Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help answer part D and E ASSIGNMENT 3- Bond Valuation The problem requires you to use the spreadsheet template attached in the assignment instructions.

please help answer part D and E

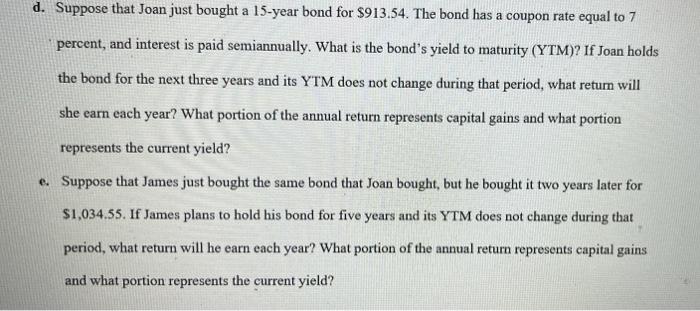

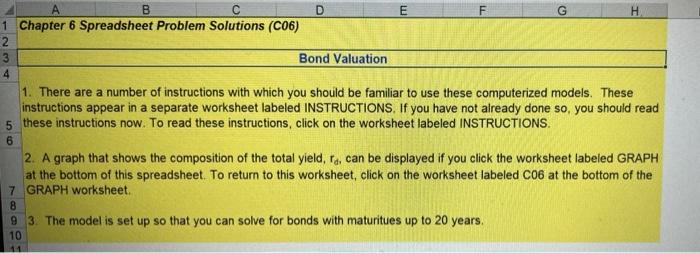

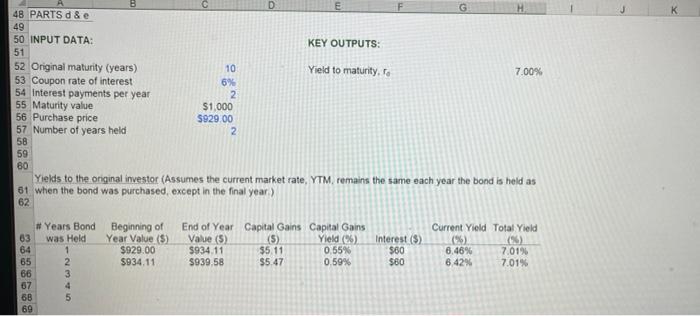

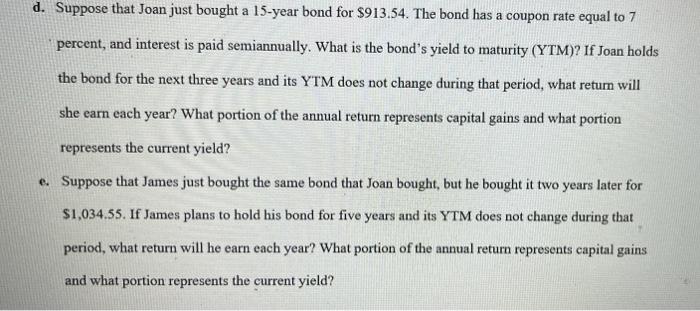

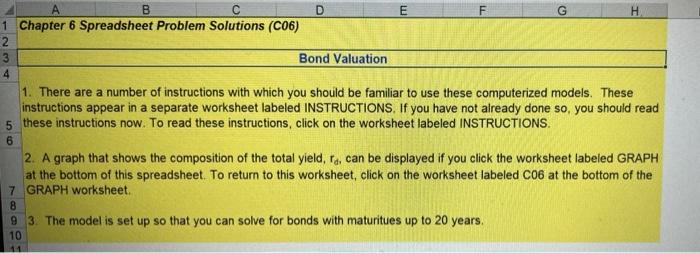

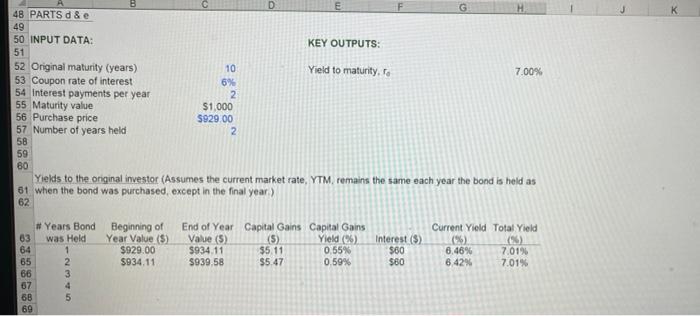

ASSIGNMENT 3- Bond Valuation The problem requires you to use the spreadsheet template attached in the assignment instructions. Jenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The bond has a $1,000 maturity value, a coupon rate equal to 9 percent, and it matures in 17 years. Interest is paid every six months; the next interest payment is scheduled for six months from today. d. Suppose that Joan just bought a 15-year bond for $913.54. The bond has a coupon rate equal to 7 percent, and interest is paid semiannually. What is the bond's yield to maturity (YTM)? If Joan holds the bond for the next three years and its YTM does not change during that period, what return will she earn each year? What portion of the annual return represents capital gains and what portion represents the current yield? e. Suppose that James just bought the same bond that Joan bought, but he bought it two years later for $1,034.55. If James plans to hold his bond for five years and its YTM does not change during that period, what return will he earn each year? What portion of the annual return represents capital gains and what portion represents the current yield? ANE B D E F G H 1 Chapter 6 Spreadsheet Problem Solutions (C06) 2 3 Bond Valuation 4 1. There are a number of instructions with which you should be familiar to use these computerized models. These instructions appear in a separate worksheet labeled INSTRUCTIONS. If you have not already done so, you should read 5 these instructions now. To read these instructions, click on the worksheet labeled INSTRUCTIONS. 2. A graph that shows the composition of the total yield, ra, can be displayed if you click the worksheet labeled GRAPH at the bottom of this spreadsheet. To return to this worksheet, click on the worksheet labeled C06 at the bottom of the 7 GRAPH worksheet 8 9 3. The model is set up so that you can solve for bonds with maturitues up to 20 years. 6 10 11 B D E G 48 PARTS d&e 49 50 INPUT DATA: KEY OUTPUTS: 51 52 Original maturity (years) 10 Yield to maturity, 7.00% 53 Coupon rate of interest 6% 54 Interest payments per year 2 55 Maturity value $1,000 56 Purchase price S929.00 57 Number of years held 2 58 59 80 Yields to the original investor (Assumes the current market rate, YTM, remains the same each year the bond is held as 61 when the bond was purchased, except in the final year) 62 # Years Bond Beginning of End of Year Capital Gains Capital Gains Current Yield Total Yield 63 was Held Year Value (5) Value (5) (5) Yield (26 Interest (S) () 64 1 $929.00 $934.11 $5.11 0.55% $60 6.46% 7.01% 65 2 $934 11 $939.58 $5.47 0.59% $80 6.42% 7,01% 66 3 67 4 5 8&98828

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started