Please help!

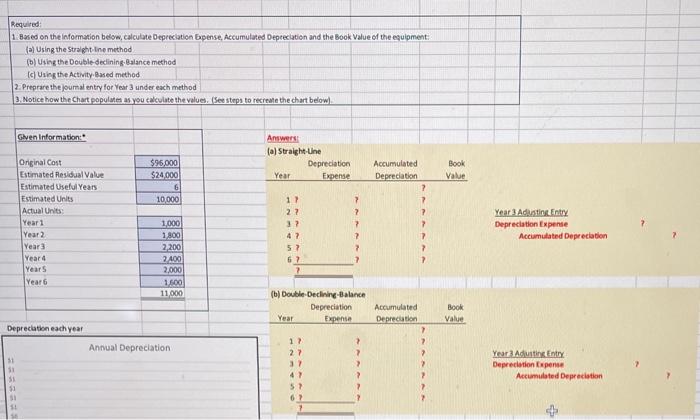

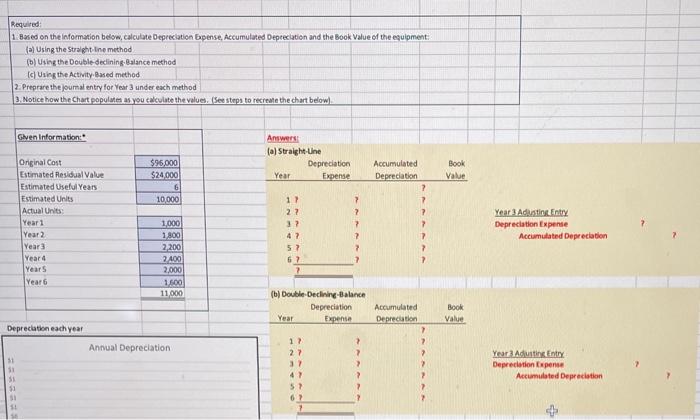

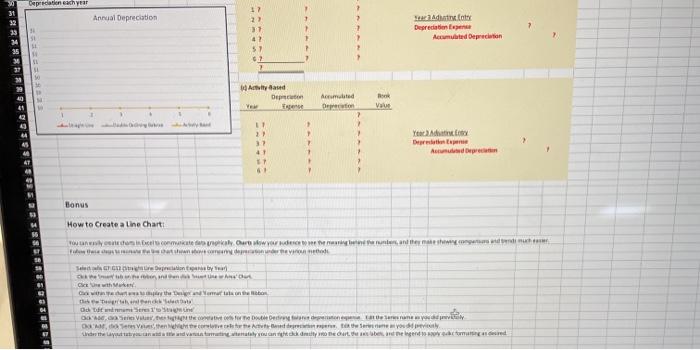

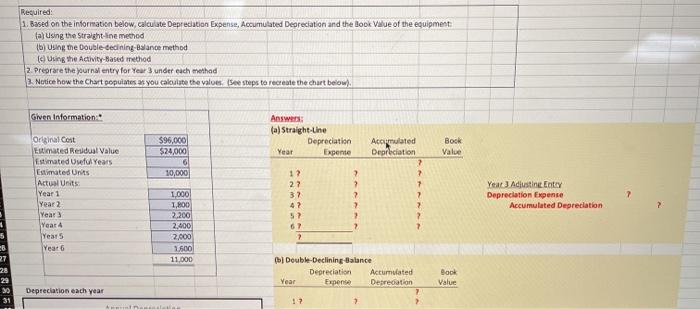

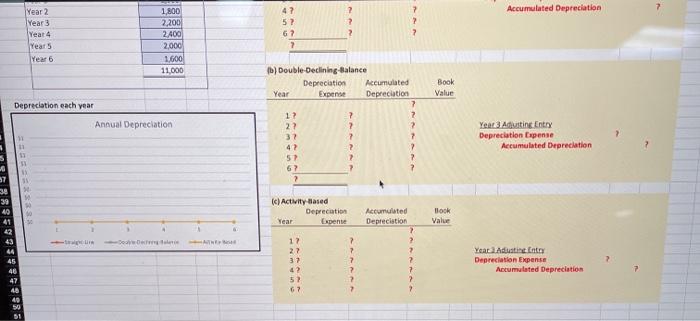

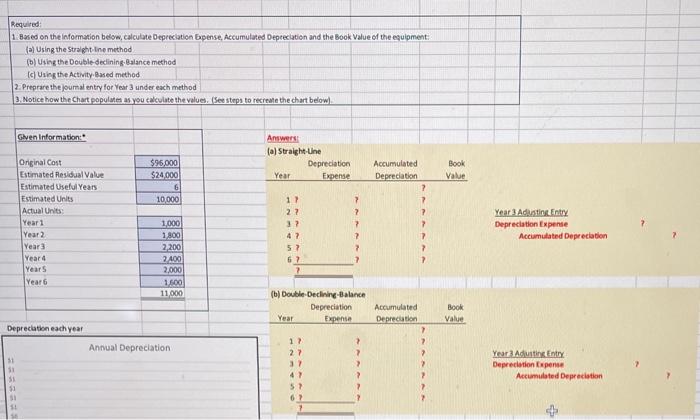

Required 1. Based on the Information below.calculate Depreciation pense Accumulated Depreciation and the Book Value of the equipment: (a) Using the Straight line method b) Using the Double declining Balance method Ich Using the Activity Based method 2. Preprare the journal entry for Year 3 under each method 3. Notice how the Chart populates as you calculate the values. (See steps to recreate the chart below Glen Information $95.000 $24.000 6 10000 Answers (a) Straight-Une Depreciation Year Expense Book Value Accumulated Depreciation 2 7 7 Orginal Cost Estimated Residual Value Estimated Useful Years Estimated Units Actual Units Year 1 Year 2 Year Yeard Years Year 6 17 27 32 42 57 7 ? 7 ? Year 3 Adusting Entry Depreciation Experte Accumulated Depreciation 7 1000 1800 2,200 2400 2,000 1.600 11,000 (b) Double Declining-Balance Depreciation Year Expense Book Valve Depreciation each year Accumulated Depreciation 7 2 Annual Depreciation 17 27 3 47 > Year Adulte Entry Depreciation Expense Accumulated Depreciation 2 2 2 51 53 55 $1 SI 11 Deprecation each year Annual Depreciation Adity Depreciation Accumulated Depreciation SI 2 11 Baud De Amated Derfon Value Der Apr Bonus How to Create a Line Chart Tume your own and they Tiles Sel Darby Out Creath the end od care, pe care come tog periode de ser name and private Tres