Answered step by step

Verified Expert Solution

Question

1 Approved Answer

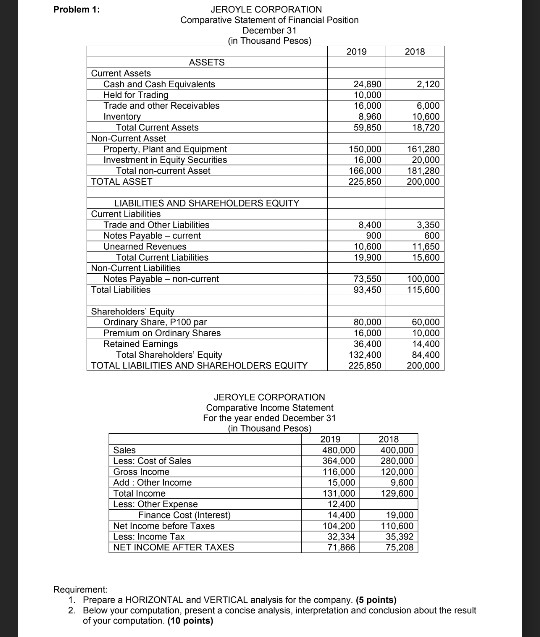

please help ASAP 2018 2,120 Problem 1: JEROYLE CORPORATION Comparative Statement of Financial Position December 31 (in Thousand Pesos) 2019 ASSETS Current Assets Cash and

please help ASAP

2018 2,120 Problem 1: JEROYLE CORPORATION Comparative Statement of Financial Position December 31 (in Thousand Pesos) 2019 ASSETS Current Assets Cash and Cash Equivalents 24,890 Held for Trading 10,000 Trade and other Receivables 16,000 Inventory 8.960 Total Current Assets 59,850 Non-Current Asset Property, Plant and Equipment 150,000 Investment in Equity Securities 16,000 Total non-current Asset 166.000 TOTAL ASSET 225,850 6,000 10,600 18.720 161,280 20,000 181,280 200,000 LIABILITIES AND SHAREHOLDERS EQUITY Current Liabilities Trade and Other Liabilities Notes Payable - Current Unearned Revenues Total Current Liabilities Non-Current Liabilities Notes Payable -non-current Total Liabilities 8,400 900 10,000 19.900 3,350 600 11.650 15,600 73,550 93,450 100,000 115,600 Shareholders' Equity Ordinary Share, P100 par Premium on Ordinary Shares Retained Earnings Total Shareholders' Equity TOTAL LIABILITIES AND SHAREHOLDERS EQUITY 80,000 16,000 36,400 132.400 225,850 60,000 10,000 14,400 84,400 200,000 JEROYLE CORPORATION Comparative Income Statement For the year ended December 31 (in Thousand Pesos) 2019 Sales 480.000 Less: Cost of Sales 364.000 Gross Income 116.000 Add : Other Income 15.000 Total Income 131.000 Less: Other Expense 12,400 Finance Cost (Interest) 14.400 Net Income before Taxes 104.200 Less: Income Tax 32,334 NET INCOME AFTER TAXES 71,568 2018 400,000 280,000 120,000 9.800 129,800 19,000 110,600 35,392 75,208 Requirement: 1. Prepare a HORIZONTAL and VERTICAL analysis for the company. (5 points) 2. Below your computation, present a concise analysis, interpretation and conclusion about the result of your computation. (10 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started