Answered step by step

Verified Expert Solution

Question

1 Approved Answer

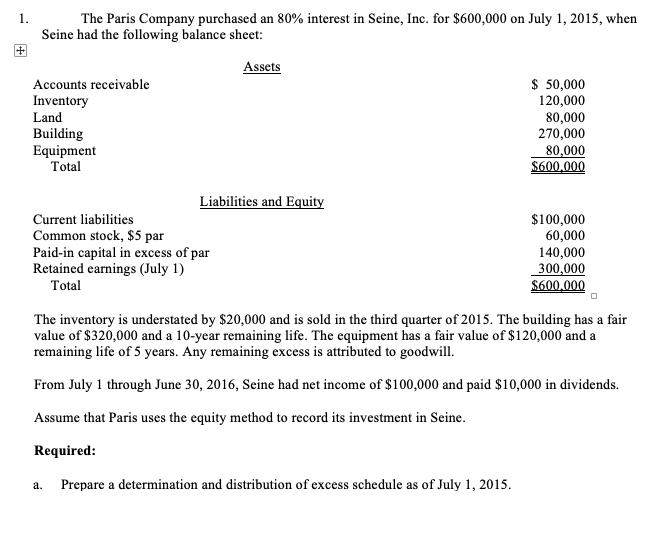

The Paris Company purchased an 80% interest in Seine, Inc. for $600,000 on July 1, 2015, when Seine had the following balance sheet: 1.

