Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help as soon as possible, this is due in four hours and I have no clue QUESTION 2 Now assume that Johnsons portfolio of

Please help as soon as possible, this is due in four hours and I have no clue

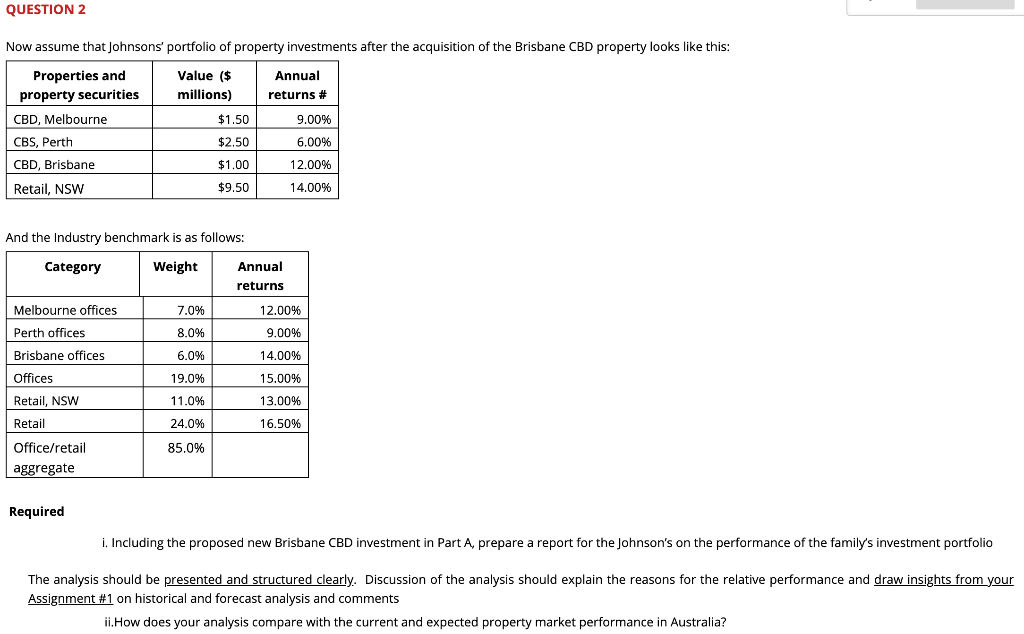

QUESTION 2 Now assume that Johnsons portfolio of property investments after the acquisition of the Brisbane CBD property looks like this: Properties and Value ($ Annual property securities millions) returns # CBD, Melbourne $1.50 9.00% CBS, Perth $2.50 6.00% CBD, Brisbane $1.00 12.00% Retail, NSW $9.50 14.00% And the Industry benchmark is as follows: Category Weight Annual returns 7.0% 12.00% 8.0% 9.00% Melbourne offices Perth offices Brisbane offices Offices Retail, NSW 6.0% 14.00% 19.0% 15.00% 11.0% 13.00% Retail 24.0% 16.50% 85.0% Office/retail aggregate Required i. Including the proposed new Brisbane CBD investment in Part A, prepare a report for the Johnson's on the performance of the family's investment portfolio The analysis should be presented and structured clearly. Discussion of the analysis should explain the reasons for the relative performance and draw insights from your Assignment #1 on historical and forecast analysis and comments ii.How does your analysis compare with the current and expected property market performance in Australia? QUESTION 2 Now assume that Johnsons portfolio of property investments after the acquisition of the Brisbane CBD property looks like this: Properties and Value ($ Annual property securities millions) returns # CBD, Melbourne $1.50 9.00% CBS, Perth $2.50 6.00% CBD, Brisbane $1.00 12.00% Retail, NSW $9.50 14.00% And the Industry benchmark is as follows: Category Weight Annual returns 7.0% 12.00% 8.0% 9.00% Melbourne offices Perth offices Brisbane offices Offices Retail, NSW 6.0% 14.00% 19.0% 15.00% 11.0% 13.00% Retail 24.0% 16.50% 85.0% Office/retail aggregate Required i. Including the proposed new Brisbane CBD investment in Part A, prepare a report for the Johnson's on the performance of the family's investment portfolio The analysis should be presented and structured clearly. Discussion of the analysis should explain the reasons for the relative performance and draw insights from your Assignment #1 on historical and forecast analysis and comments ii.How does your analysis compare with the current and expected property market performance in AustraliaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started