Vente ter were you de the aut tatandaan ang tanah yang dito e Orte berger Required: 1. Based on the information below. calculate Depreciation Expense, Accumulated Depreciation and the Book Value of the equipment: fa) using the Straight line method (6) Using the Double dedining-Balance method (Using the Activity-Based method 2. Preprare the yournal entry for Year 3 under each method 2. Notice how the Chart populares as you calculate the values. See steps to recreate the chart below) Given Information Answer: (a) Straight-Line Depreciation Year Expenie $96.000 $24,000 6 10,000 Bock Value Original Cost Estimated Resdual Value Estimated Uwful Years Estimated Units Actual Units Year 1 Year 2 Year Year 4 Years Year 6 Accumulated Depreciation ? ? 7 7 2 1? 27 37 42 5? 67 7 > 2 ? 2 Year Adiustine Entey Depreciation Expense Accumulated Depreciation 1,000 1,800 2.200 2.400 2.000 1500 11.000 7 66 27 28 29 30 31 Double-Declining Balance Depreciation Accumulated Year Expense Depreciation Bock Value Depreciation each year 17 Accumulated Depreciation Year 2 Year 3 Year 4 Year 5 Year 6 1800 2,200 2400 2,000 1.600 11000 47 57 67 2 Book Value Depreciation each year Annual Depreciation b) Double-Declining-Balance Depreciation Accumulated Year Expense Depreciation 7 1? ? 2 2? ? 2 37 ? 42 ? S? ? 6? 2 Year 3 Aditing Entry Depreciation Expense Accumulated Depreciation 11 5 (c) Activity Based Depreciation Year Espente Block Value 39 40 41 42 43 44 45 46 47 De 7 - 17 27 32 42 5? 67 986&st Accumulated Depreciation ? ? 2 2 7 ? 2 Year Austin Cata Depreciation Expense Acumulated Depreciation 7 ? 2 2