Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help and type QUESTION 3 (35 Marks) Mike and Vusi, who have both invested in the engineering sector of the JSE, are comparing their

please help and type

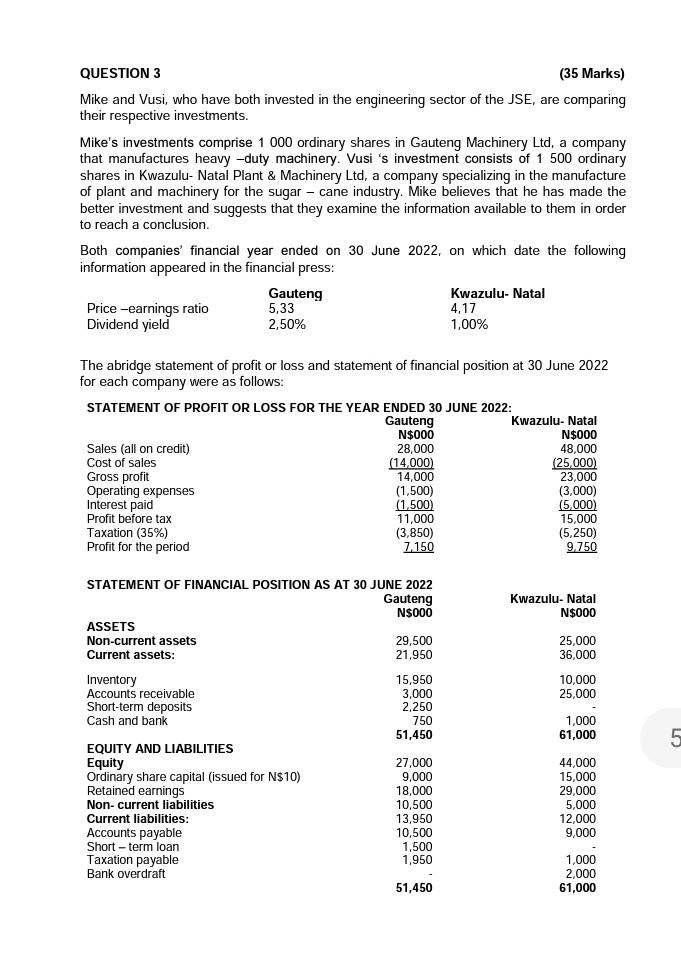

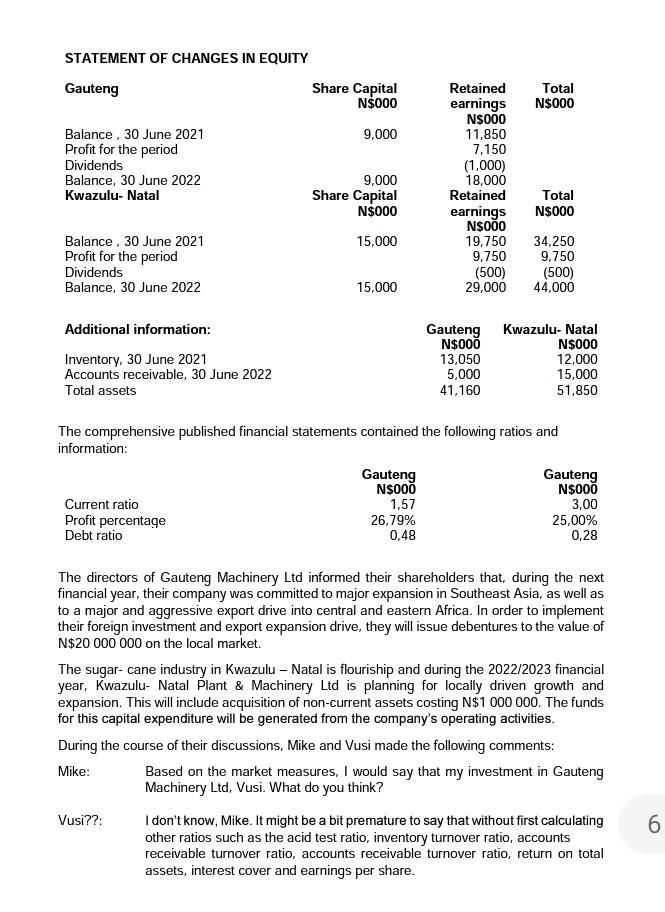

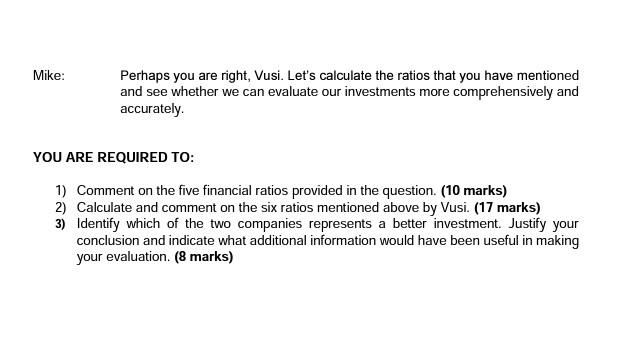

QUESTION 3 (35 Marks) Mike and Vusi, who have both invested in the engineering sector of the JSE, are comparing their respective investments. Mike's investments comprise 1000 ordinary shares in Gauteng Machinery Ltd, a company that manufactures heavy -duty machinery. Vusi 's investment consists of 1500 ordinary shares in Kwazulu- Natal Plant \& Machinery Ltd, a company specializing in the manufacture of plant and machinery for the sugar - cane industry. Mike believes that he has made the better investment and suggests that they examine the information available to them in order to reach a conclusion. Both companies' financial year ended on 30 June 2022, on which date the following information appeared in the financial press: The abridge statement of profit or loss and statement of financial position at 30 June 2022 for each company were as follows: Mike: Perhaps you are right, Vusi. Let's calculate the ratios that you have mentioned and see whether we can evaluate our investments more comprehensively and accurately. YOU ARE REQUIRED TO: 1) Comment on the five financial ratios provided in the question. (10 marks) 2) Calculate and comment on the six ratios mentioned above by Vusi. (17 marks) 3) Identify which of the two companies represents a better investment. Justify your conclusion and indicate what additional information would have been useful in making your evaluation. (8 marks) STATEMENT OF CHANGES IN EQUITY The comprehensive published financial statements contained the following ratios and information: The directors of Gauteng Machinery Ltd informed their shareholders that, during the next financial year, their company was committed to major expansion in Southeast Asia, as well as to a major and aggressive export drive into central and eastern Africa. In order to implement their foreign investment and export expansion drive, they will issue debentures to the value of N$20000000 on the local market. The sugar- cane industry in Kwazulu - Natal is flouriship and during the 2022/2023 financial year, Kwazulu- Natal Plant \& Machinery Ltd is planning for locally driven growth and expansion. This will include acquisition of non-current assets costing N$1000000. The funds for this capital expenditure will be generated from the company's operating activities. During the course of their discussions, Mike and Vusi made the following comments: Mike: Based on the market measures, I would say that my investment in Gauteng Machinery Ltd, Vusi. What do you think? Vusi??: I don't know, Mike. It might be a bit premature to say that without first calculating other ratios such as the acid test ratio, inventory turnover ratio, accounts receivable turnover ratio, accounts receivable turnover ratio, return on total assets, interest cover and earnings per shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started