Answered step by step

Verified Expert Solution

Question

1 Approved Answer

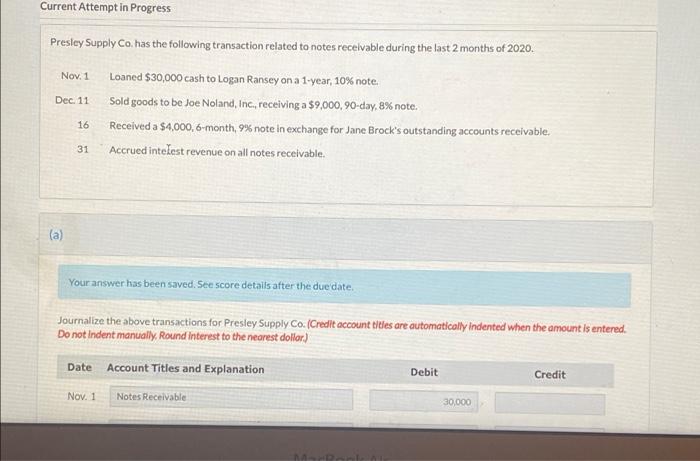

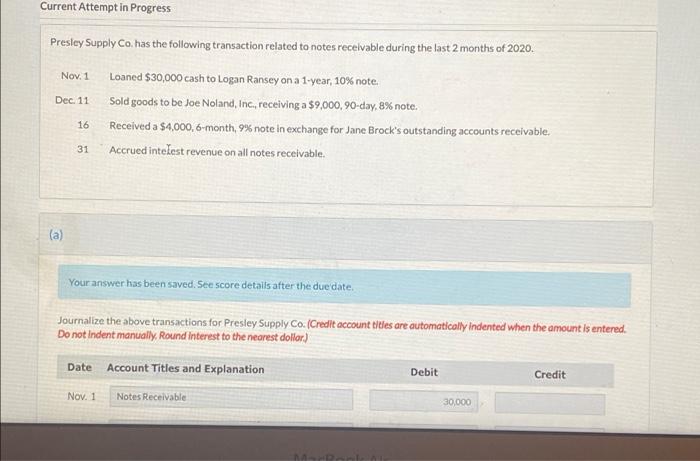

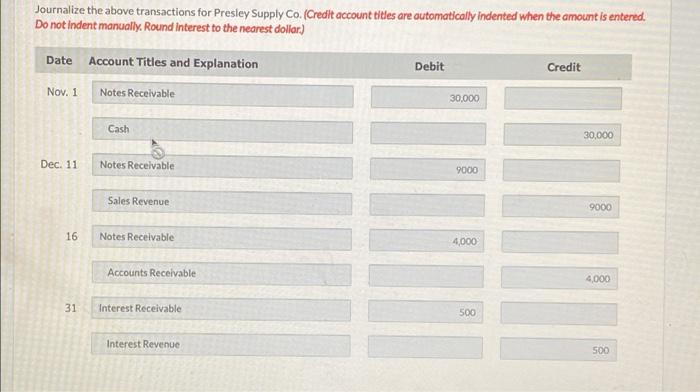

please help asap Current Attempt in Progress Presley Supply Co. has the following transaction related to notes recevable during the last 2 months of 2020.

please help asap

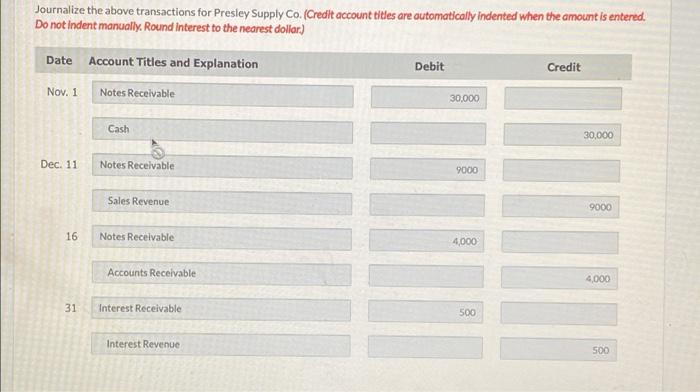

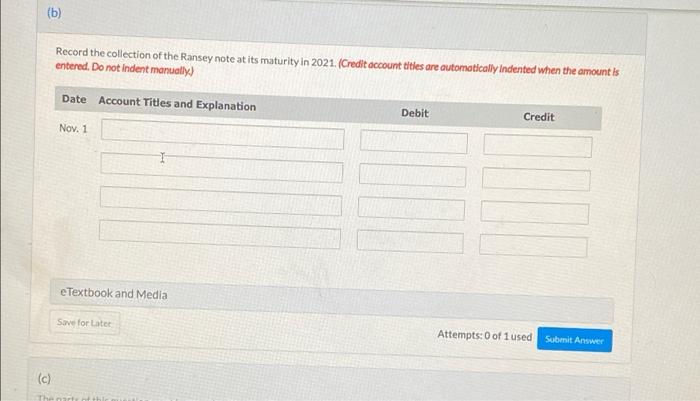

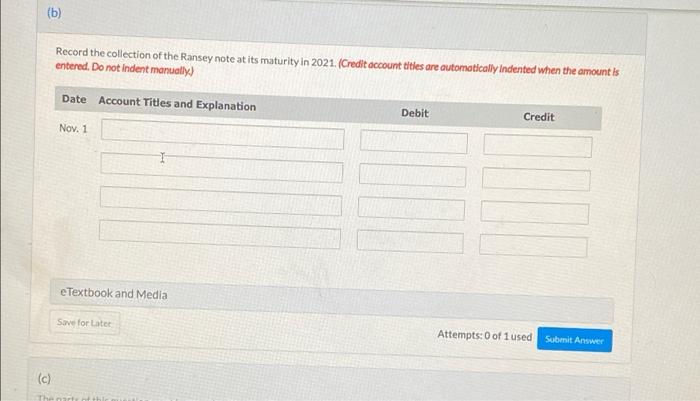

Current Attempt in Progress Presley Supply Co. has the following transaction related to notes recevable during the last 2 months of 2020. Nov. 1 Dec. 11 Loaned $30,000 cash to Logan Ransey on a 1-year, 10% note. Sold goods to be Joe Noland, Inc, receiving a $9,000, 90-day, 8% note. Received a $4,000, 6-month, 9% note in exchange for Jane Brock's outstanding accounts receivable. Accrued intefest revenue on all notes receivable. 16 31 (a) Your answer has been saved. See score details after the due date. Journalize the above transactions for Presley Supply Co. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. Round interest to the nearest dollar) Date Account Titles and Explanation Debit Credit Nov. 1 Notes Receivable 30,000 Journalize the above transactions for Presley Supply Co. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. Round interest to the nearest dollar) Date Account Titles and Explanation Debit Credit Nov. 1 Notes Receivable 30,000 Cash 30,000 Dec. 11 Notes Recelvable 9000 Sales Revenue 9000 16 Notes Receivable 4,000 Accounts Receivable 4000 31 Interest Receivable 500 Interest Revenue 500 (b) Record the collection of the Ransey note at its maturity in 2021. (Credit account tities are automatically Indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Nov. 1 e Textbook and Media Save for later Attempts: 0 of 1 used Submit Answer (c) th

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started