Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ANSWER THIS Assume a 4-year, $2,500 par value bond paying a 8% coupon semiannually and a YTM of 11%. The prime rate is

PLEASE HELP ANSWER THIS

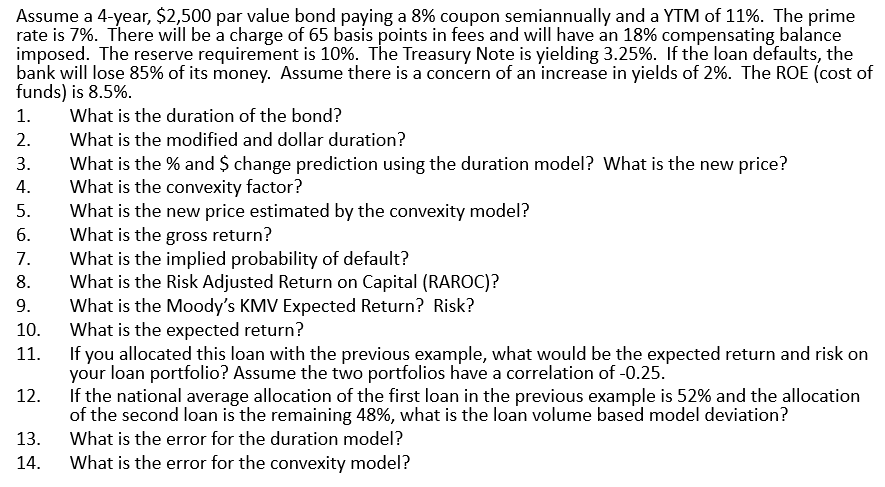

Assume a 4-year, \$2,500 par value bond paying a 8% coupon semiannually and a YTM of 11%. The prime rate is 7%. There will be a charge of 65 basis points in fees and will have an 18% compensating balance imposed. The reserve requirement is 10%. The Treasury Note is yielding 3.25%. If the loan defaults, the bank will lose 85% of its money. Assume there is a concern of an increase in yields of 2%. The ROE (cost o funds) is 8.5%. 1. What is the duration of the bond? 2. What is the modified and dollar duration? 3. What is the % and $ change prediction using the duration model? What is the new price? 4. What is the convexity factor? 5. What is the new price estimated by the convexity model? 6. What is the gross return? 7. What is the implied probability of default? 8. What is the Risk Adjusted Return on Capital (RAROC)? 9. What is the Moody's KMV Expected Return? Risk? 10. What is the expected return? 11. If you allocated this loan with the previous example, what would be the expected return and risk on your loan portfolio? Assume the two portfolios have a correlation of -0.25. 12. If the national average allocation of the first loan in the previous example is 52% and the allocation of the second loan is the remaining 48%, what is the loan volume based model deviation? 13. What is the error for the duration model? 14. What is the error for the convexity model? Assume a 4-year, \$2,500 par value bond paying a 8% coupon semiannually and a YTM of 11%. The prime rate is 7%. There will be a charge of 65 basis points in fees and will have an 18% compensating balance imposed. The reserve requirement is 10%. The Treasury Note is yielding 3.25%. If the loan defaults, the bank will lose 85% of its money. Assume there is a concern of an increase in yields of 2%. The ROE (cost o funds) is 8.5%. 1. What is the duration of the bond? 2. What is the modified and dollar duration? 3. What is the % and $ change prediction using the duration model? What is the new price? 4. What is the convexity factor? 5. What is the new price estimated by the convexity model? 6. What is the gross return? 7. What is the implied probability of default? 8. What is the Risk Adjusted Return on Capital (RAROC)? 9. What is the Moody's KMV Expected Return? Risk? 10. What is the expected return? 11. If you allocated this loan with the previous example, what would be the expected return and risk on your loan portfolio? Assume the two portfolios have a correlation of -0.25. 12. If the national average allocation of the first loan in the previous example is 52% and the allocation of the second loan is the remaining 48%, what is the loan volume based model deviation? 13. What is the error for the duration model? 14. What is the error for the convexity modelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started