Answered step by step

Verified Expert Solution

Question

1 Approved Answer

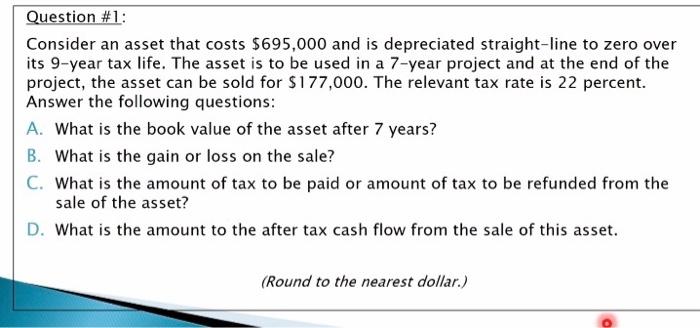

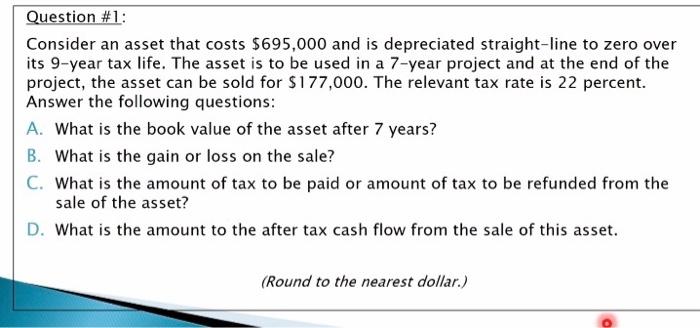

Please help asap Consider an asset that costs $695,000 and is depreciated straight-line to zero over its 9-year tax life. The asset is to be

Please help asap

Consider an asset that costs $695,000 and is depreciated straight-line to zero over its 9-year tax life. The asset is to be used in a 7-year project and at the end of the project, the asset can be sold for $177,000. The relevant tax rate is 22 percent. Answer the following questions: A. What is the book value of the asset after 7 years? B. What is the gain or loss on the sale? C. What is the amount of tax to be paid or amount of tax to be refunded from the sale of the asset? D. What is the amount to the after tax cash flow from the sale of this asset. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started