Answered step by step

Verified Expert Solution

Question

1 Approved Answer

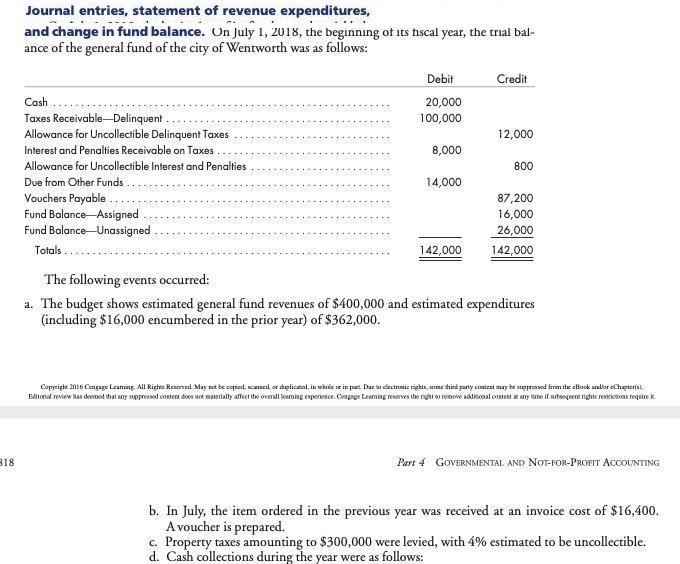

Journal entries, statement of revenue expenditures, and change in fund balance. On July 1, 2018, the beginning of its hscal year, the trial bal-

