Answered step by step

Verified Expert Solution

Question

1 Approved Answer

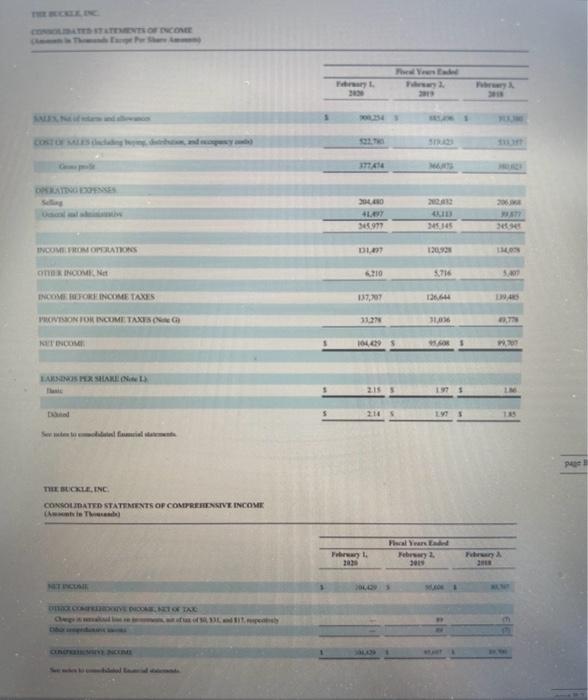

please help asap! American Eagle Outfitters, Inc. vs. The Buckle, Inc. RWP2-4 Financial information for American Eagle is presented in C Appendix A at the

please help asap!

