Answered step by step

Verified Expert Solution

Question

1 Approved Answer

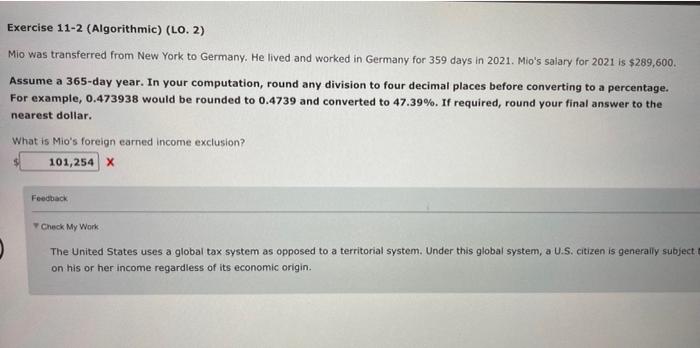

please help asap Exercise 11-2 (Algorithmic) (LO. 2) Mio was transferred from New York to Germany. He lived and worked in Germany for 359 days

please help asap

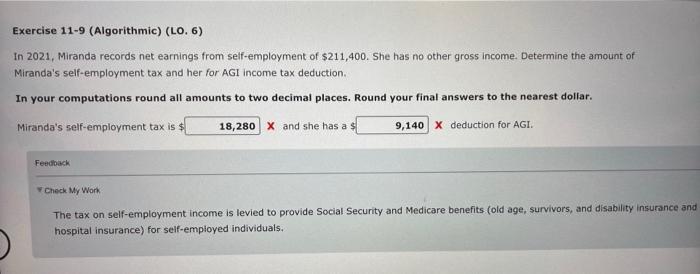

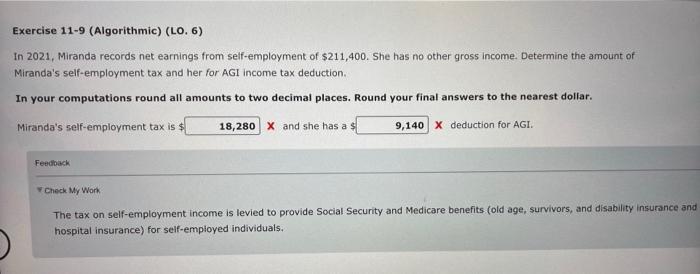

Exercise 11-2 (Algorithmic) (LO. 2) Mio was transferred from New York to Germany. He lived and worked in Germany for 359 days in 2021. Mio's salary for 2021 is $289,600. Assume a 365-day year. In your computation, round any division to four decimal places before converting to a percentage. For example, 0.473938 would be rounded to 0.4739 and converted to 47.39%. If required, round your final answer to the nearest dollar. What is Mio's foreign earned income exclusion? 101,254 x Feedback Check My Work The United States uses a global tax system as opposed to a territorial system. Under this global system, a U.S. citizen is generally subject on his or her income regardless of its economic origin. Exercise 11-9 (Algorithmic) (LO. 6) In 2021, Miranda records net earnings from self-employment of $211,400. She has no other gross Income. Determine the amount of Miranda's self-employment tax and her for AGI income tax deduction In your computations round all amounts to two decimal places. Round your final answers to the nearest dollar. Miranda's self-employment tax is $ 18,280 x and she has a $ 9,140 X deduction for AGI. Feedback Check My Work The tax on self-employment income is levied to provide Social Security and Medicare benefits (old age, survivors, and disability Insurance and hospital insurance) for self-employed individuals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started