Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help and show work. all information is given Slecat Corp. is in the 40% tax bracket and has a capital structure that is composed

please help and show work. all information is given

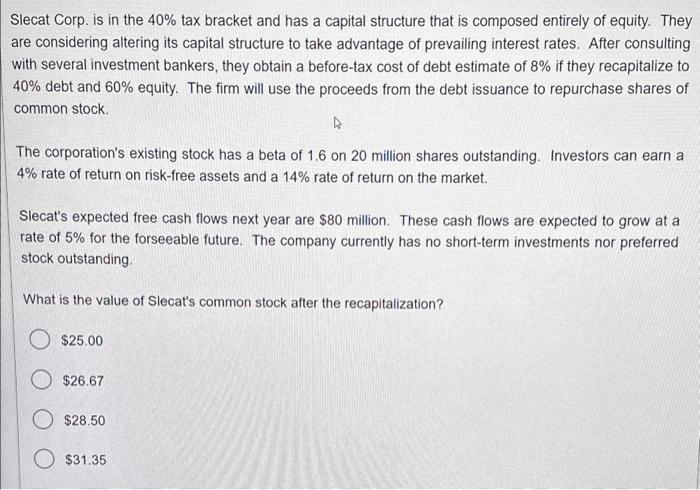

Slecat Corp. is in the 40% tax bracket and has a capital structure that is composed entirely of equity. They are considering altering its capital structure to take advantage of prevailing interest rates. After consulting with several investment bankers, they obtain a before-tax cost of debt estimate of 8% if they recapitalize to 40% debt and 60% equity. The firm will use the proceeds from the debt issuance to repurchase shares of common stock. The corporation's existing stock has a beta of 1.6 on 20 million shares outstanding. Investors can earn a 4% rate of return on risk-free assets and a 14% rate of return on the market. Slecat's expected free cash flows next year are $80 million. These cash flows are expected to grow at a rate of 5% for the forseeable future. The company currently has no short-term investments nor preferred stock outstanding. What is the value of Slecat's common stock after the recapitalization? $25.00 $26.67 $28.50 $31.35 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started