PLEASE HELP ASAP!

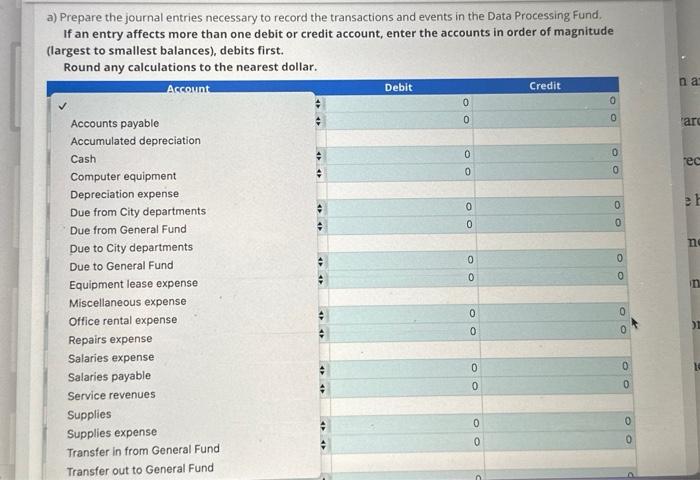

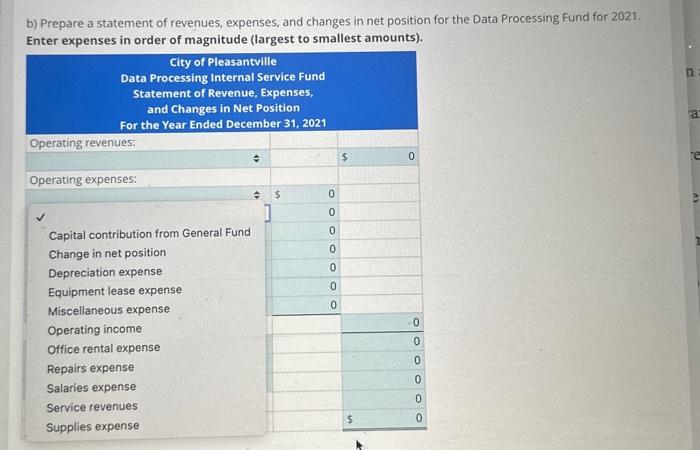

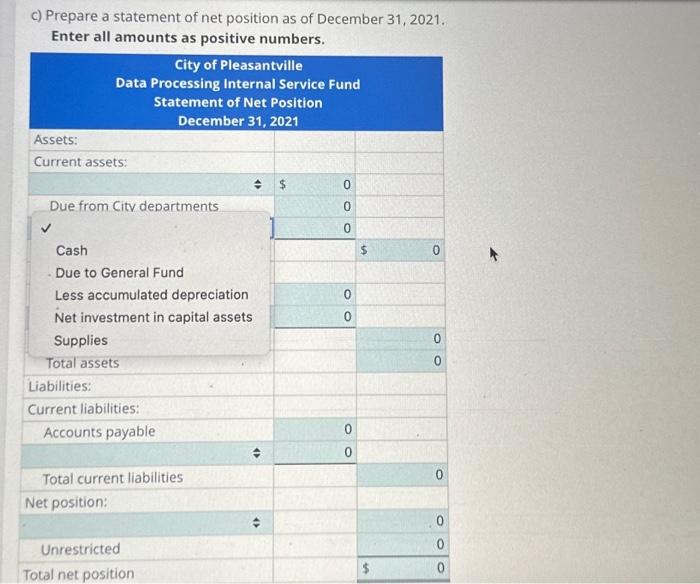

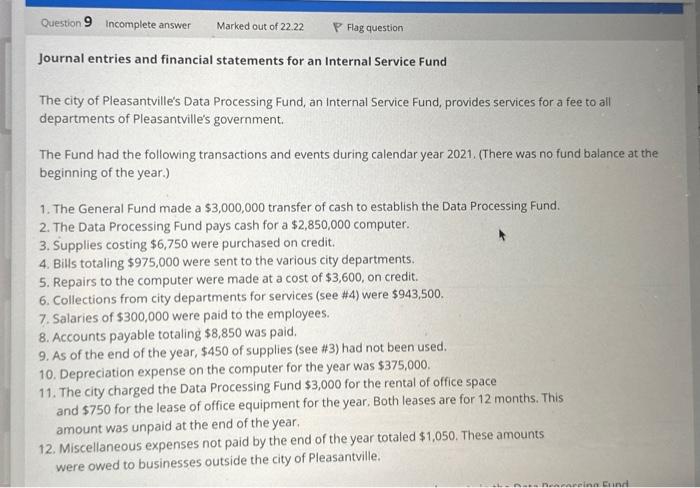

Journal entries and financial statements for an Internal Service Fund The city of Pleasantville's Data Processing Fund, an Internal Service Fund, provides services for a fee to all departments of Pleasantville's government. The Fund had the following transactions and events during calendar year 2021. (There was no fund balance at the beginning of the year.) 1. The General Fund made a $3,000,000 transfer of cash to establish the Data Processing Fund. 2. The Data Processing Fund pays cash for a $2,850,000 computer. 3. Supplies costing $6,750 were purchased on credit. 4. Bills totaling $975,000 were sent to the various city departments. 5. Repairs to the computer were made at a cost of $3,600, on credit. 6. Collections from city departments for services (see \#4) were $943,500. 7. Salaries of $300,000 were paid to the employees. 8. Accounts payable totaling $8,850 was paid. 9. As of the end of the year, $450 of supplies (see \#3) had not been used. 10. Depreciation expense on the computer for the year was $375,000. 11. The city charged the Data Processing Fund $3,000 for the rental of office space and $750 for the lease of office equipment for the year. Both leases are for 12 months. This amount was unpaid at the end of the year. 12. Miscellaneous expenses not paid by the end of the year totaled $1,050. These amounts were owed to businesses outside the city of Pleasantville. a) Prepare the journal entries necessary to record the transactions and events in the Data Processing Fund. If an entry affects more than one debit or credit account, enter the accounts in order of magnitude (largest to smallest balances), debits first. Round any calculations to the nearest dollar. b) Prepare a statement of revenues, expenses, and changes in net position for the Data Processing Fund for 2021. Enter expenses in order of magnitude (largest to smallest amounts). c) Prepare