Please help answer chapter 4 accounting before Sunday at 5 p.m.

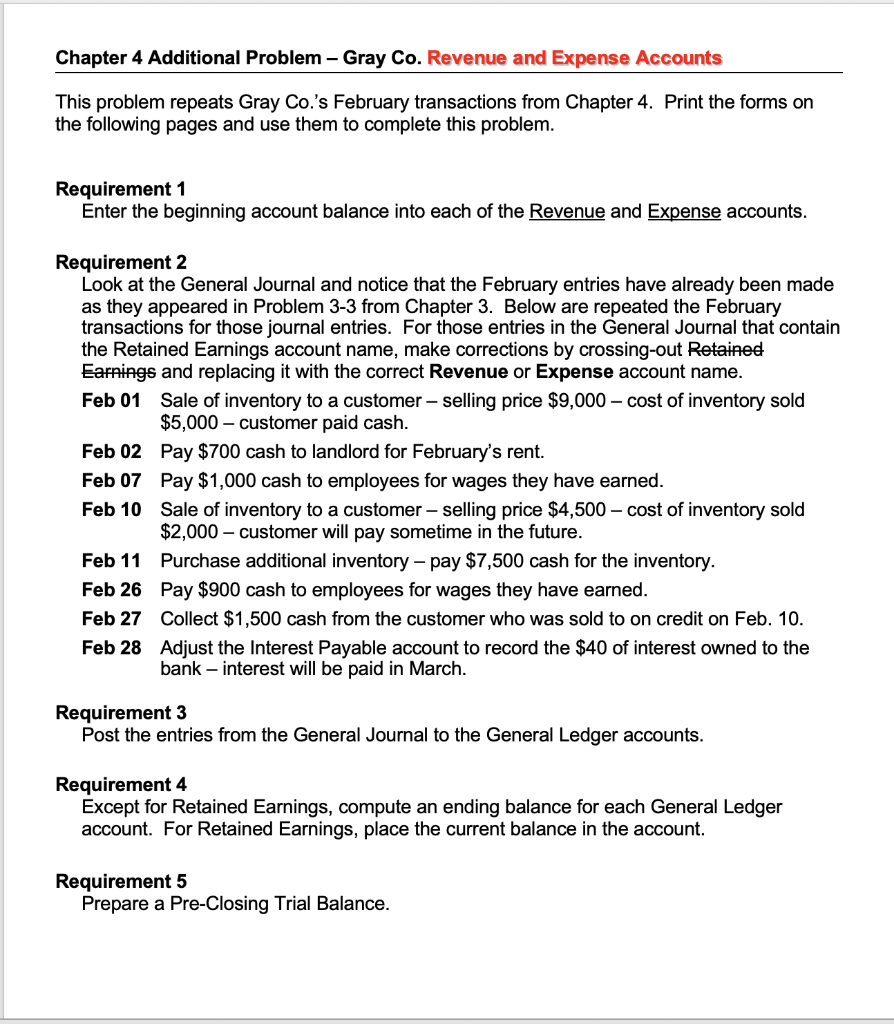

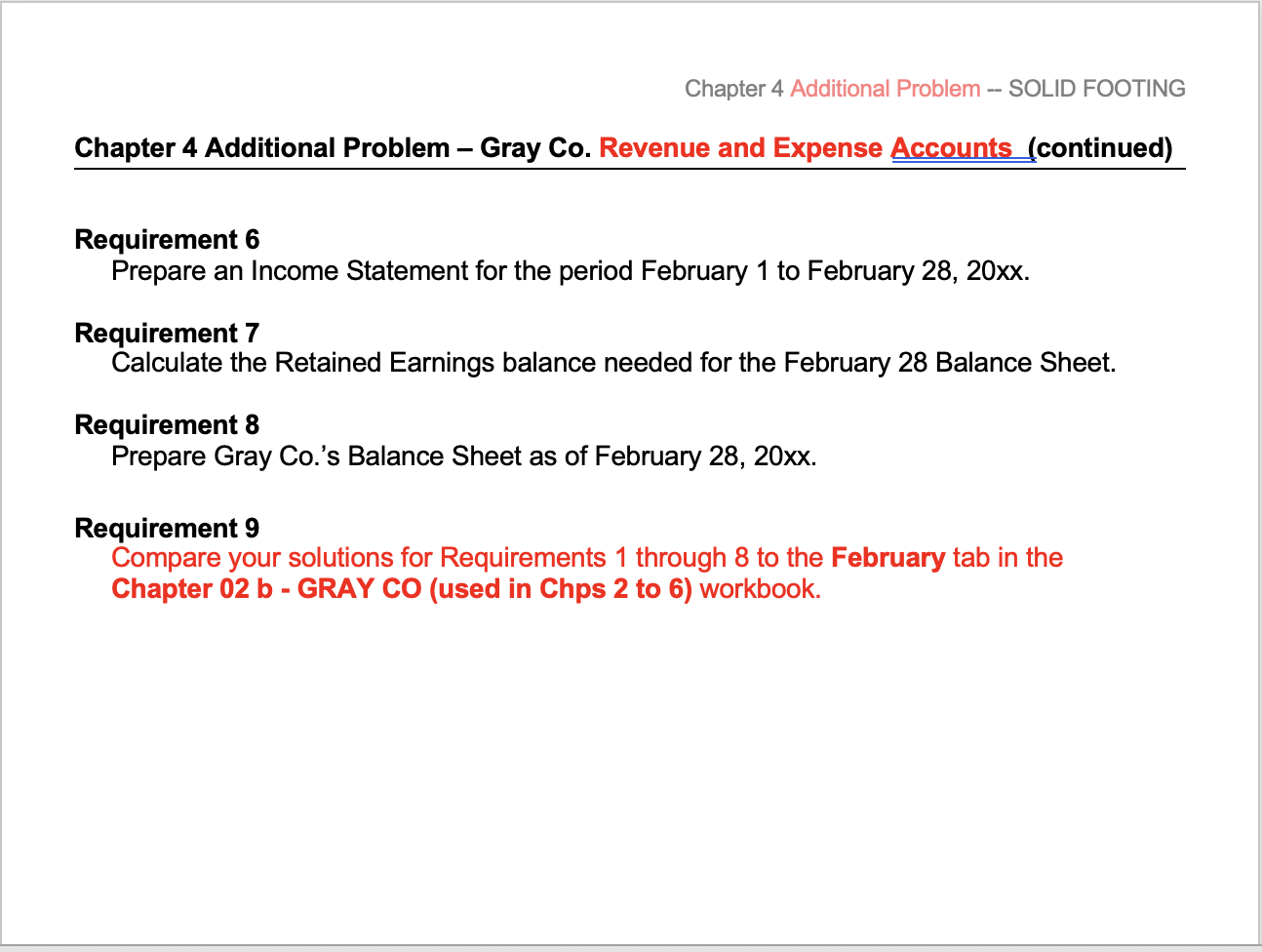

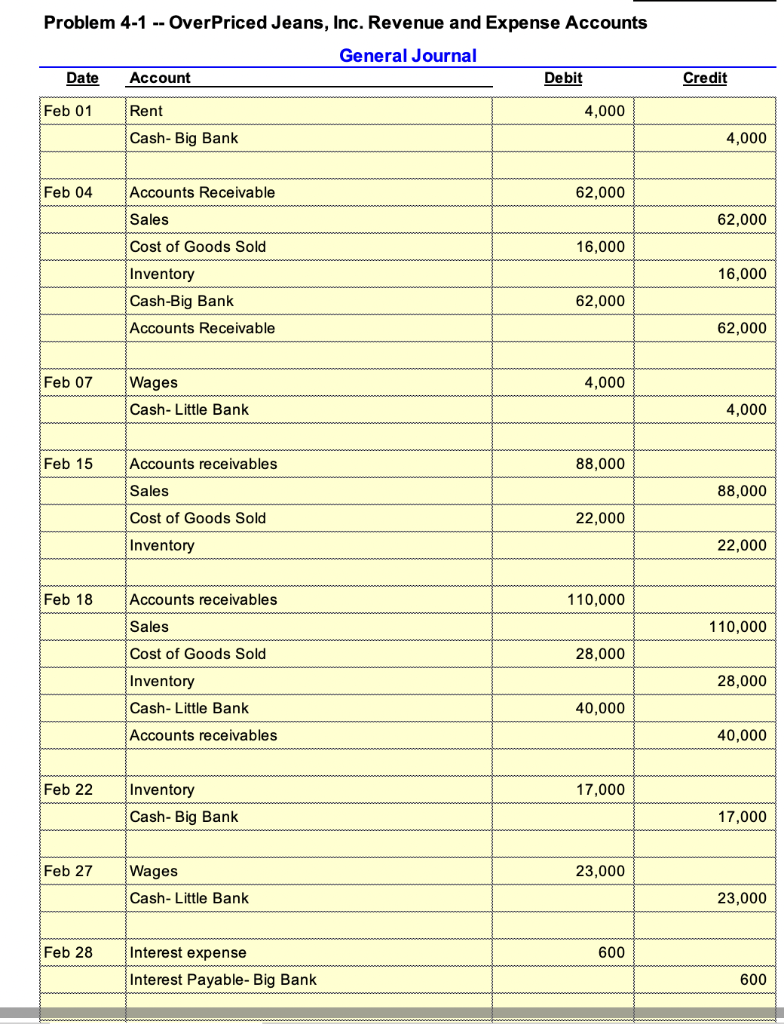

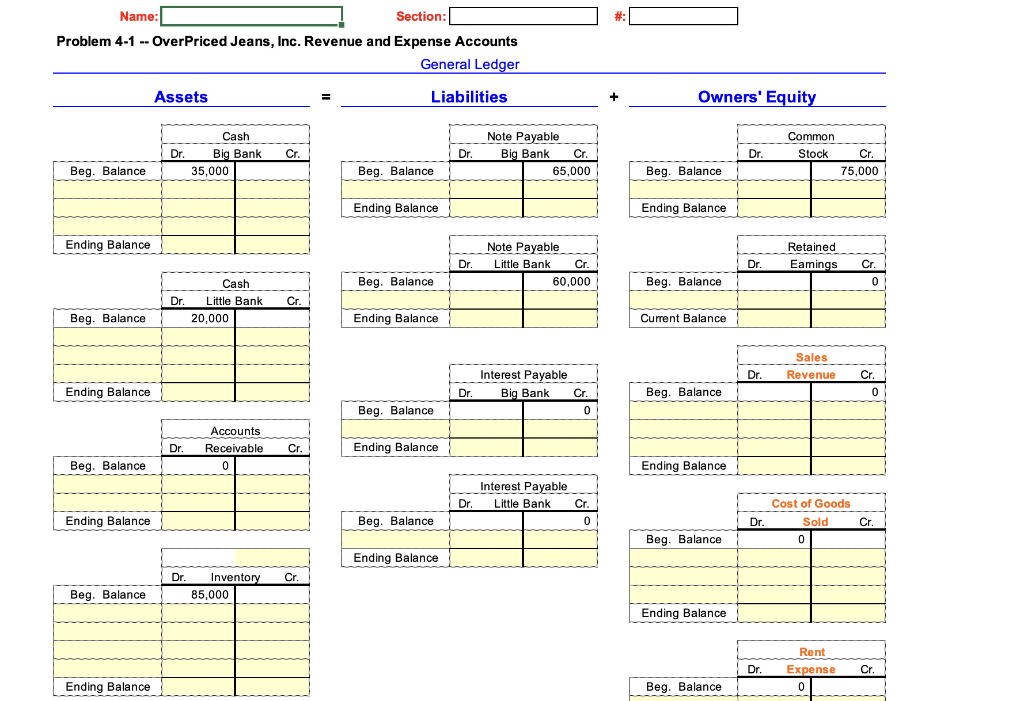

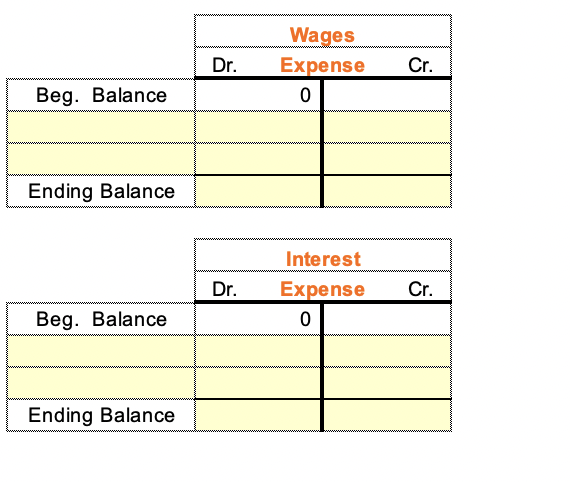

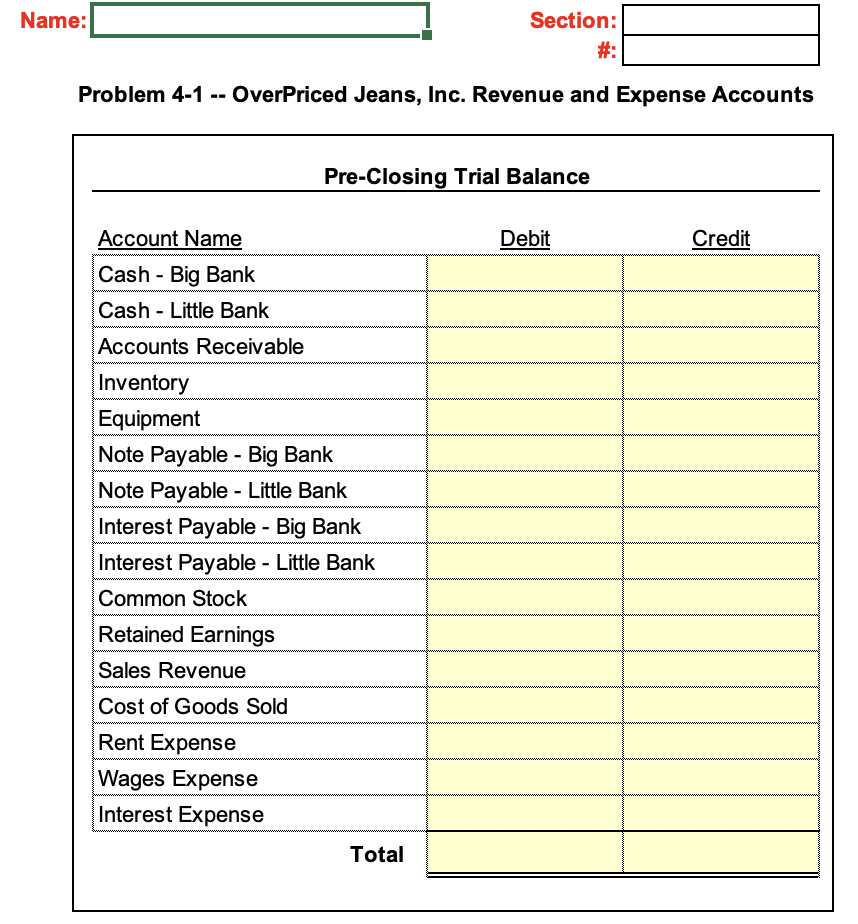

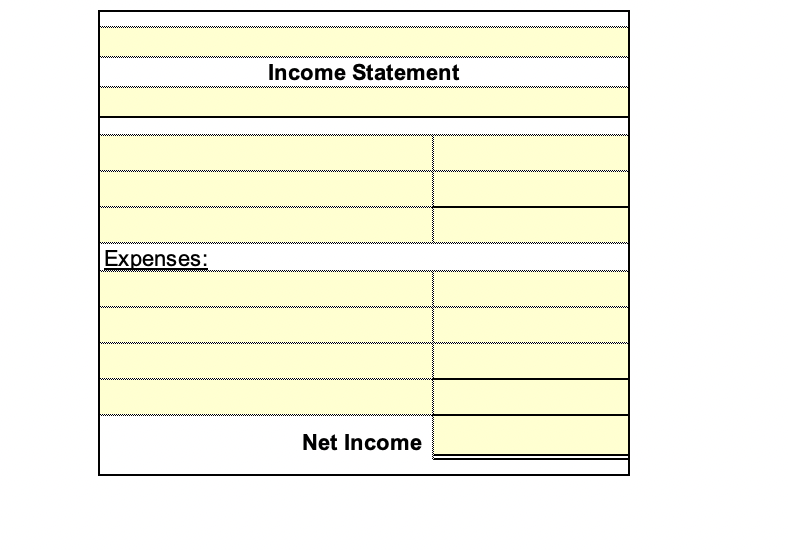

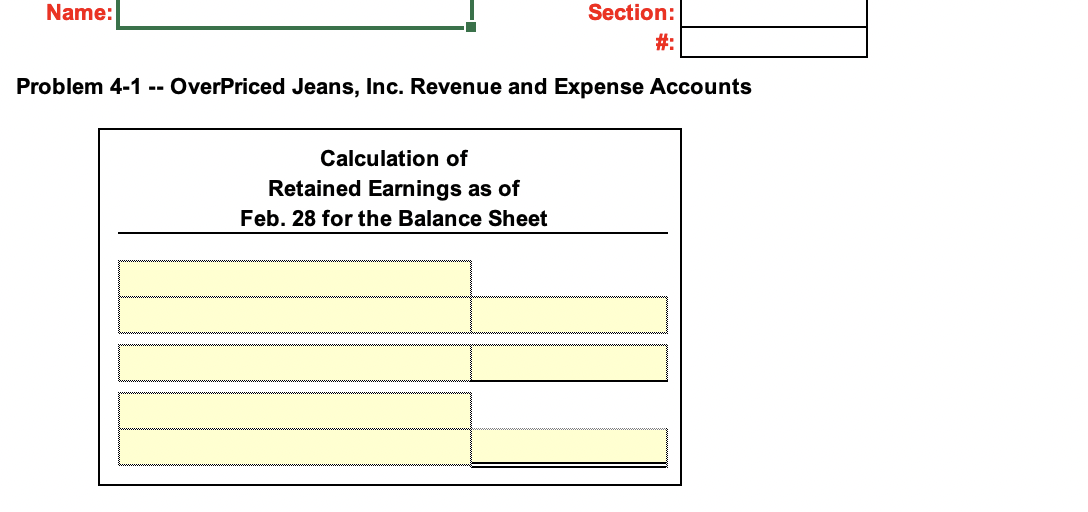

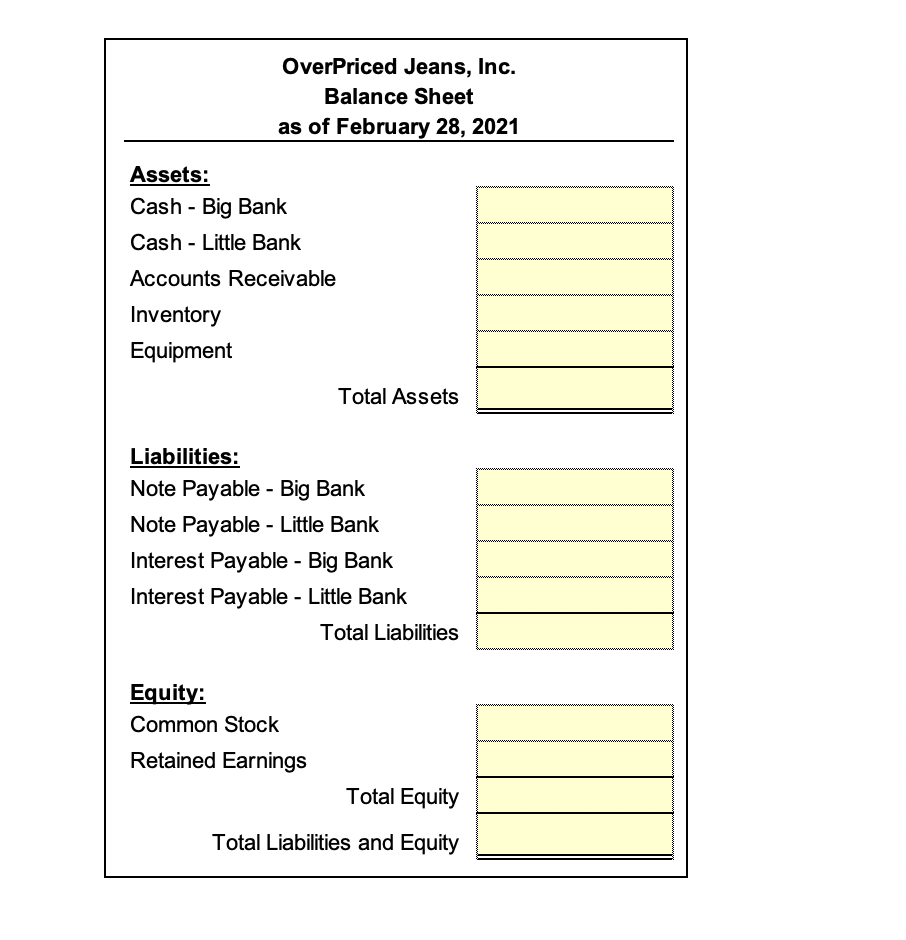

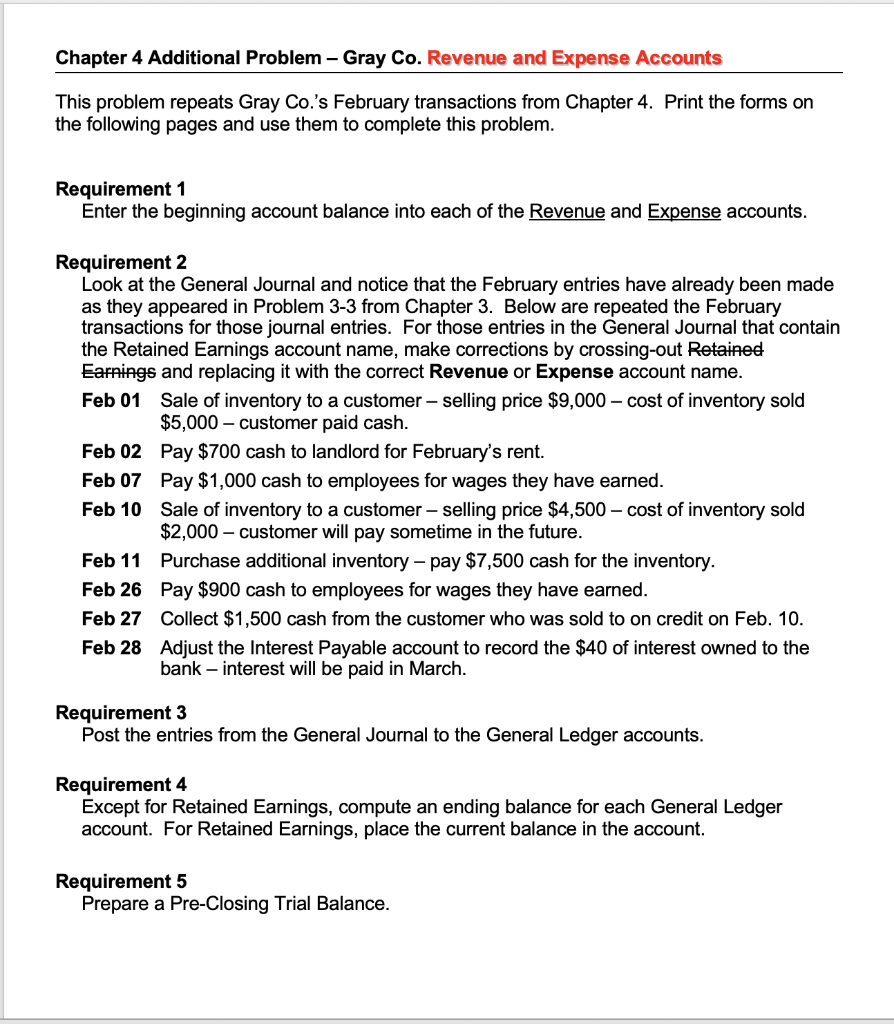

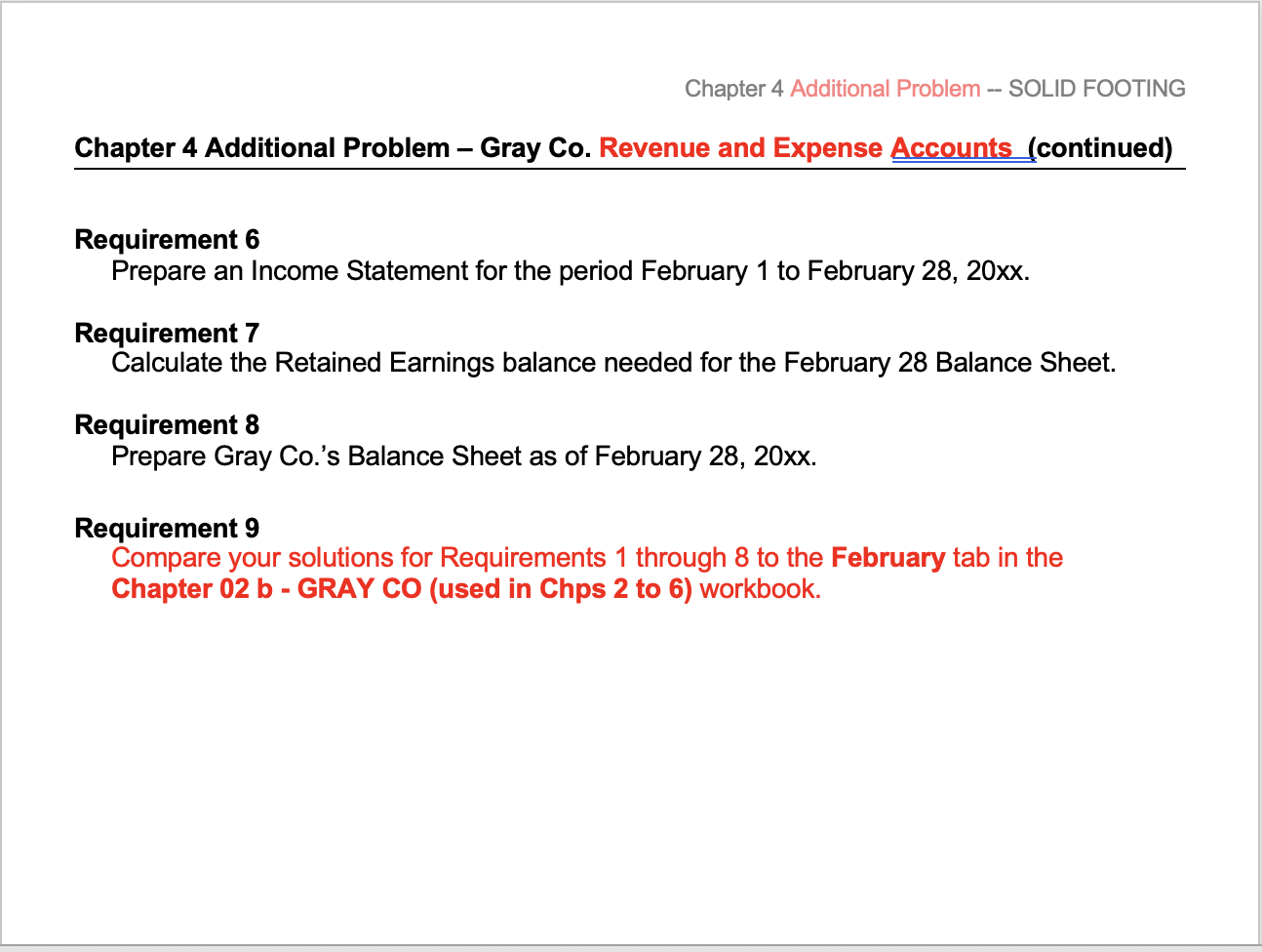

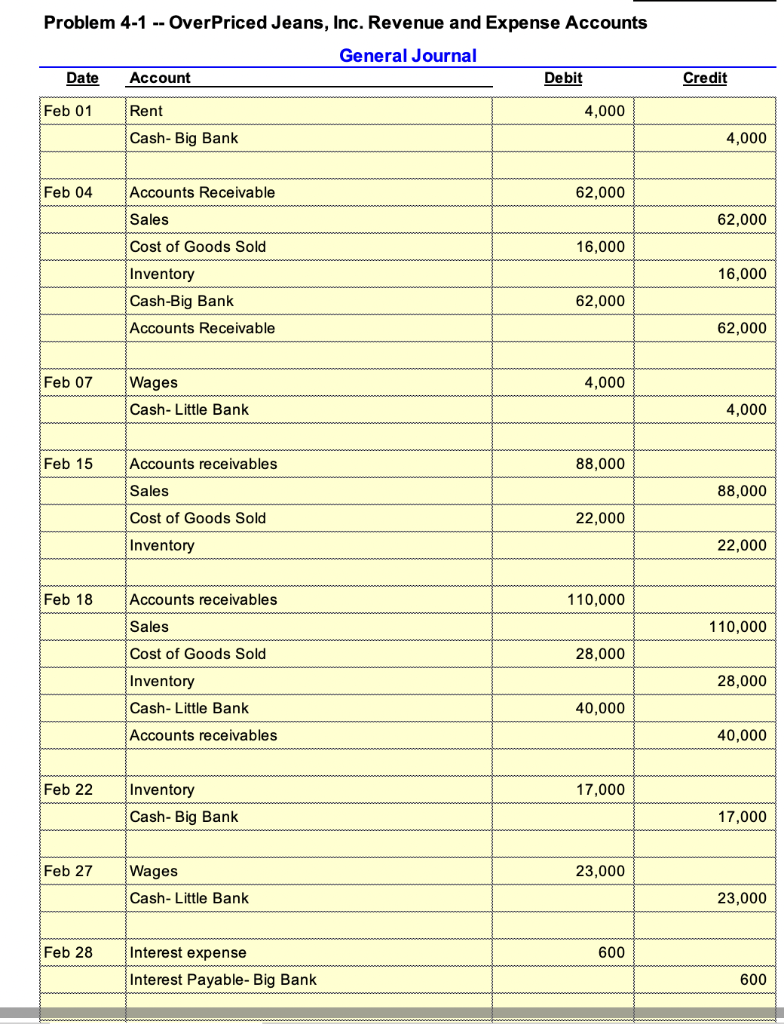

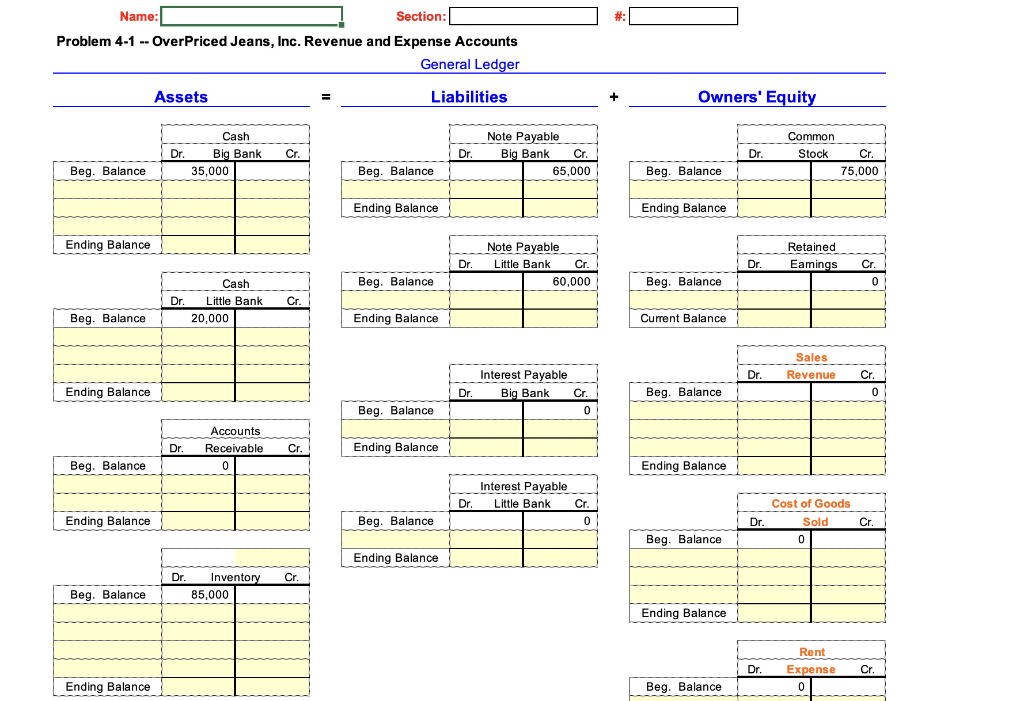

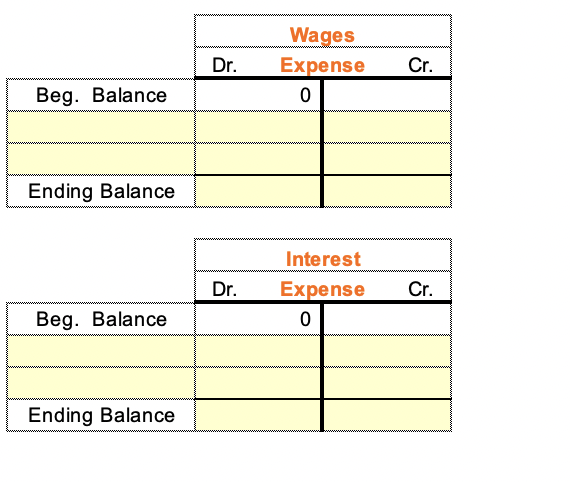

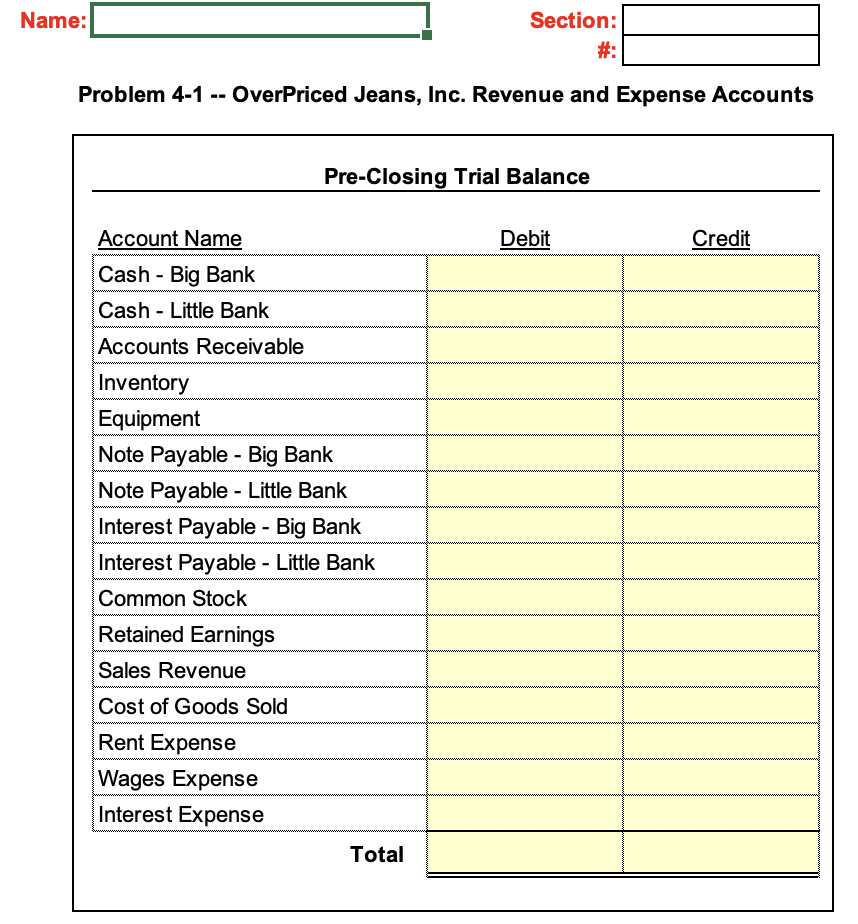

