Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help answering (a), (b), (c), (d) 2. You firm is considering in buying several companies, and then making improvements at each of these companies

Please help answering (a), (b), (c), (d)

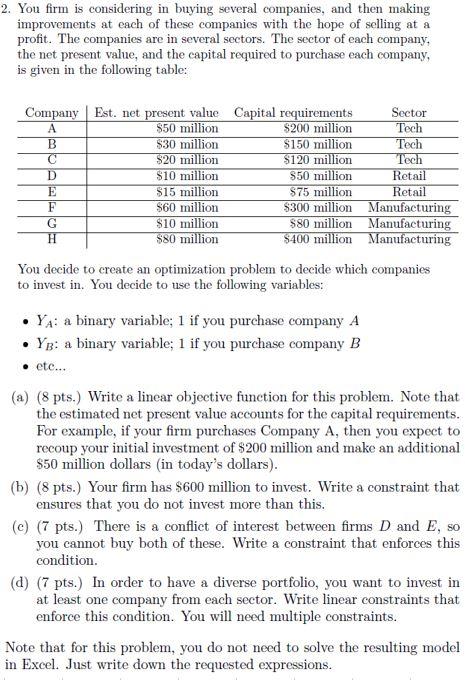

2. You firm is considering in buying several companies, and then making improvements at each of these companies with the hope of selling at a profit. The companies are in several sectors. The sector of each company, the net present value, and the capital required to purchase each company, is given in the following table: You decide to create an optimization problem to decide which companies to invest in. You decide to use the following variables: - YA : a binary variable; 1 if you purchase company A - YB : a binary variable; 1 if you purchase company B - etc... (a) (8 pts.) Write a linear objective function for this problem. Note that the estimated net present value accounts for the capital requirements. For example, if your firm purchases Company A, then you expect to recoup your initial investment of $200 million and make an additional $50 million dollars (in today's dollars). (b) (8 pts.) Your firm has $600 million to invest. Write a constraint that ensures that you do not invest more than this. (c) (7 pts.) There is a conflict of interest between firms D and E, so you cannot buy both of these. Write a constraint that enforces this condition. (d) (7 pts.) In order to have a diverse portfolio, you want to invest in at least one company from each sector. Write linear constraints that enforce this condition. You will need multiple constraints. Note that for this problem, you do not need to solve the resulting model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started