a statement of net position as of December 31, 2021. Enter all amounts as positive numbers. Journal entries and financial statements for an Internal Service Fund The city of Pleasantville's Data Processing Fund, an Internal Service Fund, provides services for a fee to all departments of Pleasantville's government. The Fund had the following transactions and events during calendar year 2021. (There was no fund balance at the beginning of the year.) 1. The General Fund made a $3,000,000 transfer of cash to establish the Data Processing Fund. 2. The Data Processing Fund pays cash for a $2,850,000 computer. 3. Supplies costing $6,750 were purchased on credit. 4. Bills totaling $975,000 were sent to the various city departments. 5. Repairs to the computer were made at a cost of $3,600, on credit. 6. Collections from city departments for services (see \#4) were $943,500. 7. Salaries of $300,000 were paid to the employees. 8. Accounts payable totaling $8,850 was paid. 9. As of the end of the year, $450 of supplies (see \#3) had not been used. 10. Depreciation expense on the computer for the year was $375,000. 11. The city charged the Data Processing Fund $3,000 for the rental of office space and $750 for the lease of office equipment for the year. Both leases are for 12 months. This amount was unpaid at the end of the year. 12. Miscellaneous expenses not paid by the end of the year totaled $1,050. These amounts were owed to businesses outside the city of Pleasantville. a) Prepare the journal entries necessary to record the transactions and events in the Data Processing Fund. If an entry affects more than one debit or credit account, enter the accounts in order of magnitude (largest to smallest balances), debits first. Round any calculations to the nearest dollar. b) Prepare a statement of revenues, expenses, and changes in net position for the Data Processing Fund for 2021. Enter expenses in order of magnitude (largest to smallest amounts). c) Prepare a statement of net position as of December 31, 2021. Enter all amounts as positive numbers