Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help answering the questions under the INSTRUCTIONS: 1. prepare journal entries 2. prepare job cost cards 3 set up The accounts and post to

Please help answering the questions under the INSTRUCTIONS:

1. prepare journal entries 2. prepare job cost cards 3 set up The accounts and post to fact subsidiary ledger 4 answer following questions

a. compute the amount of under applied or over applied overhead as of Jan 31. and transfer it to the cost of goods sold account b. why should the overhead account under or over applied overhead be transferred to the cost of goods sold account

THANKS!!!

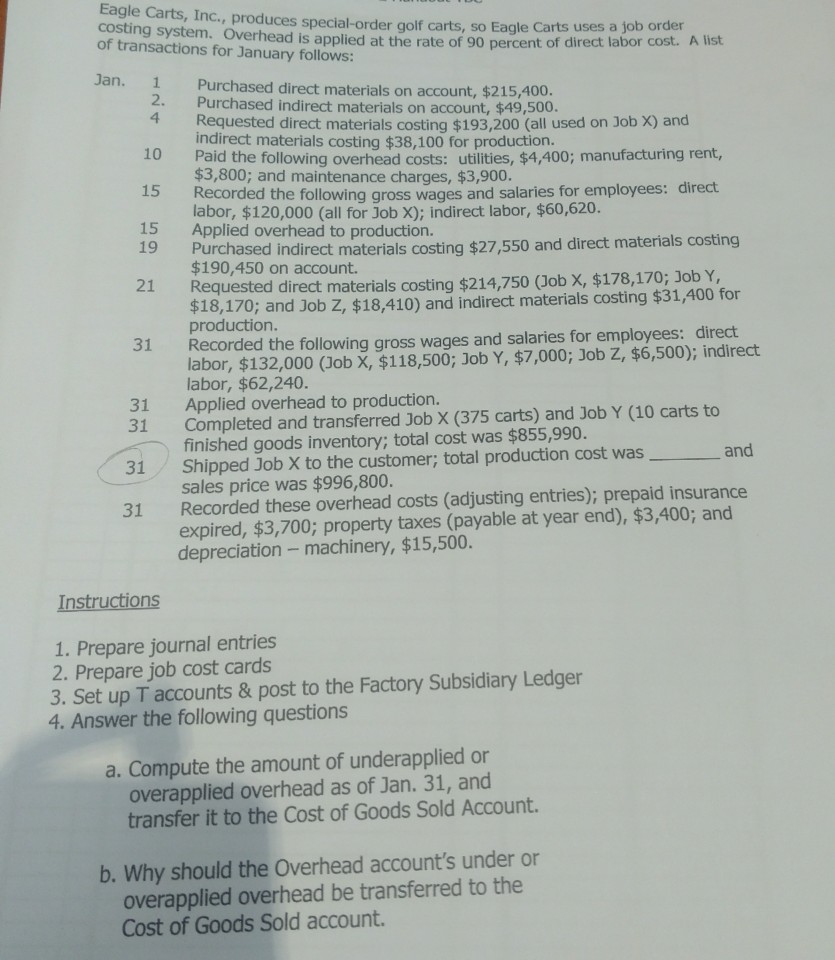

Eagle Carts, Inc., produces special-order golf carts, so Eagle Carts uses a job order oftrangaem. Overhead is applied at the rate of 90 percent of direct labor cost. A list Ja transactions for January follows: 1 2. 4 n. 10 15 15 Purchased direct materials on account, $215,400. Purchased indirect materials on account, $49,500. Requested direct materials costing $193,200 (all used on Job X) and indirect materials costing $38,100 for production. Paid the following overhead costs: utilities, $4,400; manufacturing rent, $3,800; and maintenance charges, $3,900. Recorded the following gross wages and salaries for employees: direct labor, $120,000 (all for Job X); indirect labor, $60,620. Applied overhead to production materials costing $27,550 and direct materials costing als costing $214,750 (Job X, $178,170; Job Y, 19 Purchased indirect $190,450 on account. Requested direct materi $1 21 8,170; and Job Z, $18,410) and indirect materials costing $31,400 for production 31 Recorded the following gross wages and salaries for employees: direct labor, $132,000 Job X, $118,500, 3ob Y, $7,000; Job 2, $6,500), indirect Applied overhead to production. Completed and transferred Job X (375 carts) and Job Y (10 carts to finished goods inventory; total cost was $855,990. Shipped Job X to the customer; total production cost was sales price was $996,800. Recorded these overhead costs (adjusting entries); prepaid insurance expired, $3,700; property taxes (payable at year end), $3,400; and depreciation -machinery, $15,500. 31 31 31 31 and ctions 1. Prepare journal entries 2. Prepare job cost cards 3. Set up T accounts & post to the Factory Subsidiary Ledger 4. Answer the following questions a. Compute the amount of underapplied or overapplied overhead as of Jan. 31, and transfer it to the Cost of Goods Sold Account. b. Why should the Overhead account's under or overapplied overhead be transferred to the Cost of Goods Sold accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started