Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help answer 1,2,3,4 by usuinf excel and functions! Attaching excel sheet would be great to see how to use the formuals. thank you! Violet

please help answer 1,2,3,4 by usuinf excel and functions! Attaching excel sheet would be great to see how to use the formuals. thank you!

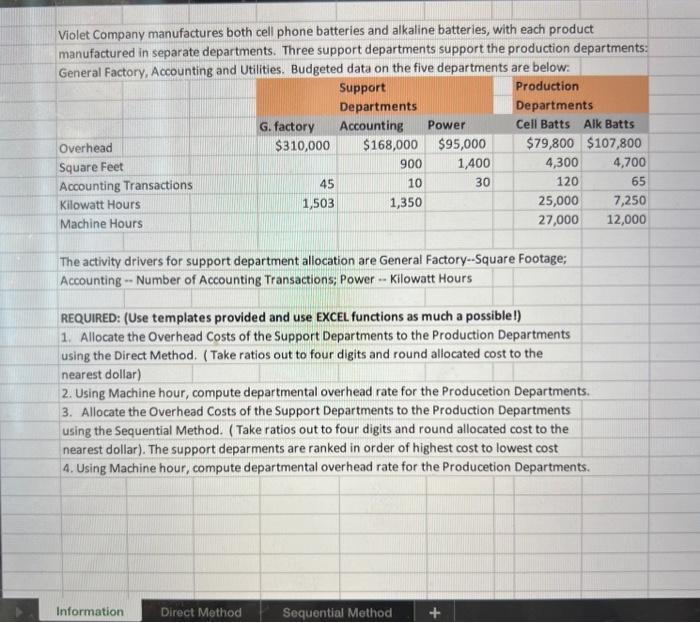

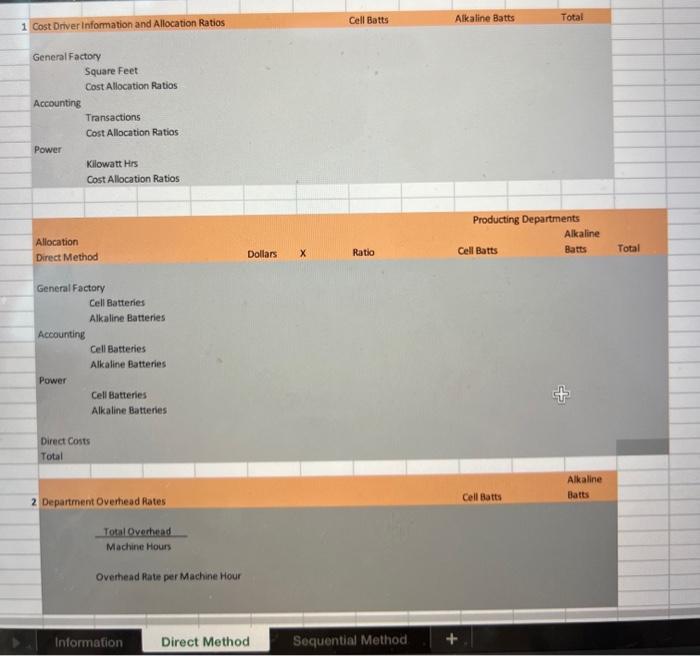

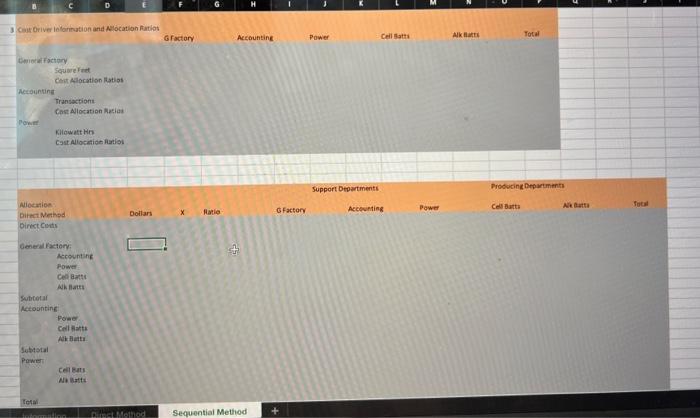

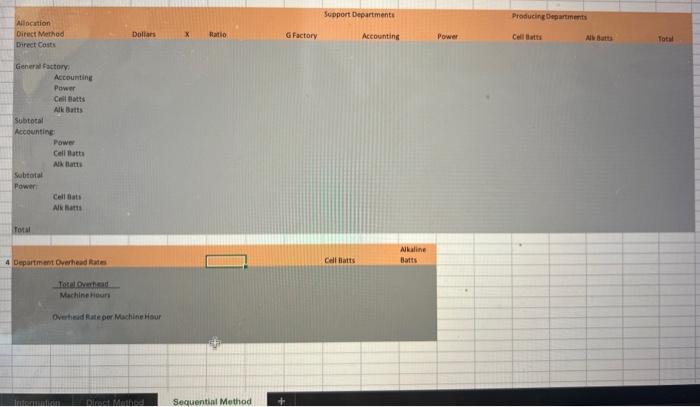

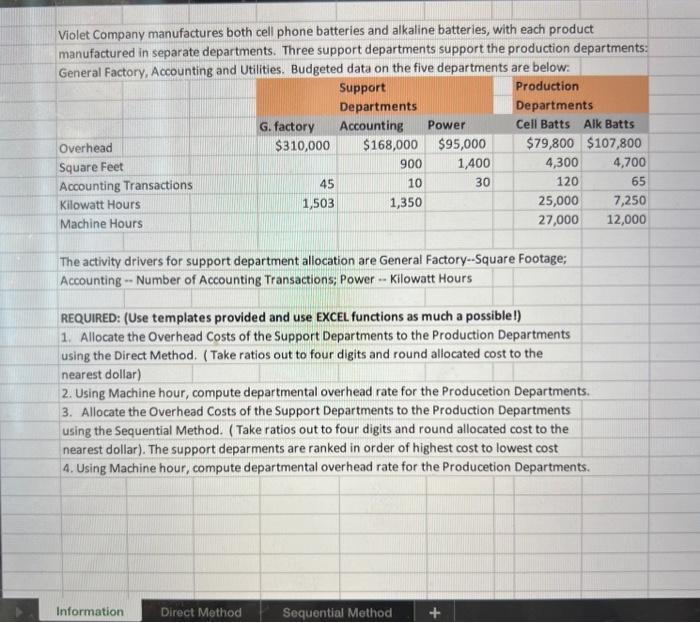

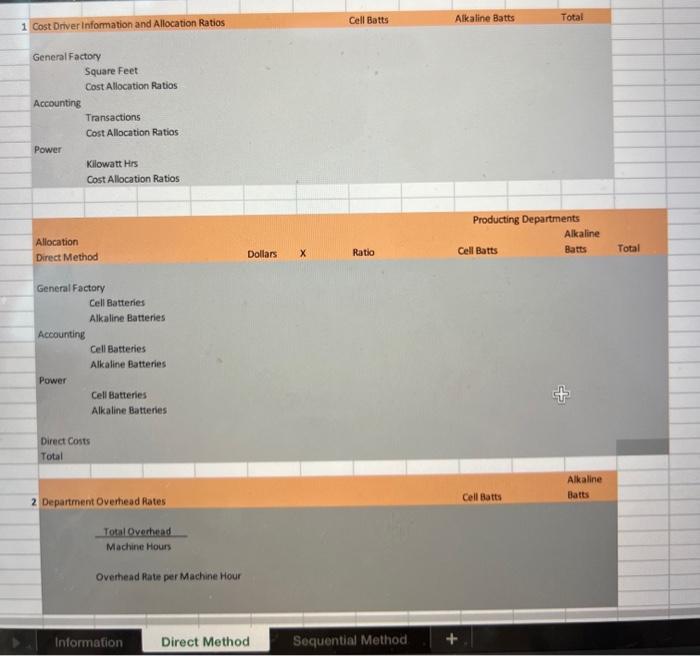

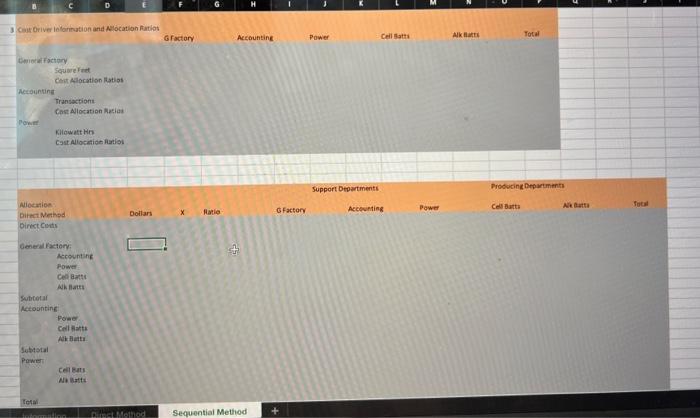

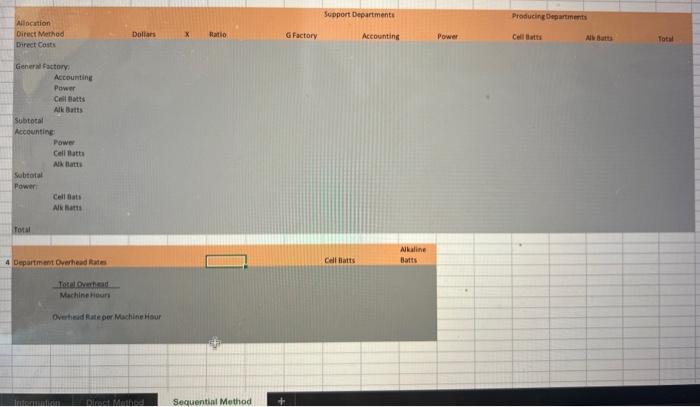

Violet Company manufactures both cell phone batteries and alkaline batteries, with each product manufactured in separate departments. Three support departments support the production departments: General Factory, Accounting and Utilities. Budgeted data on the five departments are below: The activity drivers for support department allocation are General Factory-Square Footage; Accounting - Number of Accounting Transactions; Power - Kilowatt Hours REQUIRED: (Use templates provided and use EXCEL functions as much a possiblel) 1. Allocate the Overhead Costs of the Support Departments to the Production Departments using the Direct Method. (Take ratios out to four digits and round allocated cost to the nearest dollar) 2. Using Machine hour, compute departmental overhead rate for the Producetion Departments. 3. Allocate the Overhead Costs of the Support Departments to the Production Departments using the Sequential Method. ( Take ratios out to four digits and round allocated cost to the nearest dollar). The support deparments are ranked in order of highest cost to lowest cost 4. Using Machine hour, compute departmental overhead rate for the Producetion Departments. 