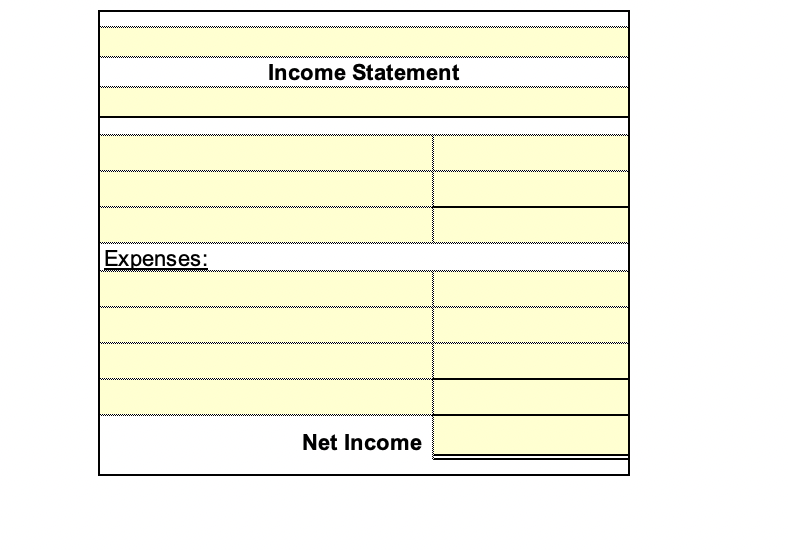

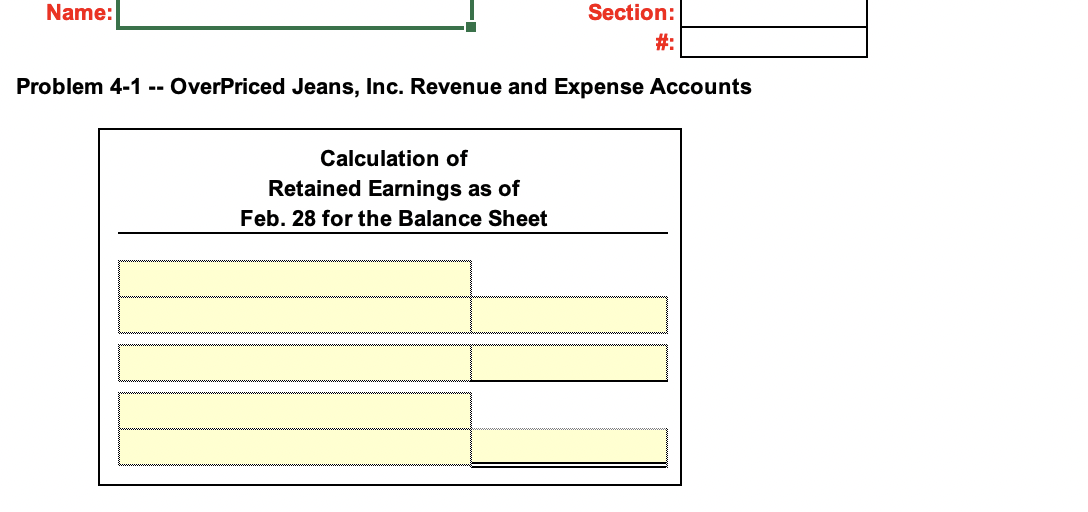

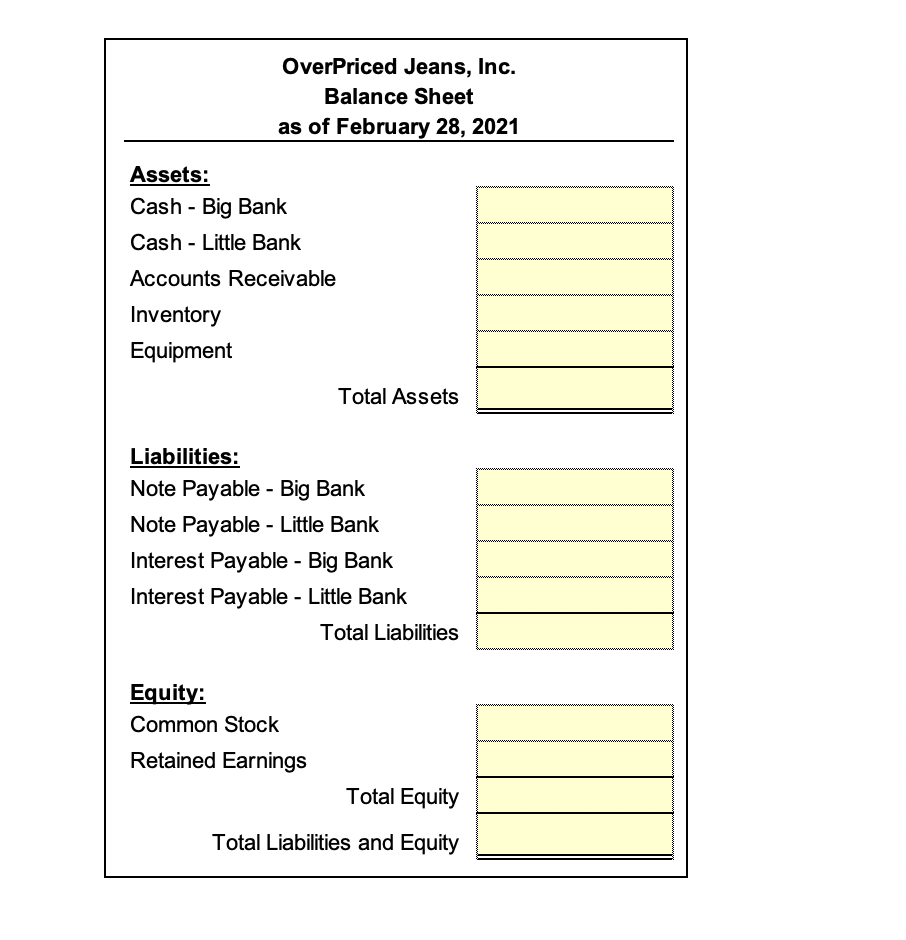

Chapter 4 Additional Problem - Gray Co. Revenue and Expense Accounts This problem repeats Gray Co.'s February transactions from Chapter 4. Print the forms on the following pages and use them to complete this problem. Requirement 1 Enter the beginning account balance into each of the Revenue and Expense accounts. Requirement 2 Look at the General Journal and notice that the February entries have already been made as they appeared in Problem 3-3 from Chapter 3. Below are repeated the February transactions for those journal entries. For those entries in the General Journal that