the dividends this company paid most recently? 6-MNO Co. stocks sell for $35 per share and its dividends keep an yearly growth rate of 2.8%. If the market requires 10% on this stock, what should be the value of the dividends this company paid most recently? 7- Assume a company that has dividends growing at a constant rate forever. Approximately how many years' worth of dividends would de equivalent to 1/3 of the current stock price, according to the dividend growth model? 8-ABC just paid a dividend of $5.50 per share, that is expected to grow at a constant rate of 2% forever. Calculate the current stock price, considering three scenarios for the required rate of return: 5%,3% or 2%. 9- Consider a company that just paid a dividend of $2.85 per share, increasing this dividend by 15% for the next year and reducing its growth rate by 3 percentage points a year until reaches a growth rate of 9%. After reaching a 9% growth, this rate will be kept forever. Calculate the stock price oday, considering that the expected return is 12% per year. 10- RST Co. is currently experiencing rapid growth. The dividends are expected to grow by $6.00 per year for the next 5 years, and then level off at % into perpetuity. Calculate the stock price today, considering that nvestors require a return rate of 8% per year, and that the last dividend paid y the company is $3.00. What would be the current stock price if the equired return was 10% ? And 12%