1 Cost Driver Information and Allocation Ratios Cell Batts Alkaline Batts Total GeneralFactory Square Feet Cost Allocation fatios Accounting Transactions Cost Allocation Ratios Power Kilowatt His Cost Allocation Ratios Producting Departments Allocation Alkaline Direct Method Dollars x Ratio Cell Batts Batts Total General Factory Cell Batteries Alkaline Batteries Accounting Cell Batteries Alkaline Batteries Power Cell Batteries Alkaline Batteries Direct Costs Total 2. Department Overhead Rates Cell Batts Alkaline Total Oyerhead Machine Hours Overhead Rate per Machine Hour Intormation Direct Method Sequential Method 3 cour Orive in loritution and Alocation funtios Gractory Aceountine Power Ceil Batti Aktianti Total Cmind factury squareh cinctification tutios Acuounting Transactions Chit Allocation Mesias Powet Kilowatt Hin Cost Allocation Artiol Rower Cellamt Ahinats Sutreatai Netountine: Powe cellerts Ak Bater. Sustatal Power CeleatsMaints: Total Alincation Direct Method Direct Costr. Dollars x Ratio Ratio G Factory Accountins Power Cell inats Ar batts: An Bats: Fotat General factory Accounting Pawer Ceileates Aik Batts Subtotal Accountine: Power Cellinata Axnatu Subtaia Powin Ceel tiats Ak Bata Potal 4 Department Orehead kates Celliats Nkaline torelowncad Machine hieun DVertieid Rute oer Muchine Hour Violet Company manufactures both cell phone batteries and alkaline batteries, with each product manufactured in separate departments. Three support departments support the production departments: General Factory, Accounting and Utilities. Budgeted data on the five departments are below: The activity drivers for support department allocation are General Factory-Square Footage; Accounting - Number of Accounting Transactions; Power - Kilowatt Hours REQUIRED: (Use templates provided and use EXCEL functions as much a possiblel) 1. Allocate the Overhead Costs of the Support Departments to the Production Departments using the Direct Method. (Take ratios out to four digits and round allocated cost to the nearest dollar) 2. Using Machine hour, compute departmental overhead rate for the Producetion Departments. 