contain the Retained Earnings account name, make corrections by crossing-out Retained Earnings and replacing it with the correct Revenue or Expense account name. Feb 01 Sale of inventory to a customer-selling price $9,000 - cost of inventory sold $5,000 - customer paid cash. Feb 02 Pay $700 cash to landlord for February's rent. Feb 07 Pay $1,000 cash to employees for wages they have earned. Feb 10 Sale of inventory to a customer-selling price $4,500 - cost of inventory sold $2,000 - customer will pay sometime in the future. Feb 11 Purchase additional inventory - pay $7,500 cash for the inventory. Feb 26 Pay $900 cash to employees for wages they have earned. Feb 27 Feb 28 Collect $1,500 cash from the customer who was sold to on credit on Feb. 10. Adjust the Interest Payable account to record the $40 of interest owned to the bank - interest will be paid in March. Requirement 3 Post the entries from the General Journal to the General Ledger accounts. Requirement 4 Except for Retained Earnings, compute an ending balance for each General Ledger account. For Retained Earnings, place the current balance in the account. Requirement 5 Prepare a Pre-Closing Trial Balance. Chapter 4 Additional Problem -- SOLID FOOTING Chapter 4 Additional Problem - Gray Co. Revenue and Expense Accounts (continued) Requirement 6 Prepare an Income Statement for the period February 1 to February 28, 20xx. Requirement 