Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help asap For the year assessment 2021. Mr. Omar, senior librarian at the MSU (59 years old) and his wife, Madam Hana, lecturer at

Please help asap

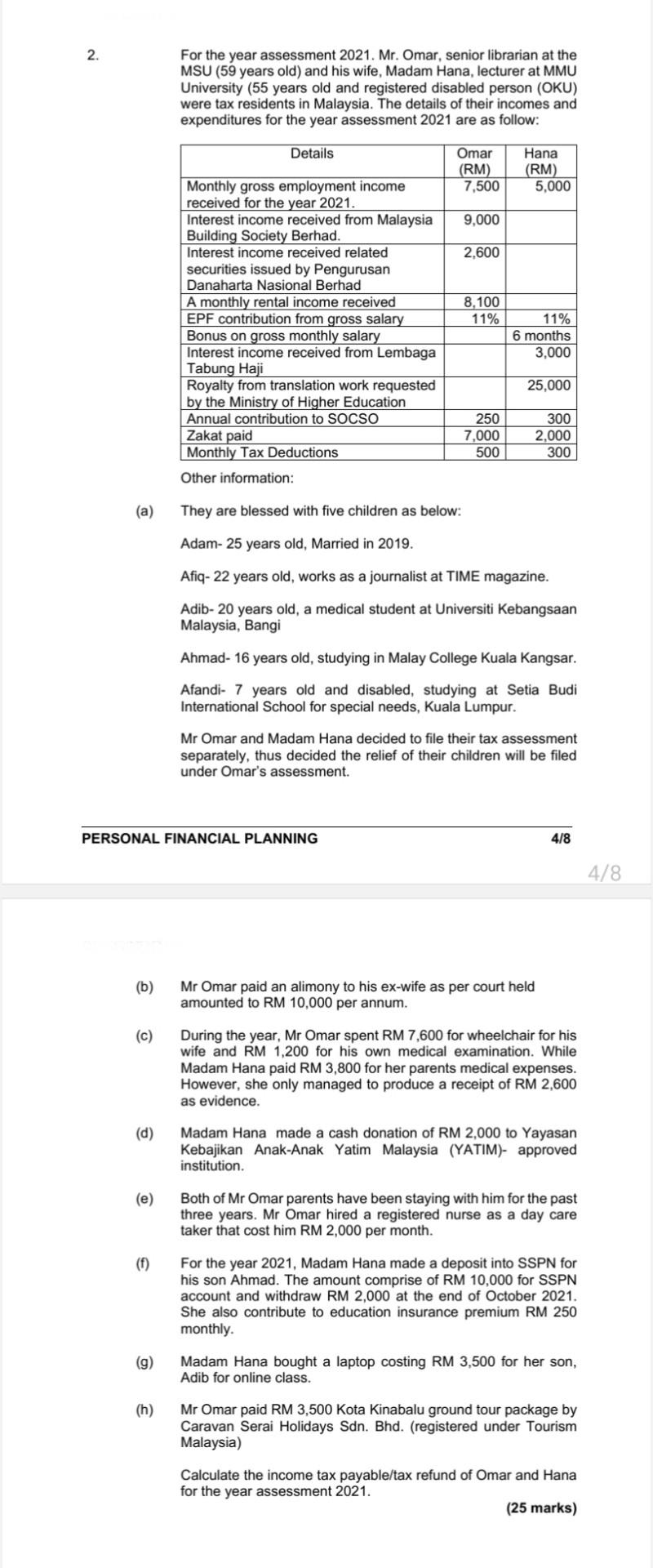

For the year assessment 2021. Mr. Omar, senior librarian at the MSU (59 years old) and his wife, Madam Hana, lecturer at MMU University (55 years old and registered disabled person (OKU) were tax residents in Malaysia. The details of their incomes and expenditures for the year assessment 2021 are as follow: Other information: (a) They are blessed with five children as below: Adam- 25 years old, Married in 2019. Afiq- 22 years old, works as a journalist at TIME magazine. Adib- 20 years old, a medical student at Universiti Kebangsaan Malaysia, Bangi Ahmad- 16 years old, studying in Malay College Kuala Kangsar. Afandi- 7 years old and disabled, studying at Setia Budi International School for special needs, Kuala Lumpur. Mr Omar and Madam Hana decided to file their tax assessment separately, thus decided the relief of their children will be filed under Omar's assessment. (b) Mr Omar paid an alimony to his ex-wife as per court held amounted to RM 10,000 per annum. (c) During the year, Mr Omar spent RM 7,600 for wheelchair for his wife and RM 1,200 for his own medical examination. While Madam Hana paid RM 3,800 for her parents medical expenses. However, she only managed to produce a receipt of RM 2,600 as evidence. (d) Madam Hana made a cash donation of RM 2,000 to Yayasan Kebajikan Anak-Anak Yatim Malaysia (YATIM)- approved institution. (e) Both of Mr Omar parents have been staying with him for the past three years. Mr Omar hired a registered nurse as a day care taker that cost him RM 2,000 per month. (f) For the year 2021, Madam Hana made a deposit into SSPN for his son Ahmad. The amount comprise of RM 10,000 for SSPN account and withdraw RM 2,000 at the end of October 2021. She also contribute to education insurance premium RM 250 monthly. (g) Madam Hana bought a laptop costing RM 3,500 for her son, Adib for online class. (h) Mr Omar paid RM 3,500 Kota Kinabalu ground tour package by Caravan Serai Holidays Sdn. Bhd. (registered under Tourism Malaysia) Calculate the income tax payable/tax refund of Omar and Hana for the year assessment 2021. (25 marks) For the year assessment 2021. Mr. Omar, senior librarian at the MSU (59 years old) and his wife, Madam Hana, lecturer at MMU University (55 years old and registered disabled person (OKU) were tax residents in Malaysia. The details of their incomes and expenditures for the year assessment 2021 are as follow: Other information: (a) They are blessed with five children as below: Adam- 25 years old, Married in 2019. Afiq- 22 years old, works as a journalist at TIME magazine. Adib- 20 years old, a medical student at Universiti Kebangsaan Malaysia, Bangi Ahmad- 16 years old, studying in Malay College Kuala Kangsar. Afandi- 7 years old and disabled, studying at Setia Budi International School for special needs, Kuala Lumpur. Mr Omar and Madam Hana decided to file their tax assessment separately, thus decided the relief of their children will be filed under Omar's assessment. (b) Mr Omar paid an alimony to his ex-wife as per court held amounted to RM 10,000 per annum. (c) During the year, Mr Omar spent RM 7,600 for wheelchair for his wife and RM 1,200 for his own medical examination. While Madam Hana paid RM 3,800 for her parents medical expenses. However, she only managed to produce a receipt of RM 2,600 as evidence. (d) Madam Hana made a cash donation of RM 2,000 to Yayasan Kebajikan Anak-Anak Yatim Malaysia (YATIM)- approved institution. (e) Both of Mr Omar parents have been staying with him for the past three years. Mr Omar hired a registered nurse as a day care taker that cost him RM 2,000 per month. (f) For the year 2021, Madam Hana made a deposit into SSPN for his son Ahmad. The amount comprise of RM 10,000 for SSPN account and withdraw RM 2,000 at the end of October 2021. She also contribute to education insurance premium RM 250 monthly. (g) Madam Hana bought a laptop costing RM 3,500 for her son, Adib for online class. (h) Mr Omar paid RM 3,500 Kota Kinabalu ground tour package by Caravan Serai Holidays Sdn. Bhd. (registered under Tourism Malaysia) Calculate the income tax payable/tax refund of Omar and Hana for the year assessment 2021. (25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started