3. Allocate the Overhead Costs of the Support Departments to the Production Departments using the Sequential Method. ( Take ratios out to four digits and round allocated cost to the nearest dollar). The support deparments are ranked in order of highest cost to lowest cost 4. Using Machine hour, compute departmental overhead rate for the Producetion Departments. 1 Cost Driver Information and Allocation Ratios Cell Batts Alkaline Batts Total GeneralFactory Square Feet Cost Allocation fatios Accounting Transactions Cost Allocation Ratios Power Kilowatt His Cost Allocation Ratios Producting Departments Allocation Alkaline Direct Method Dollars x Ratio Cell Batts Batts Total General Factory Cell Batteries Alkaline Batteries Accounting Cell Batteries Alkaline Batteries Power Cell Batteries Alkaline Batteries Direct Costs Total 2. Department Overhead Rates Cell Batts Alkaline Total Oyerhead Machine Hours Overhead Rate per Machine Hour Intormation Direct Method Sequential Method 3 cour Orive in loritution and Alocation funtios Gractory Aceountine Power Ceil Batti Aktianti Total Cmind factury squareh cinctification tutios Acuounting Transactions Chit Allocation Mesias Powet Kilowatt Hin Cost Allocation Artiol Rower Cellamt Ahinats Sutreatai Netountine: Powe cellerts Ak Bater. Sustatal Power CeleatsMaints: Total Alincation Direct Method Direct Costr. Dollars x Ratio Ratio G Factory Accountins Power Cell inats Ar batts: An Bats: Fotat General factory Accounting Pawer Ceileates Aik Batts Subtotal Accountine: Power Cellinata Axnatu Subtaia Powin Ceel tiats Ak Bata Potal 4 Department Orehead kates Celliats Nkaline torelowncad Machine hieun DVertieid Rute oer Muchine Hour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started