Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help Asap 2. Fazura, a Malaysian citizen, is employed as a lecturer from private university located in Shah Alam Selangor. She is married to

Please Help Asap

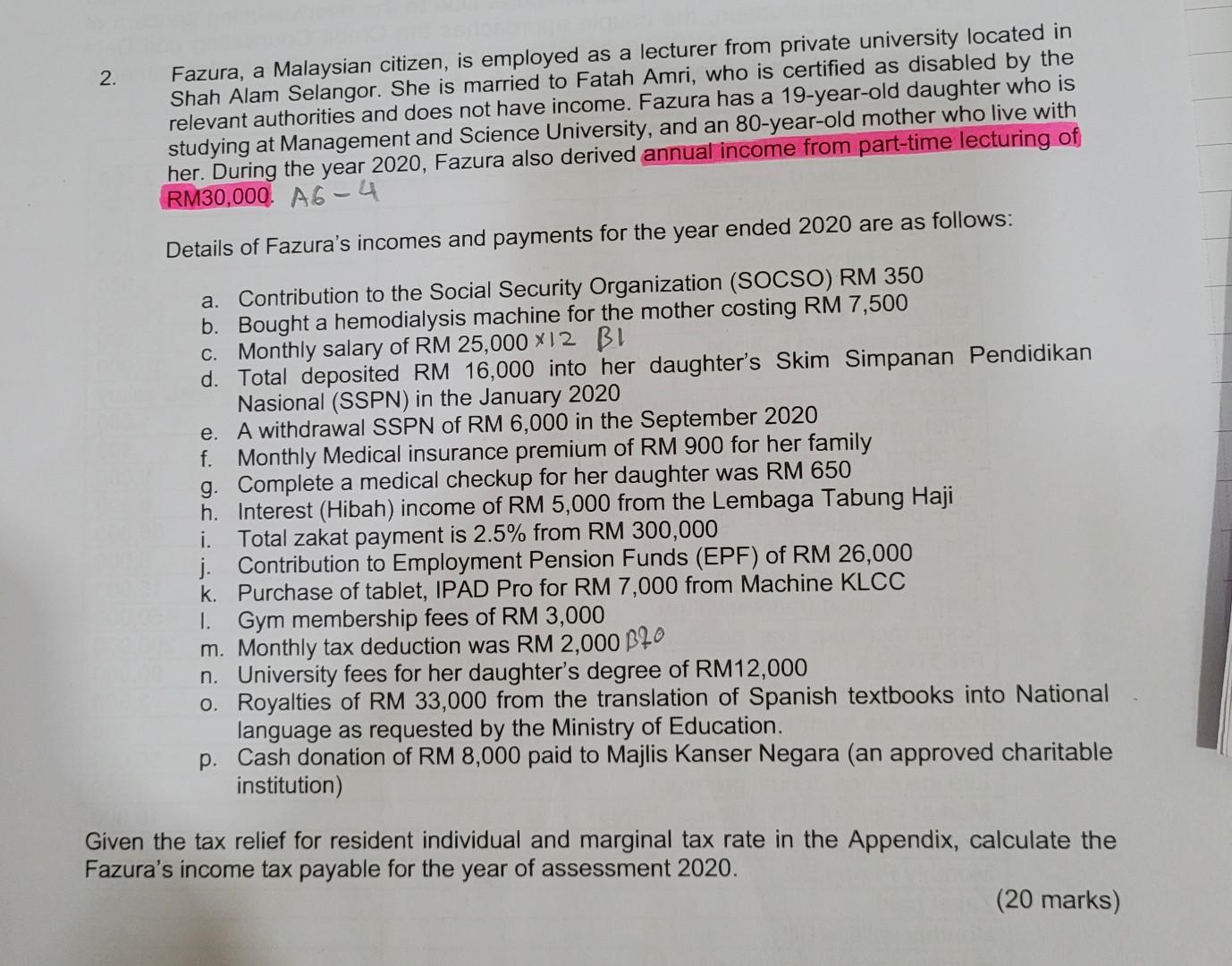

2. Fazura, a Malaysian citizen, is employed as a lecturer from private university located in Shah Alam Selangor. She is married to Fatah Amri, who is certified as disabled by the relevant authorities and does not have income. Fazura has a 19-year-old daughter who is studying at Management and Science University, and an 80-year-old mother who live with her. During the year 2020, Fazura also derived annual income from part-time lecturing of RM30,000 A6-4 Details of Fazura's incomes and payments for the year ended 2020 are as follows: a. Contribution to the Social Security Organization (SOCSO) RM 350 b. Bought a hemodialysis machine for the mother costing RM 7,500 c. Monthly salary of RM 25,000 X12 BI d. Total deposited RM 16,000 into her daughter's Skim Simpanan Pendidikan Nasional (SSPN) in the January 2020 e. A withdrawal SSPN of RM 6,000 in the September 2020 f. Monthly Medical insurance premium of RM 900 for her family g. Complete a medical checkup for her daughter was RM 650 h. Interest (Hibah) income of RM 5,000 from the Lembaga Tabung Haji i. Total zakat payment is 2.5% from RM 300,000 j. Contribution to Employment Pension Funds (EPF) of RM 26,000 k. Purchase of tablet, IPAD Pro for RM 7,000 from Machine KLCC 1. Gym membership fees of RM 3,000 m. Monthly tax deduction was RM 2,000 $20 n. University fees for her daughter's degree of RM12,000 o. Royalties of RM 33,000 from the translation of Spanish textbooks into National language as requested by the Ministry of Education. p. Cash donation of RM 8,000 paid to Majlis Kanser Negara (an approved charitable institution) Given the tax relief for resident individual and marginal tax rate in the Appendix, calculate the Fazura's income tax payable for the year of assessment 2020. (20 marks) 2. Fazura, a Malaysian citizen, is employed as a lecturer from private university located in Shah Alam Selangor. She is married to Fatah Amri, who is certified as disabled by the relevant authorities and does not have income. Fazura has a 19-year-old daughter who is studying at Management and Science University, and an 80-year-old mother who live with her. During the year 2020, Fazura also derived annual income from part-time lecturing of RM30,000 A6-4 Details of Fazura's incomes and payments for the year ended 2020 are as follows: a. Contribution to the Social Security Organization (SOCSO) RM 350 b. Bought a hemodialysis machine for the mother costing RM 7,500 c. Monthly salary of RM 25,000 X12 BI d. Total deposited RM 16,000 into her daughter's Skim Simpanan Pendidikan Nasional (SSPN) in the January 2020 e. A withdrawal SSPN of RM 6,000 in the September 2020 f. Monthly Medical insurance premium of RM 900 for her family g. Complete a medical checkup for her daughter was RM 650 h. Interest (Hibah) income of RM 5,000 from the Lembaga Tabung Haji i. Total zakat payment is 2.5% from RM 300,000 j. Contribution to Employment Pension Funds (EPF) of RM 26,000 k. Purchase of tablet, IPAD Pro for RM 7,000 from Machine KLCC 1. Gym membership fees of RM 3,000 m. Monthly tax deduction was RM 2,000 $20 n. University fees for her daughter's degree of RM12,000 o. Royalties of RM 33,000 from the translation of Spanish textbooks into National language as requested by the Ministry of Education. p. Cash donation of RM 8,000 paid to Majlis Kanser Negara (an approved charitable institution) Given the tax relief for resident individual and marginal tax rate in the Appendix, calculate the Fazura's income tax payable for the year of assessment 2020. (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started