Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help asap DCF Valuation ($0.35ps) - Dreamscape is a highly cash generative business so we view DCF valuation is appropriate. - Key Assumptions used

please help asap

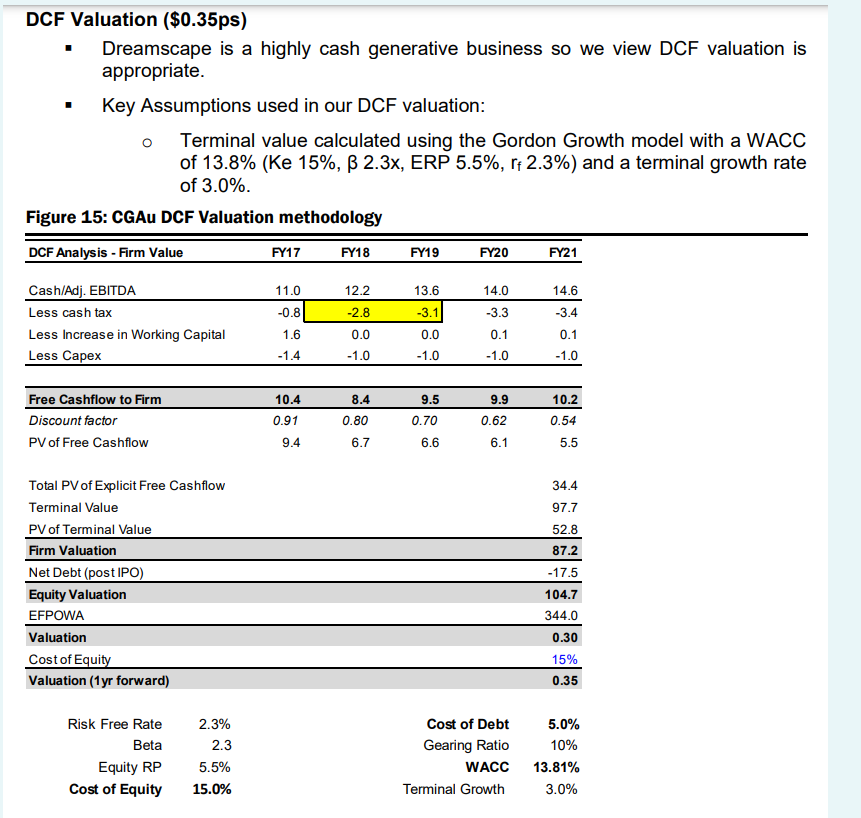

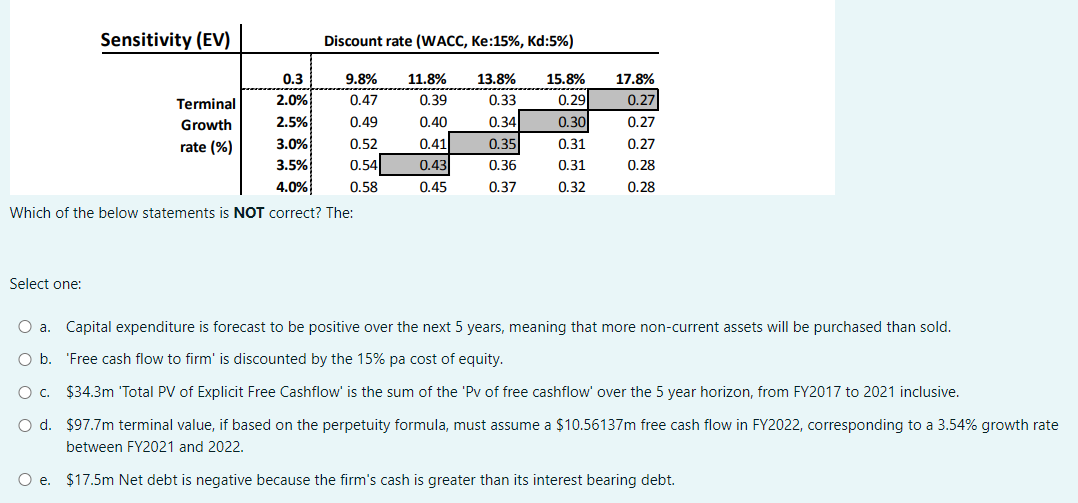

DCF Valuation (\$0.35ps) - Dreamscape is a highly cash generative business so we view DCF valuation is appropriate. - Key Assumptions used in our DCF valuation: - Terminal value calculated using the Gordon Growth model with a WACC of 13.8% (Ke 15%,2.3x, ERP 5.5%,rf2.3% ) and a terminal growth rate of 3.0%. Which of the below statements is NOT correct? The: Select one: a. Capital expenditure is forecast to be positive over the next 5 years, meaning that more non-current assets will be purchased than sold. b. 'Free cash flow to firm' is discounted by the 15% pa cost of equity. c. $34.3m 'Total PV of Explicit Free Cashflow' is the sum of the 'Pv of free cashflow' over the 5 year horizon, from FY2017 to 2021 inclusive. d. $97.7m terminal value, if based on the perpetuity formula, must assume a $10.56137m free cash flow in FY2022, corresponding to a 3.54% growth rate between FY2021 and 2022. e. $17.5m Net debt is negative because the firm's cash is greater than its interest bearing debt

DCF Valuation (\$0.35ps) - Dreamscape is a highly cash generative business so we view DCF valuation is appropriate. - Key Assumptions used in our DCF valuation: - Terminal value calculated using the Gordon Growth model with a WACC of 13.8% (Ke 15%,2.3x, ERP 5.5%,rf2.3% ) and a terminal growth rate of 3.0%. Which of the below statements is NOT correct? The: Select one: a. Capital expenditure is forecast to be positive over the next 5 years, meaning that more non-current assets will be purchased than sold. b. 'Free cash flow to firm' is discounted by the 15% pa cost of equity. c. $34.3m 'Total PV of Explicit Free Cashflow' is the sum of the 'Pv of free cashflow' over the 5 year horizon, from FY2017 to 2021 inclusive. d. $97.7m terminal value, if based on the perpetuity formula, must assume a $10.56137m free cash flow in FY2022, corresponding to a 3.54% growth rate between FY2021 and 2022. e. $17.5m Net debt is negative because the firm's cash is greater than its interest bearing debt Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started