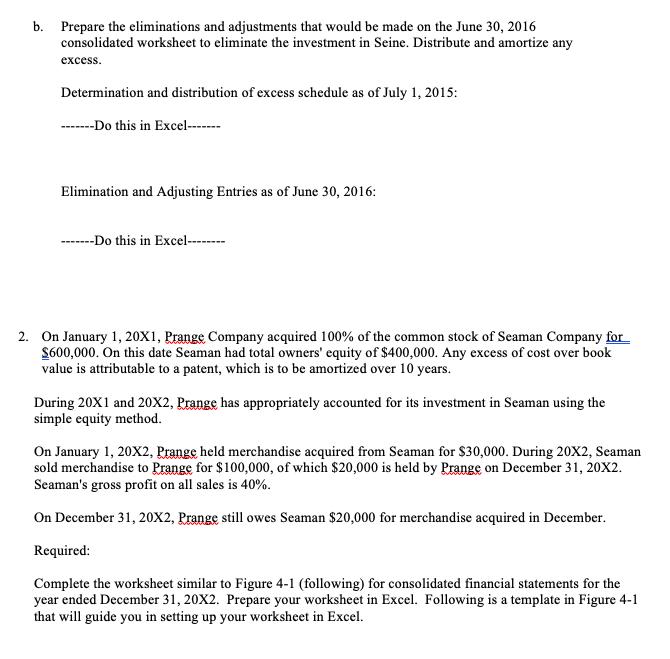

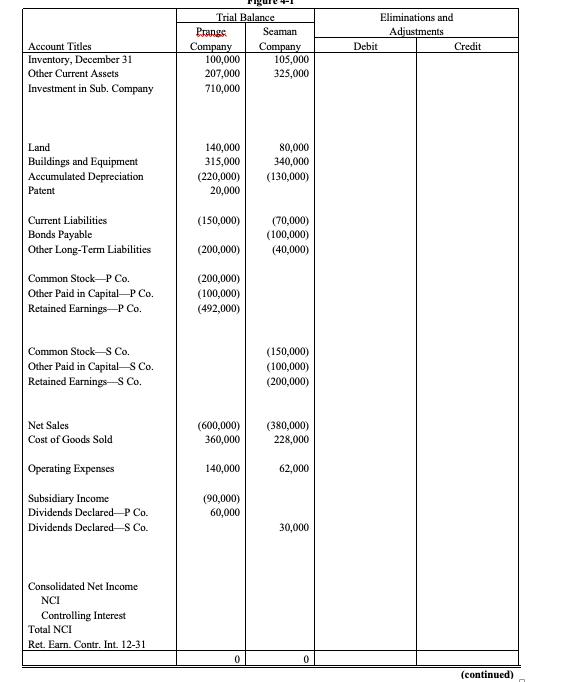

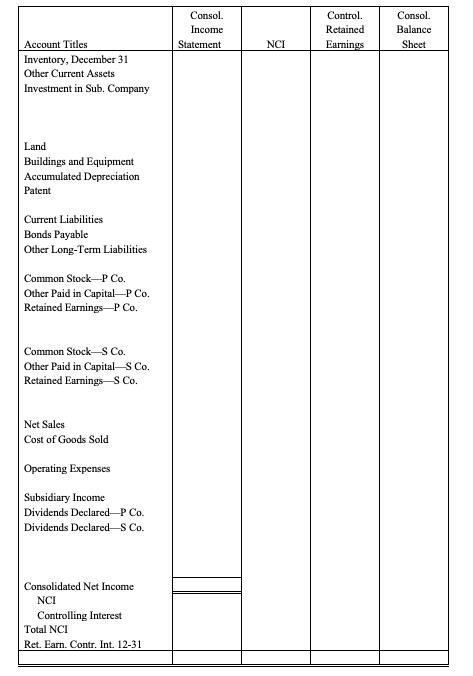

The Paris Company purchased an 80% interest in Seine, Inc. for $600,000 on July 1, 2015, when Seine had the following balance sheet: 1. + Assets $ 50,000 120,000 80,000 270,000 80,000 $600,000 Accounts receivable Inventory Land Building Equipment Total Liabilities and Equity Current liabilities Common stock, $5 par Paid-in capital in excess of par Retained earnings (July 1) $100,000 60,000 140,000 300,000 $600,000 Total The inventory is understated by $20,000 and is sold in the third quarter of 2015. The building has a fair value of $320,000 and a 10-year remaining life. The equipment has a fair value of $120,000 and a remaining life of 5 years. Any remaining excess is attributed to goodwill. From July 1 through June 30, 2016, Seine had net income of $100,000 and paid $10,000 in dividends. Assume that Paris uses the equity method to record its investment in Seine. Required: . Prepare a determination and distribution of excess schedule as of July 1, 2015. b. Prepare the eliminations and adjustments that would be made on the June 30, 2016 consolidated worksheet to eliminate the investment in Seine. Distribute and amortize any excess. Determination and distribution of excess schedule as of July 1, 2015: ---Do this in Excel------ Elimination and Adjusting Entries as of June 30, 2016: ---Do this in Excel-------- 2. On January 1, 20X1, Prange Company acquired 100% of the common stock of Seaman Company for $600,000. On this date Seaman had total owners' equity of $400,000. Any excess of cost over book value is attributable to a patent, which is to be amortized over 10 years. During 20X1 and 20X2, Prange has appropriately accounted for its investment in Seaman using the simple equity method. On January 1, 20X2, Prange held merchandise acquired from Seaman for $30,000. During 20X2, Seaman sold merchandise to Prange for $100,000, of which $20,000 is held by Prange on December 31, 20X2. Seaman's gross profit on all sales is 40%. On December 31, 20X2, Prange still owes Seaman $20,000 for merchandise acquired in December. Required: Complete the worksheet similar to Figure 4-1 (following) for consolidated financial statements for the year ended December 31, 20X2. Prepare your worksheet in Excel. Following is a template in Figure 4-1 that will guide you in setting up your worksheet in Excel. Trial Balance Eliminations and Prange Company 100,000 Scaman Adjustments Account Titles Credit Company 105,000 Debit Inventory, December 31 Other Current Assets 207,000 325,000 Investment in Sub. Company 710,000 140,000 315,000 (220,000) 20,000 Land Buildings and Equipment Accumulated Depreciation Patent 80,000 340,000 (130,000) Current Liabilities (150,000) (70,000) (100,000) (40,000) Bonds Payable Other Long-Term Liabilities (200,000) Common Stock-P Co. (200,000) (100,000) (492,000) Other Paid in Capital P Co. Retained Earnings-P Co. Common Stock-S Co. (150,000) (100,000) Other Paid in CapitalS Co. Retained Earnings-S C. (200,000) Net Sales (600,000) 360,000 (380,000) 228,000 Cost of Goods Sold Operating Expenses 140,000 62,000 (90,000) 60,000 Subsidiary Income Dividends Declared-P Co. Dividends Declared-S Co. 30,000 Consolidated Net Income NCI Controlling Interest Total NCI Ret. Earn. Contr. Int. 12-31 (continued) Consol. Control. Consol. Income Retained Balance Account Titles Statement NCI Earnings Sheet Inventory, December 31 Other Current Assets Investment in Sub. Company Land Buildings and Equipment Accumulated Depreciation Patent Current Liabilities Bonds Payable Other Long-Term Liabilities Common Stock-P Co. Other Paid in Capital P Co. Retained EarningsP Co. Common Stock-S Co. Other Paid in Capital-S Co. Retained Earnings S Co. Net Sales Cost of Goods Sold Operating Expenses Subsidiary Income Dividends Declared P Co. Dividends Declared S Co. Consolidated Net Income NCI Controlling Interest Total NCI Ret. Earn. Contr. Int. 12-31

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started