7 Calculate the Retained Earnings balance needed for the February 28 Balance Sheet. Requirement 8 Prepare Gray Co.'s Balance Sheet as of February 28, 20xx. Requirement 9 Compare your solutions for Requirements 1 through 8 to the February tab in the Chapter 02 b - GRAY CO (used in Chps 2 to 6) workbook. Problem 4-1 -- OverPriced Jeans, Inc. Revenue and Expense Accounts General Journal Date Account Debit Rent 4,000 Cash- Big Bank Accounts Receivable 62,000 Sales Cost of Goods Sold 16,000 Inventory Cash-Big Bank 62,000 Accounts Receivable Wages 4,000 Cash- Little Bank Accounts receivables 88,000 Sales Cost of Goods Sold 22,000 Inventory Accounts receivables 110,000 Sales Cost of Goods Sold 28,000 Inventory Cash- Little Bank 40,000 Accounts receivables Inventory 17,000 Cash- Big Bank Wages 23,000 Cash- Little Bank Interest expense 600 Interest Payable-Big Bank Feb 01 Feb 04 Feb 07 Feb 15 Feb 18 Feb 22 Feb 27 Feb 28 Credit 4,000 62,000 16,000 62,000 4,000 88,000 22,000 110,000 28,000 40,000 17,000 23,000 600 Name: Section: Problem 4-1 -- OverPriced Jeans, Inc. Revenue and Expense Accounts General Ledger Assets Liabilities Cash Dr. Dr. Big Bank Cr. 35,000 Beg. Balance Beg. Balance Ending Balance Ending Balance Cash Beg. Balance Dr. Little Bank Cr. 20,000 Beg. Balance Ending Balance Ending Balance Beg. Balance Accounts Ending Balance Dr. Receivable 0 Beg. Balance Ending Balance Beg. Balance