Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help as soon as possible. taxation business thru entities. Hugh has the choice between investing in a City of Heflin bond at 5.55 percent

please help as soon as possible.

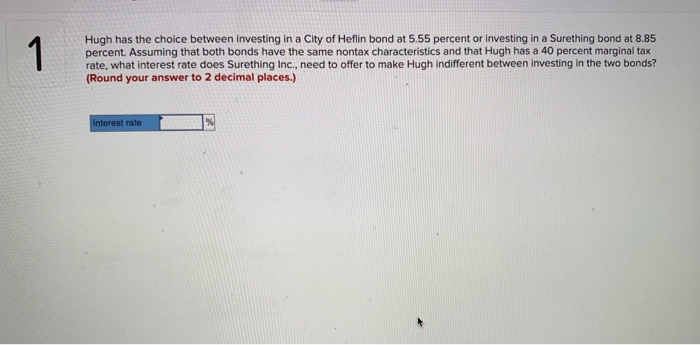

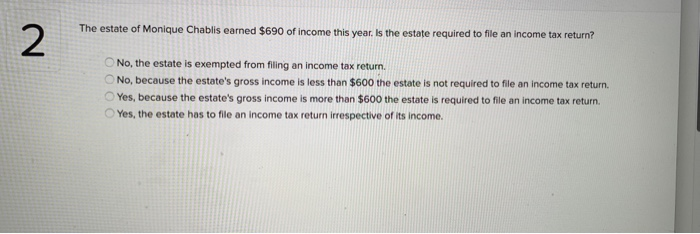

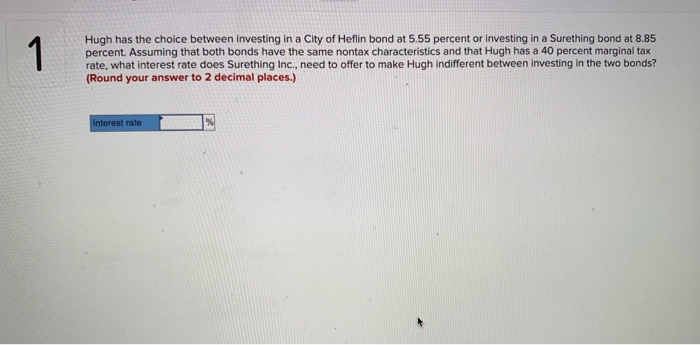

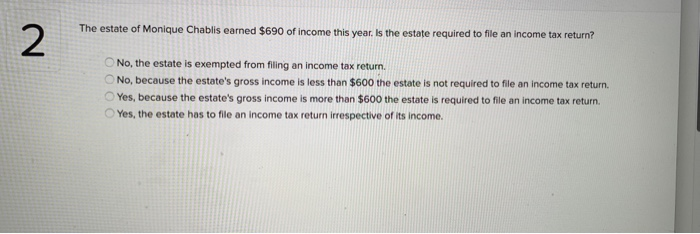

Hugh has the choice between investing in a City of Heflin bond at 5.55 percent or investing in a Surething bond at 8.85 percent. Assuming that both bonds have the same nontax characteristics and that Hugh has a 40 percent marginal tax rate, what interest rate does Surething Inc., need to offer to make Hugh indifferent between investing in the two bonds? (Round your answer to 2 decimal places.) Interest rate 2 The estate of Monique Chablis earned $690 of income this year. Is the estate required to file an income tax return? O No, the estate is exempted from filing an income tax return. O No, because the estate's gross income is less than $600 the estate is not required to file an income tax return. Yes, because the estate's gross income is more than $600 the estate is required to file an income tax return. Yes, the estate has to file an income tax return irrespective of its income taxation business thru entities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started