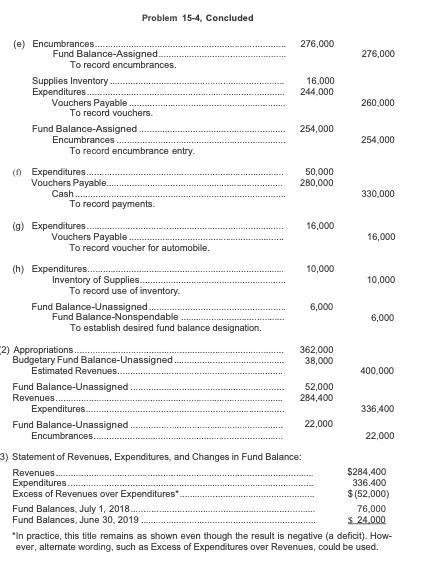

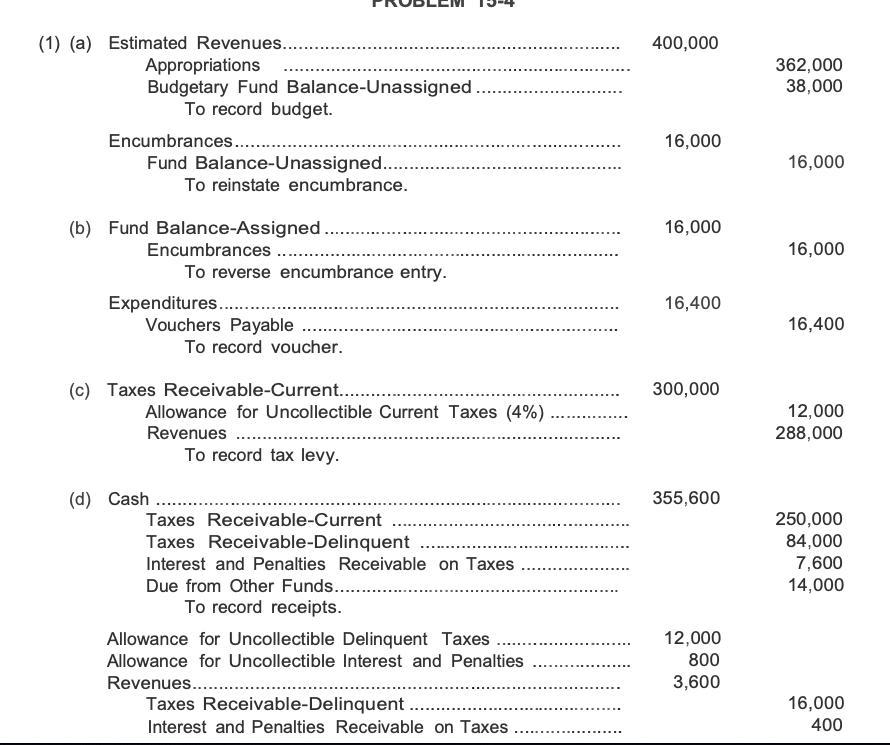

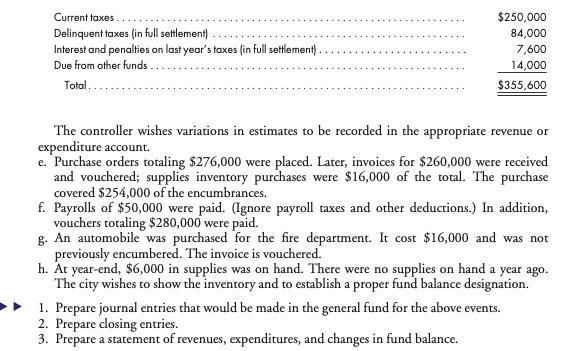

Journal entries, statement of revenue expenditures, and change in fund balance. On July 1, 2018, the beginning of its hscal year, the trial bal- ance of the general fund of the city of Wentworth was as follows: Debit Credit Cash 20,000 100,000 Taxes Receivable-Delinquent . Allowance for Uncollectible Delinquent Taxes 12,000 Interest and Penalties Receivable on Taxes .. 8,000 Allowance for Uncollectible Interest and Penalties 800 Due from Other Funds... Vouchers Payable Fund Balance Assigned Fund Balance Unassigned 14,000 87,200 16,000 26,000 142,000 Totals 142,000 The following events occurred: a. The budget shows estimated general fund revenues of $400,000 and estimated expenditures (indluding $16,000 encumbered in the prior year) of $362,000. Copyrighi 2016 Cenpage Leaming. All Righs Renarved May aet be copial, anned or daplicatal, in whule or in purt. Dae to electrosie righia, aume thied party conteat may be supprosed from the elBook andlor eChapteria) Ediorial review has demed that any suppressod contera does not maerially affect the overall leamisg esperiesce. Cenpge Leaming reserves the righi w reinove adrional comeat a any ime if sutsoqueot rights restriktions require k. B18 Part 4 GOVERNMENTAL AND NOT-FOR-PROFIT ACCOUNTING b. In July, the item ordered in the previous year was received at an invoice cost of $16,400. A voucher is prepared. c. Property taxes amounting to $300,000 were levied, with 4% estimated to be uncollectible. d. Cash collections during the year were as follows: Problem 15-4, Concluded (e) Encumbrances. 276,000 Fund Balance-Assigned. To record encumbrances. 276,000 Supplies Inventory Expenditures. Vouchers Payable To record vouchers. 16,000 244.000 260,000 Fund Balance-Assigned Encumbrances 254,000 254,000 To record encumbrance entry. (n Expenditures.. 50,000 280,000 Vouchers Payable. Cash. To record payments. 330,000 (g) Expenditures. 16,000 Vouchers Payable 16,000 To record voucher for automobile. (h) Expenditures.. 10,000 Inventory of Supplies.. To record use of inventory. 10,000 Fund Balance-Unassigned. Fund Balance-Nonspendable To establish desired fund balance designation. 6,000 6,000 2) Appropriations. Budgetary Fund Balance-Unassigned. Estimated Revenues. 362,000 38,000 400,000 Fund Balance-Unassigned Revenues. 52,000 284,400 Expenditures. 336,400 22,000 Fund Balance-Unassigned. Encumbrances. 22,000 3) Statement of Revenues, Expenditures, and Changes in Fund Balance: $284,400 336.400 Revenues Expenditures. Excess of Revenues over Expenditures". $ (52,000) Fund Balances, July 1, 2018. Fund Balances, June 30, 2019 76,000 $24.000 *In practice, this title remains as shown even though the result is negative (a deficit). How- ever, alternate wording, such as Excess of Expenditures over Revenues, could be used. (1) (a) Estimated Revenues.. 400,000 Appropriations Budgetary Fund Balance-Unassigned. To record budget. 362,000 38,000 Encumbrances... 16,000 Fund Balance-Unassigned. 16,000 To reinstate encumbrance. (b) Fund Balance-Assigned.. 16,000 Encumbrances . 16,000 To reverse encumbrance entry. Expenditures.. Vouchers Payable . 16,400 16,400 To record voucher. (c) Taxes Receivable-Current.. 300,000 Allowance for Uncollectible Current Taxes (4%) Revenues ... 12,000 288,000 To record tax levy. (d) Cash .. 355,600 250,000 84,000 7,600 14,000 Taxes Receivable-Current Taxes Receivable-Delinquent Interest and Penalties Receivable on Taxes Due from Other Funds.. To record receipts. Allowance for Uncollectible Delinquent Taxes 12,000 Allowance for Uncollectible Interest and Penalties 800 Revenues.... 3,600 Taxes Receivable-Delinquent .. 16,000 Interest and Penalties Receivable on Taxes. 400 $250,000 84,000 7,600 Current taxes . Delinquent taxes (in full settlement) Interest and penalties on last year's taxes (in full settlement). Due from other funds 14,000 Total.. $355,600 The controller wishes variations in estimates to be recorded in the appropriate revenue or expenditure account. e. Purchase orders totaling $276,000 were placed. Later, invoices for $260,000 were received and vouchered; supplies inventory purchases were $16,000 of the total. The purchase covered $254,000 of the encumbrances. f. Payrolls of $50,000 were paid. (Ignore payroll taxes and other deductions.) In addition, vouchers totaling $280,000 were paid. g. An automobile was purchased for the fire department. It cost $16,000 and was not previously encumbered. The invoice is vouchered. h. At year-end, $6,000 in supplies was on hand. There were no supplies on hand a year ago. The city wishes to show the inventory and to establish a proper fund balance designation. 1. Prepare journal entries that would be made in the general fund for the above events. 2. Prepare closing entries. 3. Prepare a statement of revenues, expenditures, and changes in fund balance. At the inception of the lease: Entries Account Fund Debit Credit First interest payment Entries Fund Account Debit Credit

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started