Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help and show the process. I will rate. Thanks. Revise: selling price: $40 Requirement 2: Single-product CVP Assume the following detailed cost data are

Please help and show the process. I will rate. Thanks.

Revise: selling price: $40

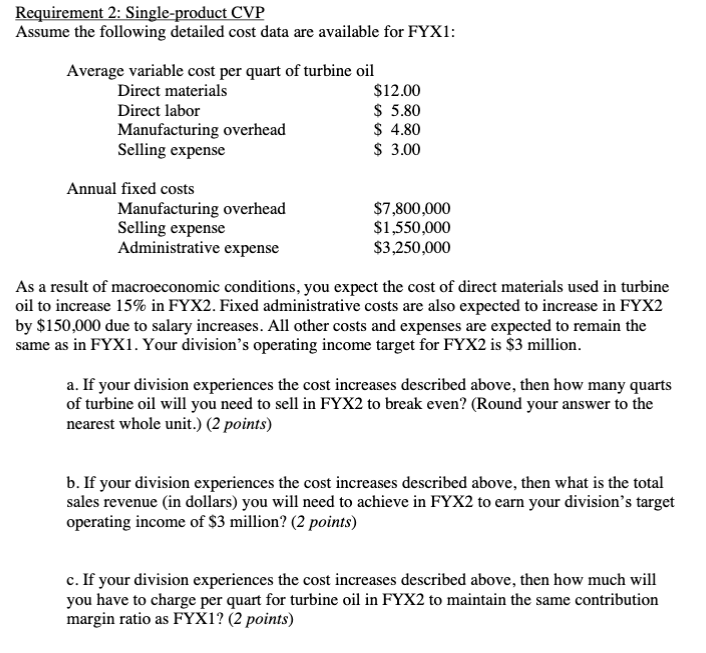

Requirement 2: Single-product CVP Assume the following detailed cost data are available for FYX1: Average variable cost per quart of turbine oil Direct materials $12.00 Direct labor $ 5.80 Manufacturing overhead $ 4.80 Selling expense $ 3.00 Annual fixed costs Manufacturing overhead $7,800,000 Selling expense $1,550,000 Administrative expense $3,250,000 As a result of macroeconomic conditions, you expect the cost of direct materials used in turbine oil to increase 15% in FYX2. Fixed administrative costs are also expected to increase in FYX2 by $150,000 due to salary increases. All other costs and expenses are expected to remain the same as in FYX1. Your division's operating income target for FYX2 is $3 million. a. If your division experiences the cost increases described above, then how many quarts of turbine oil will you need to sell in FYX2 to break even? (Round your answer to the nearest whole unit.) (2 points) b. If your division experiences the cost increases described above, then what is the total sales revenue (in dollars) you will need to achieve in FYX2 to earn your division's target operating income of $3 million? (2 points) c. If your division experiences the cost increases described above, then how much will you have to charge per quart for turbine oil in FYX2 to maintain the same contribution margin ratio as FYX1? (2 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started