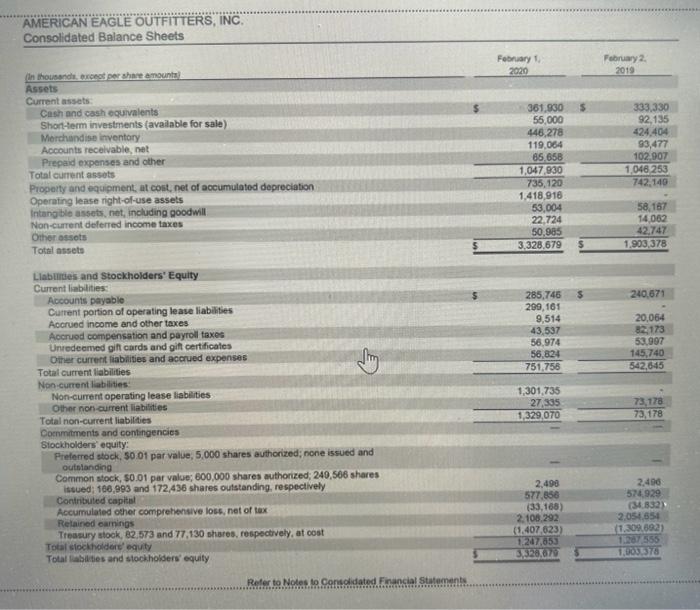

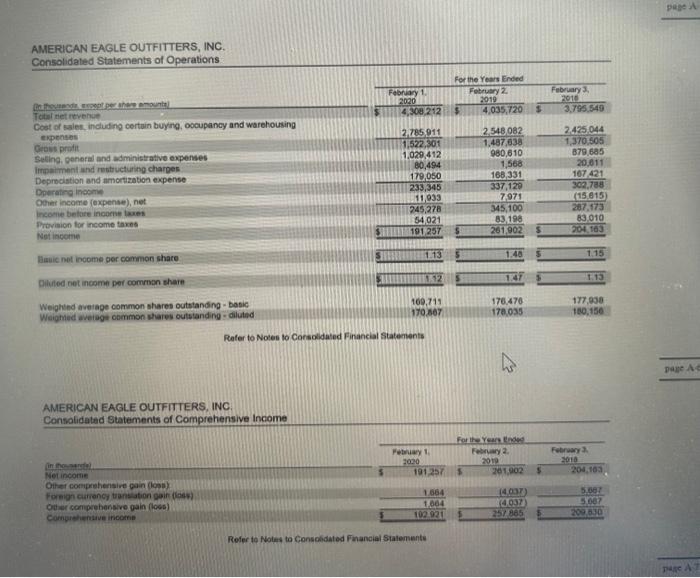

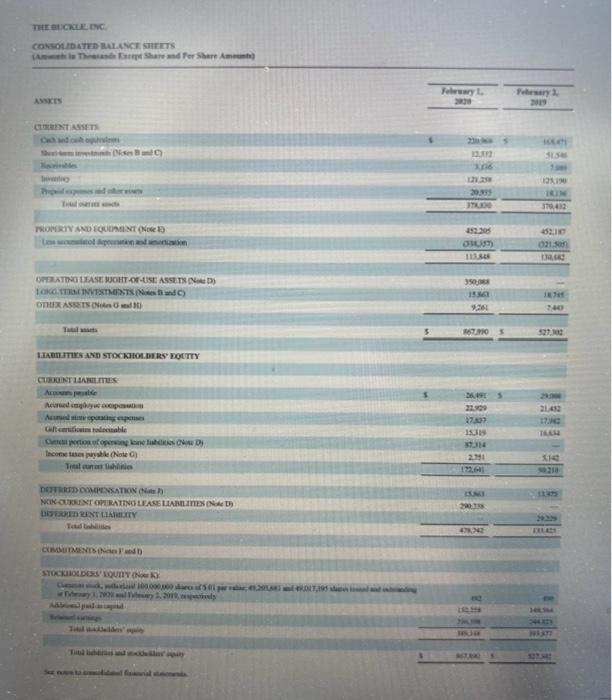

American Eagle Outfitters, Inc. vs. The Buckle, Inc. RWP2-4 Financial information for American Eagle is presented in C Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: Determine which company's growth rate in total assets, net sales, and net income is greater. Why do you think this might be the cuse? AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets (n thousandi, brocost per shave amounts) Assets Current assets Cash and cash oquvalents Shontherm investments (avalable for sale) Wiorchandise itventory Accounts recelvable, net Total cument assets Proparty and equipment, at cost, net of accumulated depreciation Operating lease right-of-use assets Intang ble assets, net, including goodwill Non-current delerred income taxes Ohtier assets Total assets Llaburties and Stockholders' Equity Cument liablities: Accounts payable Cutrent portion of operating lease liabilities Accrued income and other taxes Accruod compensation and payroll taxes Unedeemed gif cards and gift certificales Other current fiabilities and accrued expenses Total current fiabilities Non-cument labilities: Non-current operating lease liabilies Othnr noricurrent liabisties Tolal non-current liabilties Cocnmitments and contingencies Slockholders' equity: Preferred stock, 50.01 par value, 5,000 shares authorized; none issued and outstanding Common stock, 50.01 par value; 600,000 shares authorized; 240,506 shares Contributed capitsl Accumulated other comprehensive loss, net of tax Retained camings Tressury stook, 82,573 and 77,130 shares, respectrvely, at oost Total slockholdere' equity Total labities and stockholders' equity Refer to Noles is Consolidated Financial Statements. Refer to Notes to Consoidated Financial Stalemunte Tht aticktritic: xverts ctoment assts C.KaNT 13hm rmes:- stockase bosy LoumY okse 8 : Taze ntcxum, DNE. Ih ientrie Thesenete) American Eagle Outfitters, Inc. vs. The Buckle, Inc. RWP2-4 Financial information for American Eagle is presented in C Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: Determine which company's growth rate in total assets, net sales, and net income is greater. Why do you think this might be the cuse? AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets (n thousandi, brocost per shave amounts) Assets Current assets Cash and cash oquvalents Shontherm investments (avalable for sale) Wiorchandise itventory Accounts recelvable, net Total cument assets Proparty and equipment, at cost, net of accumulated depreciation Operating lease right-of-use assets Intang ble assets, net, including goodwill Non-current delerred income taxes Ohtier assets Total assets Llaburties and Stockholders' Equity Cument liablities: Accounts payable Cutrent portion of operating lease liabilities Accrued income and other taxes Accruod compensation and payroll taxes Unedeemed gif cards and gift certificales Other current fiabilities and accrued expenses Total current fiabilities Non-cument labilities: Non-current operating lease liabilies Othnr noricurrent liabisties Tolal non-current liabilties Cocnmitments and contingencies Slockholders' equity: Preferred stock, 50.01 par value, 5,000 shares authorized; none issued and outstanding Common stock, 50.01 par value; 600,000 shares authorized; 240,506 shares Contributed capitsl Accumulated other comprehensive loss, net of tax Retained camings Tressury stook, 82,573 and 77,130 shares, respectrvely, at oost Total slockholdere' equity Total labities and stockholders' equity Refer to Noles is Consolidated Financial Statements. Refer to Notes to Consoidated Financial Stalemunte Tht aticktritic: xverts ctoment assts C.KaNT 13hm rmes:- stockase bosy LoumY okse 8 : Taze ntcxum, DNE. Ih ientrie Thesenete) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started