please help asap

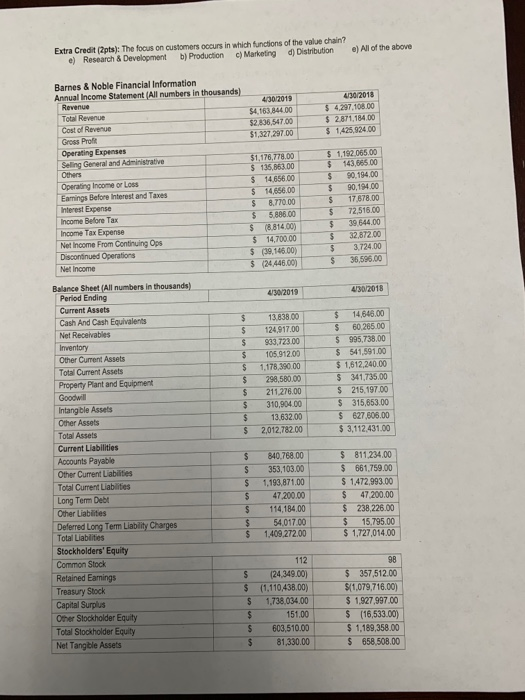

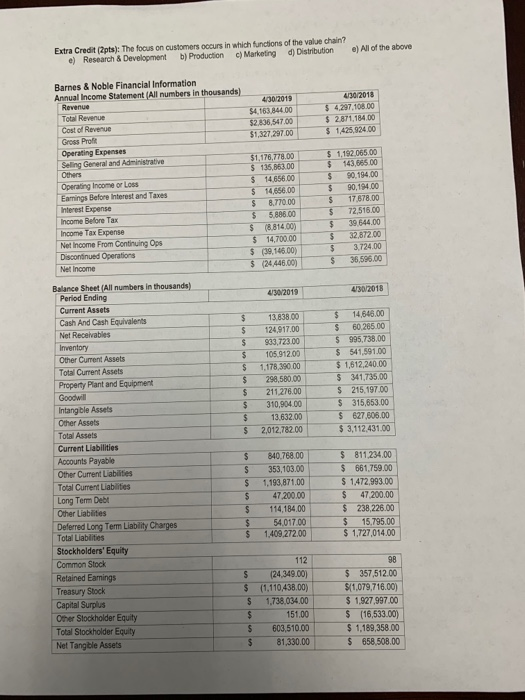

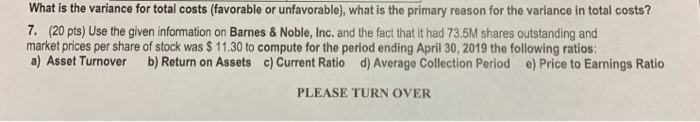

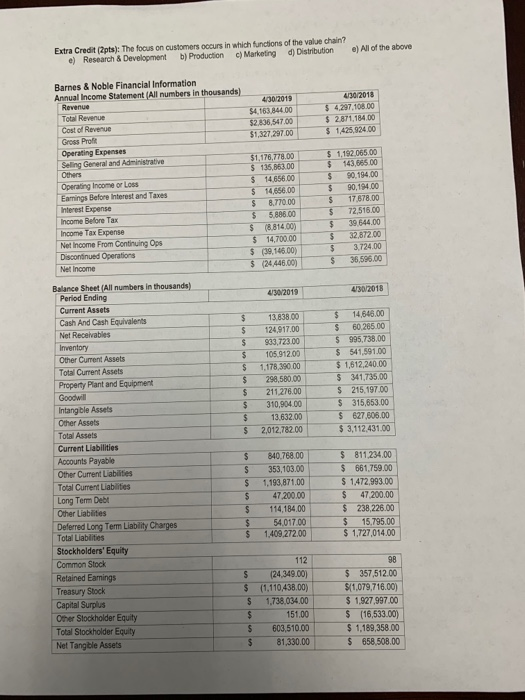

e) All of the above Extra Credit (pts): The focus on customers occurs in which functions of the value chain? e) Research & Development b) Production c) Marketing d) Distribution 4/30/2019 $4.153 84400 52836,547.00 $1,327 297 00 4/30/2018 $ 4.297.108.00 $ 2.871,184.00 $ 1,425,924.00 Barnes & Noble Financial Information Annual Income Statement (All numbers in thousands) Revenue Total Revenue Cost of Revenue Gross Profit Operating Expenses Seling General and Administrative Others Operating Income or Loss Farings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income From Continuing Ops Discontinued Operations Net Income $ $ $ $ S $1.176.778.00 $ 135,863.00 $ 14 656,00 $ 14,656.00 $ 8.770.00 $ 5.886.00 $ (8814.00) $ 14,700.00 $ (39.146.00) $ 24446.00) 1.192.065.00 143,665.00 90.194,00 90,194.00 17 878,00 72,516,00 39.644,00 32,872.00 3.724.00 36.595,00 $ S 4/30/2019 4/30/2018 $ $ $ $ $ $ 13.838.00 124,917.00 933.723.00 105 91200 1,178,390.00 298,580.00 211.276.00 310,904.00 13,632.00 2,012,782.00 $ 14,646,00 $ 60.265.00 $ 995,738,00 $ 541,591.00 $ 1,612,240.00 $ 341,735.00 $ 215,197.00 $ 315,653.00 $ 627.605.00 $ 3,112,431.00 $ Balance Sheet (All numbers in thousands) Period Ending Current Assets Cash And Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Property Plant and Equipment Goodwill Intang ble Assets Other Assets Total Assets Current Liabilities Accounts Payable Other Current Liabilities Total Current Llah tes Long Term Debt Other Liabilities Deferred Long Term Liability Charges Total Liabilities Stockholders' Equity Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Net Tangible Assets $ $ $ $ $ $ $ 840.768.00 353,103.00 1,193,871.00 47,200.00 114, 184.00 54.017.00 1,409.272.00 $ 811,234.00 $ 661.759.00 $ 1.472.993.00 $ 47,200.00 $ 238,226.00 $ 15,795.00 $ 1,727,014.00 Towe rs' Equity 98 $ $ $ $ $ 112 (24,349.00) (1,110,438.00) 1,738,034.00 151.00 603,510.00 81,330.00 $ 357,512.00 $(1.079,716.00) $ 1,927,997.00 $ (16,533.00) $ 1,189,358.00 $ 658,508.00 What is the variance for total costs (favorable or unfavorable), what is the primary reason for the variance in total costs? 7. (20 pts) Use the given information on Barnes & Noble, Inc. and the fact that it had 73.5M shares outstanding and market prices per share of stock was $ 11.30 to compute for the period ending April 30, 2019 the following ratios: a) Asset Turnover b) Return on Assets c) Current Ratio d) Average Collection Period ) Price to Earnings Ratio PLEASE TURN OVER