Ending Balance Dr. Inventory 85.000 Beg. Balance Ending Balance Cr. Cr. Dr. Dr. Dr. Note Payable Big Bank Note Payable Little Bank Interest Payable Big Bank Interest Payable Little Bank Cr. 65,000 Cr. 60,000 Cr. 0 Cr. 0 Owners' Equity Dr. Beg. Balance Ending Balance Beg. Balance Current Balance Beg. Balance Ending Balance Beg. Balance Ending Balance Beg. Balance Dr. Dr. Dr. Dr. Common Stock Cr. 75,000 Retained Eamings Cr. 0 Sales Revenue Cr. 0 Cost of Goods Sold 0 Rent Expense 0 Cr. Cr. Beg. Balance Ending Balance Beg. Balance Ending Balance Dr. Dr. Wages Expense 0 Interest Expense 0 Cr. Cr. Name: Section: #: Problem 4-1 -- OverPriced Jeans, Inc. Revenue and Expense Accounts Pre-Closing Trial Balance Account Name Debit Credit Cash - Big Bank Cash Little Bank Accounts Receivable Inventory Equipment Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Wages Expense Interest Expense Total Expenses: Income Statement Net Income Name: Section: #: Problem 4-1 -- OverPriced Jeans, Inc. Revenue and Expense Accounts Calculation of Retained Earnings as of Feb. 28 for the Balance Sheet OverPriced Jeans, Inc. Balance Sheet as of February 28, 2021 Total Assets Assets: Cash Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment Liabilities: Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank Equity: Common Stock Retained Earnings Total Liabilities Total Equity Total Liabilities and Equity